Casino affiliate programs are a way to monetize traffic by promoting online casino platforms directly from brands. If you are a webmaster, blogger or affiliate, working with an affiliate program allows you to generate profit as commissions paid for referred players, those who have registered with an online casino and made a deposit.

-

1

Direct advertiser

GEOs: India only

CPA, RevShare (50%), Hybrid (25% + $30, and some others) -

2

Direct advertiser

CPA, RevShare (up to 50%), Hybrid, Flat Fee, Guarantee, other individual models

GEOs: SE, AT, CA, AU, NZ, NO, FI, GR, PL, DE, CZ, IT, DK, CH -

3

Direct advertiser

Offers: 20+

CPA, RevShare, Hybrid

GEOs: the CIS, Asia, South and North Americas, India, Bangladesh, etc -

4

Direct advertiser

Core offer: crypto casino

RevShare: 30%

WagerShare: 10% of house edge

custom deals (higher %) possible case-by-case -

5

Both direct advertiser and a network

GEOs: CA, AU, NZ, DE, AT, CH, IT, PT, IE, DK, NO, SE, FI, HU

Offers: 600+ indirect offers and 3 direct offers

CPA, RevShare, Hybrid -

6

Direct advertiser

CPA, RevShare, Hybrid

GEOs: any -

7

Direct advertiser

Offers: 34

GEOs: India only

CPA, RevShare, Hybrid -

8

Offers: 6+

GEOs: CA, GE, AT, CH, PL, NO, BE, AU

CPA, RevShare, Hybrid -

9

Direct advertiser

GEOs: South Africa

CPA, RevShare (from 35%), Hybrid (on request) -

10

Direct advertiser

GEOs: India, Bangladesh, Brazil

CPA, RevShare, Hybrid -

11

Direct advertiser

CPA, RevShare (up to 40%), Hybrid

GEOs: 200+ -

12

Direct advertiser

GEOs: any

RevShare, CPA -

13

Direct advertiser

Strict requirements for traffic sources

RevShare (50%), CPA (up to $450), Hybrid

Min. withdrawal amount is $10

What Are Casino Affiliate Programs

Casino affiliate programs are partnerships where an online casino (or a group of casino brands) pays you for sending players who register and/or deposit through your tracked links. You promote the casino via SEO pages, reviews, bonus guides, paid ads, communities, or email, and the program attributes player actions (registration, first deposit, wagers) to your account so commissions can be calculated and paid out.

Casino Affiliate Program vs Affiliate Network

A casino affiliate program is the direct partnership arm of an operator or brand group. You send traffic to their brands, their tracking system records the player lifecycle, and they pay you based on the agreed deal.

A casino affiliate network sits in the middle. It either resells operator deals, runs its own tracking layer and routes traffic to different advertisers, OR acts as an aggregator where you manage multiple casino offers from one interface.

For your convenience, key differences with explanations are presented in this table:

| Dimension | Casino affiliate program | Casino affiliate network | What this means for you |

|---|---|---|---|

| Tracking ownership | Operator-side tracking is the source of truth (player DB + event validation sit there). | Often two layers: network tracking + advertiser tracking; disputes may require escalation. | Missing FTDs / “lost” conversions are usually faster to resolve with a program; with networks, expect longer back-and-forth. |

| Deal flexibility | Easier to get custom terms if you have volume or strong GEO: hybrids, brand-specific RevShare, CPA tuned to funnel, custom promos. | Negotiation exists, but many deals are standardized unless you drive meaningful spend. | If you’re scaling, direct programs usually give more leverage; networks are better for quick testing across brands. |

| Compliance & traffic rules | Typically stricter and more consistent: brand bidding, trademark rules, messaging, GEO restrictions—especially in regulated markets. | Can look looser on paper, but there’s risk of retroactive enforcement/clawbacks if the advertiser flags traffic later. | “Allowed traffic” matters more than the headline payout—networks can be fine, but you must get rules in writing. |

| Operational speed | Usually a dedicated affiliate manager who can push internal fixes (tracking links, promo mapping, missing events). | Support quality varies; even good networks may add a “we’ll check with the advertiser” step. | For paid traffic or fast iteration, the extra layer can slow you down when something breaks. |

| Payment risk | You’re exposed to the operator’s payment discipline, audits, and policies; can be solid or slow depending on the brand. | You’re exposed to the network’s cashflow. If they pay you net-15 but get paid net-60, they must float. | Networks can be great if they’re reliable, but payment risk shifts from “brand reliability” to “network solvency + discipline.” |

Top Casino Affiliate Programs

Now let’s move to the list of best casino affiliate programs. Each entry below is structured the same way, so you can compare terms fast instead of digging through marketing pages.

Pin-Up Partners

Pin-Up Partners is a direct casino affiliate program built around the PIN-UP casino/sportsbook ecosystem. The brand is well-known in the CIS segment, and the program pushes aggressive terms for affiliates who can deliver volume.

What players get

- A casino + sportsbook product under one brand ecosystem (your landing/funnel usually depends on GEO).

- Localized experience by market (languages, payment options, promos vary by GEO).

What affiliates get

- CPA / RevShare / RevShare+ / Hybrid (available on request) + 3% sub-affiliate.

- Rates: CPA up to $200, RevShare+ up to 50% (tiered).

- Coverage of 10+ GEOs

- Personal affiliate manager

- Analytics dashboard positioning (standard “scale-friendly” setup).

N1 Partners

N1 Partners is a multi-brand direct advertiser of 14+ casino and sportsbook brands, with a heavy focus on localization and retention.

What players get

- Access to multiple casino brands (and sportsbook brands), typically matched to GEO and localized per market.

- Retention-driven features depending on the brand: promos/tournaments, VIP mechanics, and in some cases crypto-friendly payments.

What affiliates get

- RevShare up to 45% (lifetime revenue) and no negative carryover.

- CPA from €150+, Hybrid from €100+ + 40% RevShare, and Sub-affiliate 5%+.

- A single partner account to run a multi-brand portfolio (useful when you want to rotate brands by GEO/intent without rebuilding your whole setup).

Raja Affiliates

Rajabets Affiliates (Raja Affiliates) is the affiliate program behind Rajabets Casino. It’s mostly known in the India-focused iGaming space (casino + sportsbook). The offer is simple: tiered RevShare, crypto/PayPal payouts, and low entry barrier compared to “enterprise-only” programs.

What players get

- A combined casino + sportsbook product under the Rajabets brand.

- Payment options: UPI / net banking / e-wallets / crypto (exact methods depend on GEO and the cashier).

What affiliates get

- Payment models: RevShare, CPA, Hybrid.

- RevShare rates: tiered 30% → 35% → 40% → 45%, based on monthly FTD volume (0–15 / 16–30 / 31–55 / 55+ FTDs).

- No negative carryover.

- Monthly payouts, with a $50 minimum amount.

- Payment methods: crypto and PayPal.

- Platform/tracking: MyAffiliates.

1xBet Partners

1xBet Partners is the affiliate program behind 1xBet, a brand that’s been around long enough to have real scale (and, in many GEOs, real name recognition). Their partner portal leans hard on volume: years on the market, millions of daily players, and broad country coverage — so this is typically picked for reach + localization, not for “boutique” treatment.

What players get

- A sportsbook-first product with casino also in the stack; the main advantage for players is usually localization across many markets (languages, currencies, regional promos).

- A familiar “big brand” funnel in a lot of GEOs, which can lift trust versus unknown casinos (especially on cold traffic).

What affiliates get

- RevShare, CPA, Hybrid upon request.

- RevShare rate up to 40%.

- CPA rate: CPA is GEO + quality + volume dependent.

- Sub-affiliate — 2%.

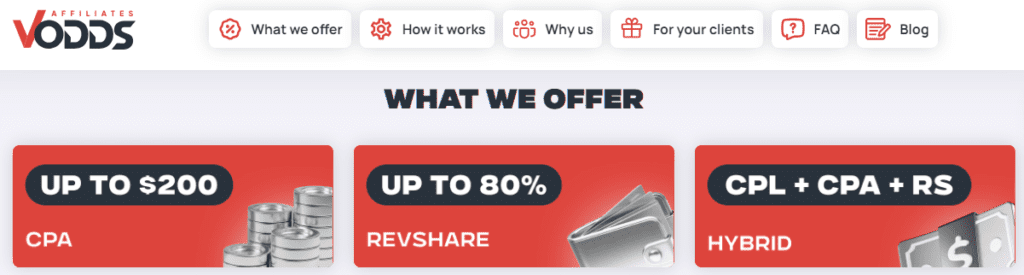

VOdds Affiliates

VOdds Affiliates is a direct sportsbook + casino partner program, mostly pitched around two things: straightforward deals and reliable monthly payouts.

What players get

- A combined sportsbook + casino product, so you can monetize both betting and casino intent off the same brand.

- Standard promo-driven funnels (welcome offers / ongoing promos depending on GEO).

What affiliates get

- Payment models: RevShare, CPA, Hybrid.

- Rates: RevShare up to 45%, CPA up to $200.

- Payout schedule: monthly.

- Minimum payout: $100.

- Payment methods: crypto, PayPal, card transfer.

- Tracking: in-house with lifetime cookies.

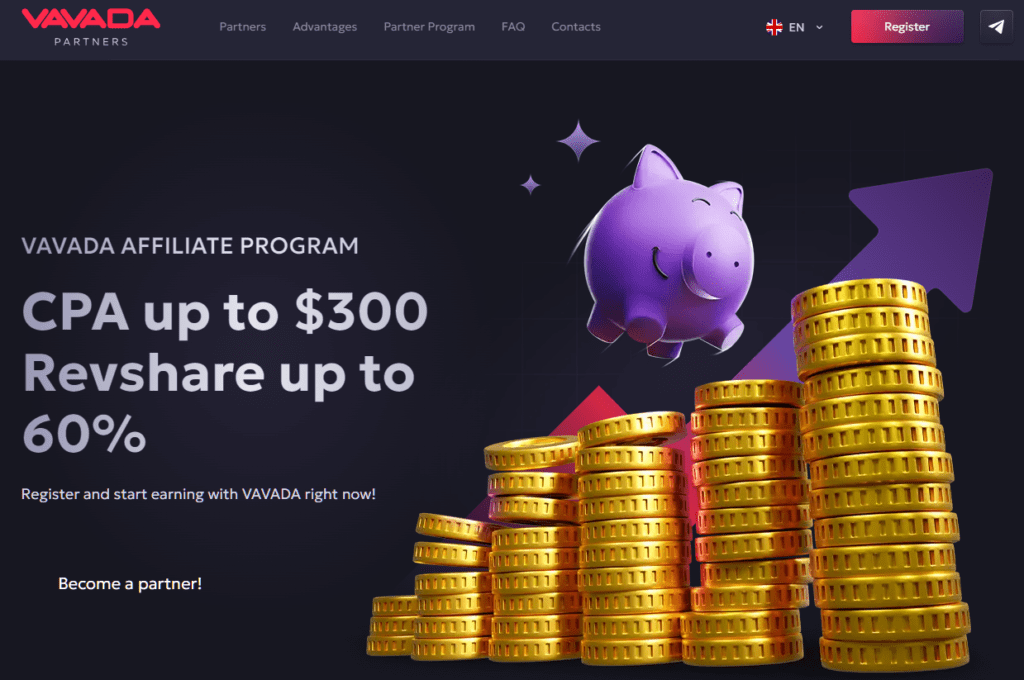

VAVADA Partners

VAVADA Partners (VavadaPart) is a casino affiliate program tied to the VAVADA brand. The offer is simple and aggressive: high RS caps, high CPA caps, and a brand that already has traction in CIS/Tier-2 markets.

What players get

- A casino + sportsbook product under one brand, with retention mechanics like promos/tournaments.

- Broad GEO coverage in program profiles (the exact funnels, promos, and cashier options depend on the player’s country).

What affiliates get

- RevShare, CPA.

- Rates: RevShare up to 60%; CPA up to $300.

- Payouts: bi-monthly; min. withdrawal is $15.

- Payments methods crypto + e-wallets (Skrill/Neteller/etc.).

- Plenty of ready-made adapted ad creatives.

Revsharks

Revsharks is the affiliate program for the Winshark casino product. The whole setup is built for affiliates who want one brand + one manager + clear deal terms, rather than juggling a bunch of unrelated offers. It’s positioned as a performance-driven program: you bring qualified traffic, they focus on converting and retaining it, and you monetize via standard iGaming deal models.

What players get

- A casino funnel under the Winshark brand with the usual retention mechanics you’d expect from a modern casino: promos, loyalty/VIP-style progression, and repeat-play hooks (important for LTV).

- A “single-product” experience (one brand, one ecosystem), which typically converts better than pushing unknown white-labels with weak trust.

What affiliates get

- Payment models: RevShare, CPA, Hybrid, plus a sub-affiliate program.

- Rates: RevShare up to 55%, CPA up to €650 per player, and sub-affiliate at 5% of NGR (lifetime).

- Payout cadence: monthly payouts.

- Ops: manager-led onboarding (you get a point of contact who helps you get tracking/links/creatives set up and answers policy questions fast).

4rabet Partner

4rabet Partner is the affiliate program for the 4rabet betting + casino brand, built primarily around Tier-2/Tier-3 traffic (especially India and nearby markets). The offer is straightforward: a single brand with multiple localized funnels, and the usual “affiliate-friendly” packaging (lots of landers/ad creatives + simple deal choices) so you can launch without reinventing everything.

What players get

- A sportsbook + casino product aimed at localized markets, with landing language and UX often adjusted by GEO/IP.

- Region-typical cashier options (you’ll commonly see India-focused methods like Paytm/UPI mentioned in product breakdowns).

What affiliates get

- RevShare / CPA / Hybrid.

- Rates: RevShare up to 50% and CPA typically in the $20–100 range depending on GEO/quality/terms.

- Sub-affiliate: 5%.

- No negative carryover.

- Payouts are weekly with a $100 minimum payout.

- Payment methods: Webmoney, PayTM, IMPS, Bitcoin, USDT.

How We Built and Ranked This List

This list isn’t random. Here’s what we checked and what gets a program pushed up or down.

Data Inputs

Each entry was checked against three things: published program terms (deal types, caps, payment cadence, basic policies), verifiable operational details (tracking stack, reporting features, whether the program supports postbacks/subIDs, how payouts are handled), and real-world affiliate signals (recurring complaints/praise about payment discipline, validation behavior on CPA, and how the manager behaves when something breaks). If a program has no clear public terms, no clear contact flow, or the same vague copy everywhere, it doesn’t get ranked high — no matter how “big” the brand looks.

Ranking Criteria

We ranked programs by what actually affects earnings and time-to-scale:

- Commercials: whether the program offers CPA/RevShare/Hybrid, how the tiers are structured, and whether the rates are realistic for the GEO.

- Transparency: clear definitions of FTD approval (for CPA) and how revenue is calculated (for RevShare), including the big items that can shrink NGR.

- Tracking & reporting: support for subIDs, postbacks, clean event mapping (reg/deposit/FTD), and whether reporting is usable for optimization.

- Traffic rules: clarity on what traffic sources are allowed, brand bidding rules, and how strictly policies are enforced.

- Support quality: whether you can reach a manager fast, get a straight answer, and resolve disputes without weeks of “we’ll check.”

Red Flags

These are the reasons programs get downgraded or removed:

- Vague terms: “high CPA” with no ranges, no validation window, no payout schedule, no minimum payout, no real policy page.

- Unclear NCO / balance behavior: if negative carryover is mentioned vaguely or buried, we consider it a bit downside for a potential partnership.

- Hidden deductions: revenue share that looks great until you realize NGR is heavily reduced by fees/bonuses/adjustments with no clean breakdown.

- Brand-level traps: unclear brand ownership, constant redirecting between mirrors, or funnels that change GEO-to-GEO without telling you — this kills attribution and makes optimization a guessing game.

- Reputation: sometimes brands and their programs can turn scammy, and we are constantly monitoring that. If a company gets proven to have gone rogue, we may even delete it from the list.

A position in our top-list reflects what we’ve found out during our evaluation, so check out the reviews for details.

Payout Models in Casino Affiliate Marketing

Before you pick any casino affiliate program, understand the deal types. The payout model decides how you get paid — and how you can get screwed.

RevShare

RevShare (Revenue Share) means you earn a percentage of the casino’s net revenue from the players you bring. The keyword is net: you’re not getting a cut of deposits, and you’re not getting a cut of “gross losses” unless the program explicitly uses that metric (most don’t). Your real earnings depend on how they calculate NGR and how strong the product is on retention.

What to look at:

- NGR definition: bonuses, payment fees, chargebacks/fraud adjustments, provider fees, and other deductions can shrink the base you’re paid on. If the program can’t explain deductions clearly, the headline % is meaningless.

- Attribution rules: what happens when a player registers on mobile, deposits later on desktop, or returns direct? Some programs handle this cleanly, some don’t — this is where “missing revenue” comes from.

- Retention fit: RevShare is a long game. If your traffic is mostly bonus hunters or low-LTV GEOs, you’ll wait longer to feel it (or never will).

RevShare is best when you can deliver players with repeat behavior (SEO, ASO, communities, warm funnels), and when the program’s accounting is transparent.

Negative Carryover

Negative carryover (NCO) is a RevShare accounting rule: if your players generate a negative month (big wins, heavy bonuses, fraud adjustments), your balance can go negative and carry over into the next month. That means you might send fresh players and still see “$0 payable” because you’re repaying last month’s deficit.

How to read it:

- No NCO / monthly reset: each month starts clean. This is generally affiliate-friendly.

- NCO applies: bad variance can chain you to zero payouts until you climb out.

When NCO hurts most:

- Low volume: one whale win can wipe a whole month.

- Promo-heavy periods: bonus costs can spike deductions.

- Weak transparency: if reporting is unclear, NCO becomes a black box you can’t verify.

If you’re on RevShare and NCO applies, you either need enough volume to smooth variance or you need terms that limit downside (no NCO, hybrid, or brand rules that reduce volatility).

CPA

CPA (cost per acquisition) is a fixed payout for an approved first-time depositor (FTD) — not just any deposit. In casino, approval is where the money is won or lost. Programs validate deposits for fraud risk, chargeback behavior, KYC status, traffic-source compliance, and sometimes minimum deposit/wager conditions.

What matters in practice:

- FTD definition: minimum deposit, eligible payment methods, time window from registration to deposit.

- Validation window: how long until an FTD is approved and payable (and whether they can claw it back later).

- Quality filters: some programs are strict but consistent (fine), others move the goalposts when you scale (bad sign).

- Traffic rules: CPA and “creative freedom” rarely go together. If you run paid traffic, assume you’ll be checked.

CPA is best when you need faster cashflow (especially for media buying) and you can control user intent and compliance tightly.

Hybrid

Hybrid is CPA + RevShare. You get an upfront payout for approved FTDs and ongoing revenue from retained players. This model exists for a reason: casinos want to reduce pure CPA risk, and affiliates want cashflow without waiting months for RevShare to mature.

Why hybrids often scale better:

- Cashflow protection: CPA covers acquisition costs while RevShare builds over time.

- Less dependence on one “gate”: if CPA approvals are harsh, RevShare can still keep the account profitable; if retention is weaker, CPA still pays for conversion.

- Negotiation leverage: hybrids are often easier to negotiate once you have a stable approval rate.

Hybrid is usually the most practical model if you’re running paid funnels and want to avoid “all-in” risk on either approvals or retention.

Flat Fee

Flat fee is when the advertiser pays for placement and distribution, not for FTDs or NGR. It’s less common in classic affiliate programs, but it shows up when you have owned inventory: rankings you control, a newsletter, a Telegram/Discord community, a streamer channel, or a high-intent directory slot.

How it’s normally structured:

- Fixed placement fee for a defined slot and time window (position, format, duration, GEO targeting).

- Often paired with performance: flat fee + CPA or flat fee + RevShare, where the flat fee buys exposure and the performance layer rewards results.

What can go wrong:

- Vague deliverables: “we’ll feature you” means nothing — define exact placement and duration.

- Unlimited obligations: lock scope (number of creatives/updates, what happens if GEO rules change).

- Compliance risk: if the brand gets restricted in a GEO, you need the right to swap/remove without eating the whole fee.

Flat fee only makes sense when you can sell predictable distribution. If you’re buying traffic, flat fee usually shifts too much risk onto you.

Comparison Table of Best Casino Affiliate Programs

| Program | CPA | RevShare | Hybrid | NCO / negative balance | Best model to start |

|---|---|---|---|---|---|

| Pin-Up Partners | up to $200 | up to 50% | Yes | Not clearly stated | Hybrid |

| N1 Partners | €150+ | up to 45% | Yes | No NCO | RevShare (or Hybrid) |

| Rajabets Affiliates | up to $300 | 30–45% | Yes | Balance reset (no carry) | CPA → Hybrid |

| 1xBet Partners | (varies by GEO/manager) | up to 40% | Yes | Not clearly stated | Hybrid |

| VOdds Affiliates | up to $200 | up to 40–45% | Often available | Can carry negative | CPA / Hybrid |

| VAVADA Partners | up to $300 | up to 60% | Often available | Not clearly stated | RevShare (or Hybrid) |

| Revsharks | up to €650 | up to 55% | Yes | Not clearly stated | Hybrid |

| 4rabet Partner | $20–100 | up to 50% | Not consistent | Balance reset (no carry) | CPA |

The table shows that the deal choice isn’t about the biggest “up to” number — it’s about downside control (NCO risk + approval predictability).

- Start Hybrid: Pin-Up Partners, 1xBet Partners, Revsharks

- Start RevShare: N1 Partners (No NCO)

- Avoid pure RevShare unless you have volume: VOdds Affiliates → go CPA/Hybrid

- Start CPA (Tier-3/India): 4rabet Partner, usually Rajabets → move to Hybrid if retention is proven

- VAVADA: RevShare for warm traffic, Hybrid for paid

Bottom line: pick the model that limits downside (NCO) first, validate on subIDs, then renegotiate.

Best Casino Affiliate Programs for Beginners

If you’re new to casino affiliate marketing, you need three things: a brand that converts without “magic,” terms that don’t trap you, and payouts that don’t stall you. These three programs fit that beginner reality best.

N1 Partners — Best All-Around Starter

Why it’s good for beginners: it reduces the biggest RevShare risk early on: No NCO, so one bad month won’t trap you in a negative balance. It’s also multi-brand, which lets you test different funnels/GEO fits inside one setup instead of signing up for five separate programs. That makes troubleshooting simpler: you can isolate what’s failing (traffic vs offer vs GEO) without rebuilding your whole stack every time.

Start with: RevShare

Pin-Up Partners

Why it’s good for beginners: low payout friction matters when your budget is small. A low minimum payout and frequent payouts help you reinvest quickly and keep testing. It’s also a single ecosystem (direct program), so your setup is straightforward: one manager, one dashboard, one set of rules — less room to screw things up while you’re still learning.

Start with: Hybrid

1xBet Partners

Why it’s good for beginners: beginners usually lose money on cold traffic because the brand doesn’t convert. A well-known brand can lift conversion rate even with average pages/creatives, which reduces the “why didn’t they deposit?” guessing game. Broad localization also helps you avoid picking a niche GEO where the product doesn’t fit and you waste weeks learning the wrong lessons.

Start with: Hybrid

By the way, previously, casino providers (the ones who developed slots and online casino platforms) did not communicate with affiliates whatsoever. But it has changed, and this cooperation is definitely a win-win one. Click here for more details.

How to Track Conversions

Before you pick a payout model, you need to know one thing: you only get paid for what the program can attribute to you. A “50% RevShare” or “$300 CPA” means nothing if conversions get “lost” or FTDs can’t be matched back to your subIDs. So after payout models, the next piece is tracking — how attribution works, where it breaks, and what to check before you scale.

Cookies vs S2S

Cookie tracking is the default: the click sets a cookie/local storage value, and the program attributes the player later. It’s fine for SEO and “warm” flows, but it leaks the moment the journey isn’t clean—privacy restrictions (ITP/ETP), in-app browsers, redirects that drop params, device/app switching, VPNs, and anything that overwrites cookies.

S2S tracking fixes that by treating the click as a server-side record. The platform stores a click ID + your subID, then matches registrations/deposits/FTDs back to that ID. If you run paid traffic or volume, S2S isn’t a feature — it’s how you avoid silent attribution loss.

What to check:

- Click ID + subID survive every redirect/lander step

- Postbacks exist for the events you optimize on (at least reg + FTD)

- Event-level reporting is available (not just totals)

Why Conversions Get “Lost” — And How to Reduce It

“Lost conversions” usually come from attribution gaps, not randomness. Most issues fall into four technical/operational buckets: broken parameter passing, cross-device identity breaks, event-definition mismatch, or approval/validation behavior.

1) Click/parameter loss (the link chain breaks).

This happens when your tracking parameters don’t survive the redirect path. Typical causes are extra hops (cloaking tools, trackers, smartlinks, prelanding pages), in-app browsers that rewrite URLs, link shorteners that drop query strings, or simply using the wrong link template (missing click ID param or encoding issues). The fix is mechanical: keep the chain minimal, verify that subID and click ID are present on the final landing URL, and run a proper end-to-end test (click → register → deposit) on each major device/browser you buy traffic from. If you can’t see your subID on the program side for test clicks, don’t scale.

2) Cross-device / app attribution breaks (identity doesn’t match).

A common flow is: user clicks on mobile, registers, then deposits on desktop; or clicks in a browser, then deposits in an app. Cookie-only setups often fail here, because the deposit event can’t be reliably connected to the original click. For paid traffic, you want programs that support S2S click ID matching and can explain how they attribute users across devices and app transitions. Ask one concrete question: what identifier is used to connect click → FTD if cookies are unavailable? If the answer is “cookies” or vague, you should expect attribution loss on mixed-device funnels.

3) Event mismatch (you’re measuring one thing, they pay on another).

Affiliates often optimize on “deposit,” while the program pays on approved FTD. Those aren’t the same. Programs can require KYC completion, minimum first deposit, eligible payment methods, and fraud checks before they mark an FTD as payable. Another common issue is timing: deposits can appear quickly in the UI, but FTD approval can take days; that can make a campaign look dead when it’s just in review. The fix is alignment: define exactly what counts as FTD, the approval window, and which events you’ll receive via postback (reg/dep/FTD/qualified FTD). Then optimize on the same event the program uses for payments.

4) Validation problems (approval behavior is the issue).

Two terms you’ll hear: shaving and going rogue. Shaving means conversions are undercounted or rejected without consistent, testable reasons. Going rogue means a program changes behavior over time — approvals slow down, rejection reasons expand, or terms get applied more aggressively — usually after you start sending volume. The only defense is process: track FTD approval rate by subID, monitor hold time and rejection reasons, and don’t scale past a test budget until you’ve seen at least one full payout cycle. If approvals drop materially as volume rises and the program can’t provide stable written rules, move spend elsewhere.

Traffic Sources for Casino Affiliate Marketing

Just like in any other niche of affiliate marketing, you need a traffic source. The table below breaks down the most common traffic sources for casino affiliate marketing, what each one means in practice, examples, and how hard it is to run as an affiliate.

| Traffic source | Definition | Examples | Difficulty |

|---|---|---|---|

| SEO | Free/organic search traffic from Google driven by informational and commercial pages (reviews, “best” lists, bonuses). | “Best online casinos in [GEO]”, brand reviews, bonus guides, comparison pages. | Medium |

| Search Ads (PPC) | Paid traffic from search engines where you buy intent-based keywords and send users to a landing/pre-lander. | Google Ads / Bing Ads campaigns on “online casino”, “casino bonus”, GEO+keyword clusters (where allowed). | High |

| Paid Social | Paid ads in social platforms targeting interests/lookalikes; usually needs a pre-lander and clean funnel. | Facebook/Instagram, TikTok, Snapchat (direct or via compliant funnels depending on GEO). | High |

| Native Ads | Sponsored “content-style” placements on publisher sites; works through advertorial-style pre-landers. | Native ad networks: Kadam, AdsCompass, Reacheffect. Advertorial → review page → casino. | High |

| Push & In-Page Push | Subscription/intent-light traffic delivered as notifications or push-like placements; cheap clicks, fast testing. | Push ad networks: PropellerAds, RichAds, EpicAds. Push creative → pre-lander → casino. | Medium |

| Pop / Popunder | Full-page/pop-under placements triggered by site visits; high volume, lower intent. | Pop ad networks: HilltopAds, PopAds, RichAds. Direct pop buys; direct-to-lander or pre-lander. | Medium |

| Display/Banner | Visual placements on sites/apps; used for retargeting or broad reach. | Banner ad networks. Programmatic display, direct banner placements, retargeting campaigns. | Medium–High |

| Video Ads | Short-form video inventory; needs strong creatives and tight compliance. | Video ad networks. YouTube, TikTok video, DSP video; video → pre-lander → casino. | High |

| Telegram & Messengers | Traffic from channels/chats where you control distribution and warm up audiences. | Telegram channel posts, bot funnels. Other messengers where applicable. | Medium |

| Influencers & Creators | Paid/affiliate placements from creators with a relevant audience; trust-driven traffic. | YouTube integrations, Instagram stories, streamer promo codes. | Medium |

| Streaming | Ongoing content that monetizes via trust + repeat exposure (often promo codes). | Twitch/Kick streams, live sessions, “casino stream” segments. | Medium |

| Email (owned lists) | Traffic from email newsletters/lists you own or rent; strong for retention and repeat promos. | Weekly newsletter, bonus drops, reactivation sequences. | Medium |

| Forums & Communities | Traffic from niche communities where users already discuss gambling; needs soft promotion. | Reddit threads, niche forums, Discord servers, Q&A sites. | Medium |

| Media buys / Direct deals | Buying inventory directly from publishers (ask website owners for fixed placements, sponsorships). | Homepage takeover, sponsored articles, fixed banner slots, newsletter sponsor. | High |

| ASO | Traffic generated through App Store / Google Play listings and installs (app-based funnels). | Keyword-optimized app pages, incentivized installs, store ads (where possible), third-party app rentals. | High |

How to Choose the Right Affiliate Program

For your convenience, we picked the most important factors when considering a program to partner with. If any of the points is missing, you might be risking.

| Check | Red flag (fail signal) | How to verify fast |

|---|---|---|

| Company identity | No legal entity / shell pages / constant domain swapping | Footer legal info + T&Cs + who owns the brands |

| Public terms exist | Vague promises, no rules, no docs | Partner site: terms, privacy, traffic rules |

| Deal definitions | “FTD” not defined; “net” not explained | Ask manager for written definitions |

| Payment schedule | “On request only” with no schedule | Terms + screenshots from dashboard payments page |

| Minimum payout | High min payout + long holds | Partner FAQ/terms |

| Payment methods | Only obscure methods / constantly “down” | Ask what methods are available for your GEO |

| Tracking stack | No subIDs, no postbacks, links often break | Test click → see subID in stats; request postback URL |

| Event transparency | Only totals; no event-level detail | Ask for demo screenshots or test account |

| Validation policy | Endless “under review” / unexplained rejects | Ask: approval window + top rejection reasons in writing |

| Clawback rules | Retroactive mass clawbacks | Check terms; ask for examples of clawback cases |

| NCO / negative balance | Hidden NCO or vague “net balance rules” | Terms: “negative carryover”, “balance reset” |

| Traffic rules | “Any traffic” until you scale → then bans | Written whitelist/blacklist; brand bidding rules |

| Brand bidding | Punished for something not stated | Ask for brand bidding policy PDF/text |

| Support reality | Copy-paste replies, dodges direct questions | Ask 5 hard questions (below) and time the replies |

| Reputation signals | Repeated complaints about shaving/non-payment | Search “[brand] affiliate program payment” + forums |

| “Going rogue” risk | “Was fine, then started shaving/delaying” patterns | Check dates on complaints; look for trend changes |

Also, there are 5 questions that expose bullshit fast (ask any manager):

- “Define an approved FTD for CPA: min deposit, time window, KYC, payment methods.”

- “List NGR deductions for RevShare and confirm whether NCO applies.”

- “Do you support subIDs + postbacks for reg and FTD? Send the postback format.”

- “What is your approval window and the top 3 rejection reasons?”

- “What is the exact payout schedule, minimum payout, and available methods for my GEO?”

How to use this checklist: if you hit 2–3 red flags in the top half (identity/terms/payments/tracking), skip. If everything looks clean, do a small test and judge them by the first payout cycle.

GEOs & Tiers in Casino Affiliate Marketing

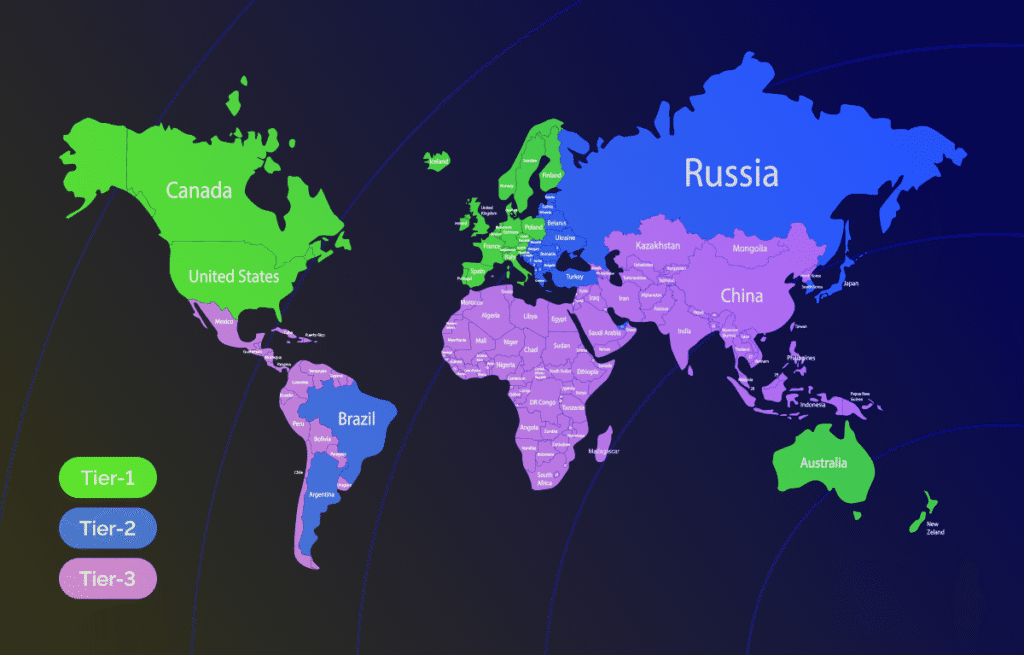

Tiers are a quick way for affiliates to estimate the economics of a GEO before testing: how expensive traffic will be, how hard it’ll be to get approvals, and what kind of player value (LTV) you can realistically expect.

What Tiers Mean

“Tiers” are shorthand for how expensive it is to buy/earn traffic in a country and how valuable players tend to be there. Higher-tier GEOs usually mean higher purchasing power and stronger LTV, but also higher CPMs, stricter moderation/compliance, and more competition. Lower-tier GEOs can give you cheaper volume, but you often trade that for weaker retention, more payment friction, and a higher risk of low-quality or fraudulent traffic.

Tier 1 vs Tier 2 vs Tier 3

Tier 1 is where deposits and LTV can be great, but you pay for it: tougher approvals, higher costs, and less room for aggressive angles. Tier 2 is the middle ground most affiliates scale on because the economics are more forgiving — you can still get solid deposit rates without Tier 1-level costs. Tier 3 is where traffic is cheap and volume exists, but everything becomes more operational: payment methods can be messy, KYC drop-off can be high, support and brand trust matter more, and you need tighter filtering because junk traffic shows up faster.

| Tier | GEO examples |

|---|---|

| Tier-1 | United Kingdom, Ireland, Canada, Australia, New Zealand, Germany, Austria, Switzerland, Netherlands, Belgium, France, Spain, Italy, Sweden, Norway, Finland, Denmark, Iceland, Luxembourg |

| Tier-2 | Poland, Czechia, Slovakia, Hungary, Romania, Bulgaria, Greece, Portugal, Croatia, Slovenia, Serbia, Bosnia & Herzegovina, Montenegro, North Macedonia, Albania, Latvia, Lithuania, Estonia, Turkey, Brazil, Mexico, Argentina, Chile, Colombia, Peru, Ecuador, Uruguay, South Africa |

| Tier-3 | India, Pakistan, Bangladesh, Sri Lanka, Nepal, Philippines, Vietnam, Indonesia, Thailand, Malaysia, Cambodia, Laos, Myanmar, Nigeria, Kenya, Tanzania, Uganda, Ghana, Egypt, Morocco, Algeria, Tunisia, Jordan, Iraq, Lebanon, Azerbaijan, Georgia, Armenia, Kazakhstan, Uzbekistan, Kyrgyzstan, Mongolia |

Casino Licenses and Traffic

Licensing is one of those details that looks “legal” on the surface, but it directly affects whether your traffic is sustainable.

What a License Means

A casino license is legal permission for a specific entity to offer gambling in a specific jurisdiction. For affiliates, “licensed” only matters in context: license + operator entity + target GEO + domain you’re sending traffic to.

Licensed vs Unlicensed: What Changes for Affiliates

Licensed-for-GEO brands are usually more predictable: clearer rules, fewer sudden domain changes, fewer payment disruptions. Unlicensed (or “licensed somewhere else”) brands can still convert and pay, but the risk shifts onto you — more platform issues, more volatility, less leverage when something goes wrong.

Key Risks (Legal, Platform, Payments)

Legal risk shows up as takedowns or restrictions in certain countries. Platform risk is the bigger one for most affiliates: ad disapprovals, account bans, domain burns. Payment risk is operational: unstable cashier options hurt retention, and in bad cases the program goes rogue (starts delaying payouts or shaving conversions).

Quick Due Diligence Checklist

- Verify entity + regulator + license number (not just a badge).

- Confirm the brand is allowed for your GEO.

- Make sure the exact domain you link to is covered and stable.

- Get traffic rules in writing (especially paid + brand bidding).

How to Promote Casino Affiliate Offers

At this moment, there are four most popular ways to promote casino affiliate offers. Almost every major program accepts these kinds of traffic. Let’s describe how it is normally done, but all of them definitely deserve a separate article/guide.

SEO

Casino SEO is driven by a few page types: “best casinos in [GEO]”, brand reviews, and bonus pages. Keep the structure simple (answer → comparison → bonus terms → payments → licensing note → FAQ) and focus on GEO fit. The fastest way to kill casino SEO is linking to brands that constantly rotate domains or change funnels by country — your links rot, your content becomes wrong, and rankings drop.

ASO

ASO is install-first traffic: you rank an app for keywords, then monetize through in-app flows or a controlled redirect after onboarding. It can scale hard, but it’s not “quick”: you need clean event tracking (install → reg → FTD) and strict discipline around store compliance, otherwise the app gets removed and you lose the channel. You can also rent apps. More about ASO here.

PPC (Ad Networks)

Casino PPC is tracking + compliance + funnel control. You usually need a pre-landing pages, subIDs that survive redirects, postbacks for reg/FTD, and a good ad network. Don’t scale until you have written traffic rules (brand bidding, restricted GEOs, creative claims) and you’ve validated approval behavior on a full payout cycle.

Telegram

Telegram works on repeat exposure and trust. It converts when you publish useful, GEO-specific posts (bonuses explained, payment methods, withdrawals), keep one clean CTA, and track posts with subIDs so you know what content drives FTDs. The main risk is operational: link bans, channel copies, and “mirror” domain churn breaking your pinned funnel. Also, you’ll need a lot of accounts to promote a casino on Telegram, and you can get them with bulk account creators.

Find more in our iGaming marketing guide!

Ad Creatives for Casino Affiliate Offers

Treat creatives as part of the offer setup. They can convert totally differently depending on where you run them (SEO, PPC, Telegram, ASO), how localized it is, and whether you use a pre-lander or send users direct. The goal is to ship a set of creatives that matches the traffic source rules, builds trust fast, and gives you enough variants to test without burning the offer in a week.

Creative Angles That Convert in Casino

Casino creatives usually win on one of four angles: a clear bonus hook (welcome package, reloads, cashback), a VIP/benefits hook (fast payouts, higher limits, manager support), a game hook (slots, live casino, sports+casino cross-sell), or a trust hook (payments, licenses, brand reputation). Pick one primary angle per ad set, and keep the promise consistent across ad → pre-lander → landing page; if the creative screams “big bonus” but the page looks like a generic brand review, your CTR might be fine but CR will die.

Pre-Landers vs Direct Linking

Direct linking is simplest but fragile: it works best when the brand is strong, the offer is straightforward, and the traffic is already warm (e.g., SEO intent). Pre-landers are what you use when the traffic is colder, the platform is stricter, or you need to “shape” the user (explain bonus terms, payment methods, KYC, steps to deposit). A good pre-lander is not a long article — it’s a short conversion page with one job: align expectations, qualify the user, and pass them to the casino with higher intent and fewer surprises.

Localization for GEOs

Casino creatives must be localized beyond translation: show local currency, highlight local payment rails (cards, e-wallets, bank methods), and adapt the tone to how people actually talk about gambling in that GEO. Even small details matter: the “best” hook in one region might be “fast withdrawals,” while in another it’s “low minimum deposit” or “popular live dealers.” If your creative doesn’t visually and verbally “belong” to the GEO, you’ll pay more for clicks and get lower deposit rates.

Compliance & Risk Control

In casino, the fastest way to lose an account or get your ads throttled is sloppy wording and misleading claims. Avoid absolute promises (“guaranteed wins”), be careful with “free” language, and keep bonus messaging accurate (wagering, max cashout, eligibility). Add basic responsibility cues where appropriate (18+, responsible gambling), and make sure your creatives don’t accidentally look like they target minors. Think of compliance as performance protection: stable accounts and approvals are what let you run tests long enough to find winners.

Testing & Creative Ops

You need a testing system, not a single “best banner.” Build sets with multiple angles and formats, rotate to prevent fatigue, and track at the level that matters (CTR is nice, but deposits/FTDs and net revenue decide). Keep creative naming and versioning strict, so you know exactly what produced the result, and align tracking across ad → pre-lander → offer (UTMs, subIDs, postbacks). Operationally, the affiliates who scale are the ones who can ship new variants quickly without breaking links, losing attribution, or repeating the same tired creatives for weeks.

Effective ad creatives and promo materials are described in much more detail here.

Ad Creatives for Casino Affiliate Marketing

Casino creatives act as a bridge between click and deposit. This section is about picking the right creative approach, keeping trust high, and avoiding the typical traps that inflate CTR but kill FTDs.

Creative Angles That Convert in Casino

Most casino ads convert on aspiration: beautiful girls, luxury items, cars, watches, nightlife, stacks of cash — the “play = rich life” fantasy. It’s fast to understand and works especially well on push/native/Telegram/Facebook, but it’s also riskier (moderation + low-quality clicks), so keep it more “premium lifestyle” than explicit, and always have 1–2 backup variants in the pack (bonus clarity or trust/withdrawals) so you can scale without getting stuck on one fragile angle.

Creative Formats by Traffic Source

In SEO, creatives are usually on-page widgets (comparison tables, bonus blocks, screenshots, “how to claim” steps). In PPC/ad networks you need volume and variety: static + HTML5 banners, native image/headline packs, push icon/title/description packs. In Telegram the creative is the post format and sequencing (short “drop” + pinned guide + bot flow). In ASO the creative is store-facing (screenshots/video/text) and the goal is to look like a normal product while pre-selling the funnel you’ll monetize later.

Pre-Landers vs Direct Linking

Direct linking is simple but fragile: it works best when the brand is known and the traffic is already warm. Pre-landers are how you make colder traffic deposit—by removing uncertainty (what the bonus really is, what deposit methods exist, what KYC might look like, how fast withdrawals usually go). The best pre-landers are short and practical: one message, a few steps, one proof element, and a clean CTA.

Localization for GEOs

Localization is not translation. Your creative should “feel local” fast: currency, popular payment methods, and the way people talk about gambling in that region. One GEO might respond to “fast withdrawals,” another to “low min deposit,” another to “live dealers.” If your creative looks imported, you’ll pay more for clicks and get less deposit intent.

Compliance & Risk Control

In casino promos, sloppy wording and visuals cost you more than rejections — they can also attract the wrong audience and ruin conversion quality. Avoid guaranteed-win vibes, be careful with “free” language, and don’t let the creative promise something the landing page can’t deliver (wagering, limits, eligibility).

Testing & Creative Ops

You need enough variants to test without burning out the audience: rotate, watch fatigue, and refresh by changing the hook or proof element while keeping the core promise. Track beyond CTR: for casino, you care about deposit rate/FTDs and net value, so keep naming, UTMs/subIDs, and version control clean or you’ll never know what actually worked.

How to Create (or Source) Creatives for Casino Promotions

Start with the ready-made creatives your affiliate program provides, then ask your affiliate manager what’s converting right now in your GEO and traffic source (angles, formats, “do/don’t” notes) — that’s the fastest shortcut to current market reality. If you need to make new creatives, open a spy tool like Adheart, filter by GEO and format, and reverse-engineer what’s actively running (hooks, layouts, CTAs, pre-lander patterns). Then produce your own version based on basics that actually move deposits: define the target audience’s pain points, match the tone to their “culture level,” and adapt the execution to the traffic source (push/native/Telegram/SEO all need different pacing). And if you don’t want to design in-house, outsource to a specialized studio/agency.

FAQ

CPA pays you a fixed amount per qualified depositor (FTD). RevShare pays you a percentage of the casino’s net revenue from your players over time. Hybrid combines both (often a smaller CPA + ongoing RevShare). CPA is usually easier to forecast short-term; RevShare can outperform long-term if you send higher-quality players.

FTD = First Time Depositor (a user who makes their first deposit). An FTD is typically approved only after basic fraud checks (duplicate accounts, VPN/proxy patterns, payment anomalies, chargebacks). The exact approval timing depends on the program, but you should always ask whether they count FTD instantly, after manual review, or after a holding period.

NCO means negative player balance (losses for the casino caused by wins/bonuses/chargebacks) can carry over into the next month and reduce your RevShare payouts. No NCO is usually better for affiliates because one “lucky” player month won’t wipe your earnings for the next period. Always confirm if NCO applies to RevShare and Hybrid deals.

Most programs accept SEO/content, Telegram communities, PPC/ad networks, and email—but restrictions vary by brand and GEO. Some prohibit or limit brand bidding, incentivized traffic, adult/porn placements, misleading creatives, or certain ad networks. Don’t assume “all paid traffic is fine”: get the allowed sources in writing from your manager.

Tracking is done via a referral link that assigns your traffic to your account; conversions are attributed when users register and deposit through that flow. SubIDs (or “click IDs”) let you pass extra tags (source, campaign, ad, placement) so you can see what produces registrations and deposits, and so the program can do better investigations if something gets flagged.

Payout timing is usually weekly, bi-weekly, or monthly, often with a minimum threshold. Payment methods commonly include bank transfer, crypto, e-wallets, or region-specific methods depending on the program. Always confirm the hold period, minimum payout, fees, and whether you’ll be paid on approved FTDs only.

In casino, deposits fail when there’s friction: wrong GEO/brand fit, weak payment methods, heavy KYC at the wrong moment, mismatched bonus messaging, or low-intent traffic from aggressive creatives. The fix is usually practical: align GEO + payments, tighten the funnel, add trust proof (withdrawals/payment logos), and test a pre-lander if the traffic is cold.

Ask for: top converting GEOs right now, allowed traffic sources, current best angles/creatives, what counts as a qualified FTD, whether NCO applies, hold period and payout schedule, and any caps/limits. This saves weeks of “guess and burn” testing.