Betting, being one of the main verticals in affiliate marketing, allows affiliates to earn money by attracting new players to bookmakers. If you’re familiar with this industry, you can try making money by promoting it. But to do this, you need to choose an affiliate program (or network) to partner with first:

-

1

Direct advertiser of licensed products

GEOs: Brazil, Peru, Mexico, CIS

CPA, Hybrid, Fix, RevShare -

2

Direct advertiser

GEOs: India, Bangladesh, Canada, and Germany

CPA, RevShare, Hybrid -

3

Offers: 18,000+

GEOs: 180 -

4

Direct advertiser

RevShare: 30%

WagerShare: 10% of house edge

custom deals (higher %) possible case-by-case -

5

Both direct advertiser and a network

GEOs: CA, AU, NZ, DE, AT, CH, IT, PT, IE, DK, NO, SE, FI, HU

Offers: 600+ indirect offers and 3 direct offers

CPA, RevShare, Hybrid -

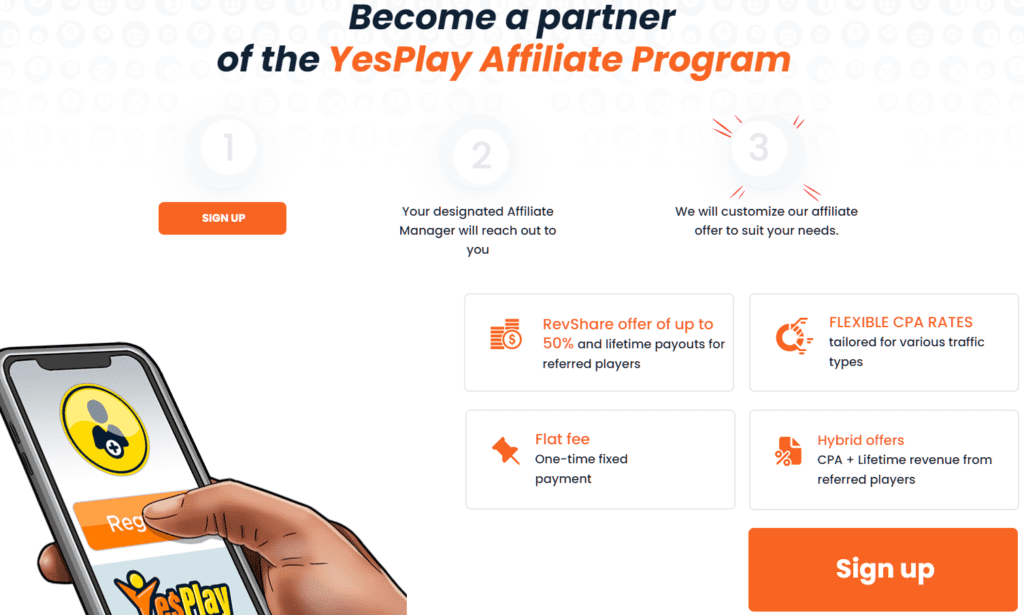

6

Direct advertiser

GEOs: India only

CPA, RevShare (50%), Hybrid (25% + $30, and some others) -

7

Direct advertiser

Offers: 34

GEOs: India only

CPA, RevShare, Hybrid -

8

Offers: 6+

GEOs: CA, GE, AT, CH, PL, NO, BE, AU

CPA, RevShare, Hybrid -

9

Direct advertiser

Offers: 20+

CPA, RevShare, Hybrid

GEOs: the CIS, Asia, South and North Americas, India, Bangladesh, etc -

10

Direct advertiser

GEOs: South Africa

CPA, RevShare (from 35%), Hybrid (on request) -

11

Direct offers

CPA, RevShare, Hybrid

GEOs: any -

12

Direct advertiser

CPA, RevShare (up to 40%), Hybrid

GEOs: 200+ -

13

Offers: 2000+

GEOs: any

CPA, CPL, CPS, CPI, RevShare, Hybrid -

14

1 in-house offer

GEOs: RU, KZ, AZ, UZ/KG, BD, TR

CPA only -

15

Offers: 1000+

GEOs: 40+

CPA, CPL, RevShare -

16

Offers: 800+

GEOs: 80+

CPA, RevShare, Hybrid -

17

Offers: 700+

GEOs: any

CPA, FTD, RevShare, Hybrid, CPL, CPI, CPS, free trial -

18

Direct advertiser

GEOs: India, Bangladesh, Brazil

CPA, RevShare, Hybrid -

19

Offers: 7300+

GEOs: any

CPA, CPL, CPS, COD, SS

In-house SmartLink -

20

Offers: 250+

GEOs: any

CPA, RevShare, Hybrid

Min. payout is $250 -

21

Offers: 1000+

GEOs: any

CPA, RevShare -

22

Gambling, Betting, Dating, Finance, Apps, e-Commerce, Education

GEOs: any

CPA, CPI, CPS, CPL, Hybrid, RevShare -

23

Offers: 400+

GEOs: 80+

CPA, CPL, CPI, CPS, CPR, RevShare

A great option for beginners -

24

Offers: 1000+

GEOs: any

CPA, RevShare, Hybrid

What Are Betting Affiliate Programs

Betting affiliate programs are partner programs run by sportsbooks (or operators) where affiliates promote a betting brand and earn commissions when referred users complete defined actions inside that brand’s funnel — typically registration and first deposit, or ongoing revenue share based on betting activity. The relationship is governed by tracked attribution (affiliate links, IDs/SubIDs), payout terms (CPA/CPL/RevShare/Hybrid), and program rules on GEOs, traffic sources, and promotional compliance, with reporting provided in an affiliate dashboard.

Betting Affiliate Networks: Difference

A betting affiliate network is a third-party platform that aggregates multiple betting brands under one interface, so affiliates can apply, track, and get paid across several operators without managing separate accounts for each program. The practical differences are centralized onboarding and reporting, sometimes bundled offers and “smartlink” routing, and network-level payment/hold policies — while brand-level restrictions still apply, because licensing, GEO availability, and promo rules are set by the underlying sportsbook/operator.

How Betting Affiliate Programs Work

Betting affiliate marketing basic flow is like this: you send a user to a sportsbook (via different traffic channels), the brand tracks that user under your affiliate account, and you get paid when the user completes the actions required by your deal. In sports betting, those actions are usually tied to registration and first deposit, not just clicks.

What makes betting different from many other affiliate niches is that sportsbooks don’t evaluate traffic only by volume. They look at player quality: does the user actually deposit, place bets, and come back again — or do they register, grab a bonus, and disappear. That’s why two affiliates can send the same number of signups and earn completely different money.

Also, every program runs on rules: which GEOs you’re allowed to target, what traffic sources are acceptable, how long validation takes, and what gets rejected (fraud, duplicates, bonus abuse, incentivized traffic, etc.). You don’t need to memorize the technical details yet — but you do need to treat betting as a “terms-driven” vertical: the results depend on the rules just as much as on your traffic.

Payout Models in Sports Betting Affiliate Programs

Sports betting affiliate programs usually pay on one of four models. The difference is in what event triggers payment, how long validation takes, and how predictable your cashflow is versus how much upside you keep long-term.

CPA

CPA is a fixed payout for a qualified acquisition, most commonly a first-time deposit (FTD). The exact trigger is defined by the program: it can be “FTD confirmed,” or FTD plus qualifiers like minimum deposit amount, KYC approval, or a first settled bet. CPA is typically processed through a validation window, so approved conversions appear after review rather than instantly.

CPL

CPL pays for a lead action — usually registration — but the definition varies by brand. Some programs count only verified registrations (email/SMS confirmation), and others require KYC even on CPL deals in regulated markets. CPL rates are lower than CPA because the user hasn’t deposited yet, and programs often cap or tightly filter CPL traffic depending on GEO and source.

Revenue Share

Revenue Share pays a percentage of the sportsbook’s net revenue generated by your referred players over time. “Net” matters: most programs calculate RevShare on NGR (Net Gaming Revenue) after specific deductions listed in the terms—commonly bonuses/free bets, chargebacks, fraud adjustments, and payment processing costs (the exact set depends on the operator). RevShare is performance-aligned: earnings track player activity, retention, and margins, and reporting usually updates as bets settle and revenue is finalized.

Hybrid Deals

Hybrid deals combine an upfront component (CPA) with an ongoing percentage (RevShare) for the same cohort of players. The tradeoff is structured in the numbers: hybrid CPA is typically lower than pure CPA, and hybrid RevShare is often lower than pure RevShare, because you’re taking value in two ways. Hybrids are common when you want cashflow without giving up long-term upside, or when a program wants to balance acquisition costs with retained player value.

Best Betting Affiliate Programs & Networks

In this top list, we’ll include both betting affiliate programs and betting affiliate networks, because some networks, acting as an intermediary between a program and an affiliate, provide both parties with benefits.

BetBoom Partners

BetBoom Partners is the official affiliate program of the BetBoom sportsbook. The brand operates under its own product stack with sports betting, esports, and casino integrated in one account. The program is actively expanding in LatAm with local licenses in Brazil and Mexico, which makes it suitable for affiliates working with Spanish- and Portuguese-speaking traffic. GEOs with stable conversion include Brazil, Mexico, Peru, Chile, and several CIS markets where BetBoom still has brand recognition.

What players get

- Full-featured sportsbook with competitive odds on football, basketball, tennis, and local LatAm leagues.

- Esports betting as a core product line — covers CS2, Dota 2, Valorant, and mobile disciplines.

- Mobile-first interface (native iOS/Android apps with fast onboarding and live betting support).

- Localized payment methods — PIX, Boleto, and crypto for LATAM; cards and wallets for CIS.

- Retention layer built into the product: CRM pushes, reload bonuses, and loyalty levels.

What affiliates get

- Conversion behavior: stable on Tier-2 GEOs (Brazil, Mexico, Chile); lower hold periods than average for LATAM betting programs.

- Commission models: RevShare up to 40%, CPA starting from $25, and Hybrid on request for stable traffic.

- Payout frequency: weekly; minimum withdrawal $10.

- Payment methods: USDT (TRC-20, ERC-20) and Bank Transfer, with average processing time 3–7 days.

- Manager support quality: fast onboarding (approval usually within one day), managers available via Telegram and email, capable of issuing custom rates for high-quality traffic or exclusive GEOs.

- Allowed traffic: SEO, social media (Twitter, by the way), Telegram, tipster channels, PPC on non-branded keywords, and content-based communities. Incentivized and brand-bidding traffic are restricted.

- Tracking and tools: detailed postback integration, multi-level SubID reporting, and real-time stats on FTDs and deposits.

Batery Partners

Batery Partners is an affiliate program running sports betting offers (plus casino) across its own brand portfolio. The platform is built around multi-GEO betting funnels and manager-led operations, with a clear focus on getting traffic to deposit.

What players get

- Sportsbook with live/in-play betting and standard pre-match markets across top sports (plus extras like parlays/combos).

- Esports lines included alongside traditional sports coverage.

- Casino layer in the same ecosystem (so sportsbook + casino cross-sell is part of the product).

- A broad set of deposit methods including bank cards + multiple crypto rails (USDT TRC-20 / ERC-20, BTC, ETH, etc.), plus local options depending on GEO.

What affiliates get

- In-house betting offers.

- Deal models: CPA / Revenue Share / Hybrid.

- Rates: CPA from $25 up to $300.

- Funnel benchmark: Reg → Dep > 30%.

- Payouts: every 2 weeks & on request.

- Withdrawal methods: bank cards, crypto, and e-wallets.

- Affiliate manager support: personal manager 24/7, plus direct comms via Telegram; in practice this is a manager-driven program (onboarding, terms, and materials are handled through the AM).

- Tools: easy-to-use affiliate account + detailed partner stats, and ready-made creatives for campaigns.

- Bonus on earnings: +25% to your first payment (one-time uplift mentioned as a program perk).

Rajabets Affiliates

Rajabets Affiliates is the affiliate program for Rajabets (sportsbook + casino), built around a tiered Revenue Share model. The product positioning is strongly India-oriented (cricket-first live betting content, Indian football leagues, and India-focused sportsbook UX), while the brand operates under a Curaçao license and runs standard affiliate tracking with a 30-day cookie.

What players get

- A sportsbook designed around live (in-play) betting with dynamic odds, and live markets.

- Strong cricket coverage for live betting, plus football markets including Indian Super League / I-League and major European competitions (EPL, UCL, La Liga, etc.).

- A promo layer built around big acquisition hooks: 200% welcome bonuses and instant cashback up to 25% (positioned for both sports betting and casino).

What affiliates get

- Tiering RevShare rates (by monthly FTD volume):

- 0–15 FTDs: 30%

- 16–30 FTDs: 35%

- 31–55 FTDs: 40%

- 55+ FTDs: 45%

- Monthly payouts.

- Minimum payout threshold: $50.

- Withdrawal methods: Crypto and PayPal.

- Affiliate manager support: 24/7 support with a personal manager.

- Traffic/compliance rules: prohibited promo methods include email spam, contextual ads using the Rajabets brand, and ClickUnder/PopUnder; cookie stuffing and false bonus claims are also explicitly forbidden.

4ra Partners

4RA PARTNER is a direct betting affiliate program focused on India and South Asia (with additional Tier-3 reach). The pitch is straightforward: a product stack built for mobile-heavy GEOs (including PWA options) and a partner workflow where you get offers, plug in tracking, and scale around the events and formats that actually move volume in these markets.

What players get

- Sportsbook product built around India / South Asia demand (cricket-centric calendar, regional sports interest, etc.).

- Betting + casino under one roof.

- Mobile-first access (the program highlights PWA availability, which usually matters in GEOs where app installs and lightweight UX are key).

- Local-market orientation (South Asia focus is explicitly stated: Bangladesh, Sri Lanka, Nepal).

What affiliates get

- Deal types: CPA, RevShare, Hybrid.

- Payout methods: USDT, USDC, or bank transfer (USD/EUR denomination at the company’s discretion).

- Minimum payout: $100.

- Payouts: NET30 by default unless otherwise agreed.

- Hold period: an initial 1-week holding period for commission validation.

- Traffic & compliance rules: clear bans on incent/incent-like sources, automated traffic, spam, and strict restrictions around brand usage/brand PPC/brand SEO.

- Tools & ops: PWA availability + “transparent traffic analytics” positioning, plus cases/recommendations for launching offers.

- Support: 24/7.

ClickDealer

ClickDealer is an affiliate network with an iGaming line that includes betting platforms. The network positions betting campaigns as brand-safe and runs them at scale across 180 countries, with a large overall catalog of offers and in-house platform features for routing and optimization.

What affiliates get

- Dozens of offers: With betting being its top vertical, the network operates across 180 countries with a large offer portfolio.

- Smartlink: an ML-driven Smartlink system that optimizes routing and supports “individual deals” (i.e., the ability to get custom terms when an advertiser likes your traffic).

- Tracking/tools: global and campaign-level postback/pixel, custom domains for tracking links, and API access (offer feed, links, postbacks, reports).

- Platform features for offer testing: LP rotation, creative splitting, and multi-event reporting (useful for Reg/FTD/qualified-event funnels).

- Payout terms: default is NET15 with a $500 minimum payout threshold.

- Smartlink payout terms: NET15 with a $100 minimum; after traffic quality approval, the $100 monthly threshold can be switched to $500+ weekly payouts.

- Withdrawal methods: Wire Transfer, Crypto, PayPal, Tipalti, eCheck, Payoneer (and Smartlink also lists Paxum among options).

- Affiliate manager support: 24/7 support; positioned as experienced and proactive managers who provide granular reporting insights and niche-specific input.

- Compliance & traffic quality controls: affiliate screening, anti-fraud/alerting, and monitored campaign setup.

Alfaleads

Alfaleads is an iGaming affiliate network with a dedicated betting direction. The network runs betting campaigns globally (175+ countries) and focuses on matching traffic to the right offer set (including brands licensed for specific GEOs).

What affiliates get

- Betting-oriented expertise: the network has a dedicated betting offers team and received an industry “Best Affiliate Network: Betting” recognition (Kinza Awards 2023).

- Offer scale: 1000+ direct advertisers and 5000+ offers across iGaming (betting included).

- Deal models: CPA, CPL, RevShare, Hybrid, Flat Fee.

- Traffic sources accepted: SEO, ASO, PPC, UAC, In-App, SMS, Email.

- Payout speed: average payout time is 7 days.

- Withdrawal methods: Capitalist, bank cards, Wire, Wise, PayPal (and more on request).

- Support quality: you get a personal manager who helps pick offers/funnels, can provide key campaign metrics on request, and you also have a dedicated Customer Care / finance support layer for payout-related questions.

LGaming

LGaming is an iGaming affiliate network focused on betting offers (among others), built as more than a “links + payouts” platform: it bundles exclusive offers, free app rentals, and a workflow where affiliates can run betting funnels with event-driven hooks (streams, stats, postback setup) and withdraw earnings on demand instead of waiting for a fixed payout date.

What affiliates get

- Dozens of betting offers.

- Deal models: CPA, RevShare.

- Payout format: on request (withdrawal is initiated by the affiliate).

- Minimum withdrawal: $100.

- Withdrawal methods: bank cards, USDT, Bitcoin, Capitalist, wire transfer (with an option to add a method by request at sufficient volume).

- Processing time: up to 5 business days after requesting a payout.

- Tracking/tools for betting campaigns: stream creation + postback setup, plus filtering stats by streams/offers/landings/devices/countries/sub-accounts.

- Manager support: manager-led onboarding (private registration + short interview) and fast comms (~15 min average response time).

Comparison Table

For your convenience, we took the most important parameters of the above-mentioned best betting affiliate programs and networks in this table:

| Program / Network | Type | GEO fit | Deal models & headline rates | Min payout | Withdrawal methods | Traffic / compliance notes |

|---|---|---|---|---|---|---|

| BetBoom Partners | Program | Brazil, Peru, Mexico, CIS | CPA (core) + Fix/RevShare/Hybrid negotiable for SEO; No hold (CIS), 7-day hold (intl.) | $10 | USDT TRC-20 / USDT ERC-20 / bank transfer (all from $10) | Accepts ASO / PPC / SEO (quality-focused onboarding) |

| Batery Partners | Program | India, Bangladesh, Canada, Germany | RevShare up to 55% (India/Bangladesh) + CPA up to $300 (Canada) + Hybrid | $100 | USDT (TRC-20) + bank transfer (on request) | Emphasis on promo materials + lead-level stats; managers help with campaign/payment tooling |

| Rajabets Affiliates | Program | India-only | CPA / Hybrid / RevShare; official terms list 25% net profit commission (negotiable) + “no negative carryover” | $50 (RevShare/Hybrid) or 1 FTD (CPA) | USDT (other crypto can be added individually) | Brand keyword restrictions noted; broad channel mix supported (social/apps/ASO/UAC/PPC/email/SMS/influencer/SEO) |

| 4ra Partner | Program | India, Bangladesh, Sri Lanka, Nepal | RevShare + CPA | $100 | USDT / USDC / bank transfer (international) | Standard program compliance clauses + geo/offer-specific rules in T&C |

| ClickDealer | Network | Dozens of offers for dozens of GEOs | Depends on offer; network-level terms: Monthly NET15 default; expedited Weekly NET5 possible for trusted partners | $500 (default network) / $100 (Smartlink) | Wire, Crypto, PayPal, Tipalti, eCheck, Payoneer | “Whitehat” positioning; pops/incent allowed only on some offers (offer card rules matter) |

| Alfaleads | Network | Dozens of offers for dozens of GEOs | Multi-model network; review highlights weekly payouts and broad payment rails | $30 (USD/EUR) | WebMoney, Capitalist, Wire, Paxum, PayPal, Visa/Mastercard | “Work with large/trusted affiliates” positioning; terms often offer-dependent |

| LGaming | Network | Dozens of offers for dozens of GEOs | CPA + RevShare | $100 | Bank cards, USDT, Bitcoin, Capitalist, Wire transfer | Private onboarding (interview), offer-level caps/holds/reconciliation inside dashboard |

How We Compiled This Top List

This list isn’t built from scraped “directories” or recycled brand blurbs. We review each betting affiliate program or network one by one, using a consistent checklist that focuses on what actually matters in sportsbook affiliate work: GEO fit, product depth, payment logistics, licensing, and traffic rules. For every entry you see here, we collect the same set of operational details and then publish it in a standalone review page, so you can verify the specifics and compare offers on equal terms.

Our evaluation is based on concrete criteria: commission models and exact rates where publicly stated, payout cadence, minimum payout, and withdrawal methods; plus betting-specific factors like sportsbook/esports coverage, live betting features, onboarding/KYC flow, and localized payments for the target GEOs. We also assess the affiliate-side workflow: tracking capabilities (SubIDs, postback, reporting depth), allowed traffic sources and compliance limits, and the practical value of support — whether affiliate managers are reachable, technically competent, and able to provide offer access, creatives, and deal improvements when traffic quality is proven.

Key Things to Look for in a Betting Affiliate Program (or Network)

Betting is a “rules + logistics” vertical. If you miss one clause (attribution, qualification, traffic restrictions), you can end up optimizing the wrong funnel event.

Commission Terms

For CPA, check the qualification trigger: is it FTD only, or FTD + KYC, minimum deposit, first settled bet, or wagering requirement. Also ask what gets rejected: duplicate accounts, fraud flags, bonus abuse, self-exclusion. For RevShare, confirm what the share is calculated on (NGR definition) and whether they use negative carryover; also verify which deductions exist (bonuses/free bets, chargebacks, payment fees, fraud adjustments).

Cookie Lifespan & Attribution Rules

Don’t treat “30-day cookie” as a guarantee. You need the attribution rules: last click vs other models, whether attribution survives app install (web → app handoff), and what happens if the user returns via internal channels (push/email/CRM). If you run multiple landers, make sure SubIDs persist through redirects and “one-click” link chains.

GEO Coverage, Licensing & Payments

GEO fit is not just language. You need:

- Legal/operational availability;

- Local deposit rails that match the GEO (PIX/Boleto, UPI, bank cards, local wallets, crypto);

- A bonus structure that’s normal for that market (free bet vs deposit match). If a GEO’s top payment method isn’t supported, your Reg→Dep will collapse regardless of traffic quality.

Validation, Hold, and Cashflow Reality

Ask for the full timeline: click recorded → reg → FTD → validation window → payout date. Many betting brands run a hold (often 7–30 days) for fraud screening and chargeback risk. Also confirm whether first payouts are slower (new affiliate onboarding) and whether you can move to weekly after a track record.

Traffic Rules That Matter for Betting

Get specifics: is PPC allowed on non-brand keywords, and are trademarks/brand bidding banned? Are tipster communities, Telegram channels, and odds content allowed? Do they forbid incent (cashback to users), pop-under, or certain ad formats? Betting advertisers are stricter on messaging: “guaranteed win” and misleading bonus claims get accounts flagged fast.

Tracking and Reporting Depth

Minimum: SubIDs + event-level reporting. For betting, you want to see Reg, FTD, and ideally deposit amount / bet activity signals (even if aggregated). If you buy traffic, you’ll need postback (S2S) and stable event timestamps to debug attribution. Also check how they handle multi-GEO routing (one link vs separate offers) so you don’t mix funnels with different qualification rules.

Affiliate Manager Quality

A good AM in betting does more than “support”: they can unlock GEOs, negotiate CPA/RevShare tiers, adjust caps, provide localized promo packs, and confirm the exact conversion definition for your offer. If offer access is manager-gated or approvals are manual, response speed directly affects your ability to scale during sports calendar spikes (derbies, playoffs, major tournaments).

Types of Betting Affiliate Offers

In betting, an “offer” is a funnel mechanic that changes how users move from click → signup → deposit → first bets → repeat deposits. Most sportsbook promos used in affiliate funnels fall into a few repeatable formats.

Deposit-Triggered Offers (FTD drivers)

These are promos where the main requirement is first deposit, because sportsbooks want the user to cross the payment barrier.

- Deposit match (percentage match, sometimes tiered by amount).

- Bet credits on deposit (e.g., credits/free bet unlocked after funding).

- Deposit + qualifying bet (deposit alone isn’t enough; the user must place a bet or place a bet on a specific market).

Affiliate note: always check the qualifier: minimum deposit, eligible payment methods, and whether the reward is given instantly or after a settled bet.

Registration-Triggered Offers

These offers pay attention to lowering the first step friction (account creation).

- Signup reward (free bet/bet credits after registration).

- Signup + verification (reward only after phone/email/KYC, common in regulated or high-fraud GEOs).

Affiliate note: if verification is required, treat it as part of the conversion path and align your pre-lander copy with that reality.

Odds/Market Mechanics

These are promos tied to a specific match or market and are used to create urgency.

- Enhanced odds on selected games/markets.

- Parlay/accumulator promos (boosts or rewards tied to multi-leg bets).

- Risk-free first bet / stake-back formats (usually “refund as free bet/credits” if the first bet loses).

Affiliate note: these convert best with event-driven traffic (match previews, tips, communities) because the intent is already “I’m betting this game”.

Loss-Protection & Cashback

These offers reduce perceived downside and are used to keep users betting beyond the first session.

- Cashback on losses (percentage, capped).

- Insurance on specific bet types (e.g., “one leg loses” on parlays).

- Time-window cashback (weekly/monthly calculations, sometimes requiring activity thresholds).

Affiliate note: cashback terms are where programs hide the most constraints (caps, eligible markets, min odds, settlement rules). If you ignore them, you’ll mis-segment traffic and inflate expectations.

Multi-Step / Lifecycle Offers

These offers are designed as sequences rather than a single trigger.

- Signup → deposit → turnover milestone (rewards unlocked as the user progresses).

- Streak mechanics (rewards for consecutive betting days or deposit frequency).

- Seasonal ladders (sports calendar-based promos: tournament periods, playoffs, “new season” resets).

Affiliate note: these are ideal for channels where you can follow up (SEO content hubs, Telegram, email, push) because the value is realized over multiple sessions.

Channel-Specific Promos

Some offers are less about betting markets and more about how the user enters the product.

- App-first bonuses (reward only via app/PWA install).

- Payment-method incentives (extra reward for local rails or crypto).

- Localized onboarding promos (GEO-specific bonus pages, currency and method alignment).

Affiliate note: if the offer is tied to app or a payment rail, your landing page must pre-qualify the user; otherwise you’ll drive clicks that can’t complete the required action.

Best Traffic Sources in Betting Affiliate Marketing

In betting, a “traffic source” is often part of the offer’s rules: many programs approve campaigns source-by-source (SEO allowed, brand PPC banned, pops restricted, etc.). So you don’t pick a channel in isolation — you pick a channel that matches the offer mechanic (deposit bonus, odds boost, cashback) and the sports calendar (pre-match vs live spikes).

Paid Social (TikTok / Meta / Instagram, etc.)

Paid social works when your funnel is built around simple entry actions: app/open → signup → first deposit. Betting creatives that scale are usually tied to events and emotions (big matchdays, local leagues, “today’s games”), but your real constraint is compliance: many brands and platforms limit how you can describe bonuses, “wins,” and targeting. Treat social as a volume channel that needs fast iteration on creatives, domains, and landing flows.

SEO & Content Sites (previews, odds pages, match hubs)

SEO is the most stable channel for betting when you structure content around queries with intent: match previews, market explainers (“over/under,” handicaps), bookmaker comparisons by GEO, and payment-method pages. The strongest monetization layer is an event hub model: preview → live-related pages → recap → next fixture, so links stay relevant across the season instead of dying after one match.

PPC / Search (Google, etc.)

Search traffic converts when you target non-brand intent that already implies a betting action (“best odds for…”, “how to bet on…”, “sportsbook for [GEO/payment]”). The operational edge is precision: landing pages must match the exact promise (bonus terms, eligible markets, payment rails), and you need clean separation between brand vs non-brand policies because many programs explicitly restrict trademark usage.

Email / Telegram / Communities

These channels are built for repeat betting sessions: weekly fixture cycles, tournament runs, and recurring promos (reload, cashback windows, odds boosts). The main advantage is control: you can segment by sport, GEO, and promo type, so you don’t push an offer to users who can’t deposit with the available rails or who are outside the allowed countries.

Push Notifications

Push is a mass channel that works best when you route traffic into time-sensitive hooks (match starts soon, limited-time odds boost, short cashback window). It’s heavily dependent on filtering and routing: you need tight GEO/device controls and landers that pre-qualify quickly, because betting programs validate aggressively when the source produces noisy registrations.

ClickUnder / PopUnder

Pops can be used for betting only when the offer and brand explicitly allow the format and you run a hard-qualifying pre-lander (GEO, sport interest, and a clear CTA). Without qualification, you’re optimizing for the wrong event (clicks) and you’ll see weak deposit performance and higher rejection risk under program rules.

Native / Teaser Networks

Native/teasers can move volume for betting when the creative is aligned with sports context (match story, team angle, tournament narrative) rather than generic “bonus” messaging. The key is controlling expectations: you want the click to land on a page that explains the promo mechanics for that GEO (deposit/turnover/eligible markets) before the user hits the sportsbook.

Doorway-Style Landing Pages

Doorways are not “betting SEO” in the long-term sense; they’re a short-lived routing method. If you use them, the only sustainable way is to treat them as GEO-specific routing pages with minimal claims and clear compliance—otherwise they become unstable and hard to scale without constant replacement.

Comparison Table

Along with pros, even best traffic sources for betting affiliate sources have cons. You can compare them here:

| Traffic source | Pros | Cons |

|---|---|---|

| Paid Social (TikTok/Meta/IG) | Fast scaling; strong reach; good for event hooks | Account bans; strict ad policies; frequent creative fatigue |

| SEO / Content sites | Long-term compounding traffic; high-intent users; strong Reg→Dep when localized | Slow to ramp; competitive SERPs; requires ongoing content updates |

| PPC / Search ads | High intent; precise GEO/keyword control; predictable testing | Expensive clicks in many GEOs; heavy optimization; brand/trademark restrictions |

| Communities (Telegram/Discord/forums) | High trust; repeat sessions; good for matchday promos | Hard to scale; depends on moderation; link/promo restrictions |

| Email marketing | Segmentation; retention; strong for reload/cashback cycles | List building takes time; deliverability risk; compliance/spam rules |

| Push notifications | Cheap volume; good for time-sensitive promos; quick tests | Noisy traffic; fast burnout; needs tight filtering/pre-landers |

| ClickUnder / PopUnder | Very cheap reach; massive volume; quick scaling | Low intent; brand damage risk; often restricted by advertisers |

| Native / Teaser networks | Good CTR; works with sports narratives; scalable testing | Mixed quality; moderation issues; needs strong landers |

| Doorway landers (doorways) | Fast deployment; GEO routing; low build cost | Unstable (indexing/ban risk); low trust; short lifecycle |

More about traffic sources for iGaming affiliate offers can be found here.

Trends in Betting Affiliate Marketing (2026)

The “best offers” are getting less universal and more GEO- and channel-specific. In 2026, most shifts come from two forces: regulation (more local rules) and measurement (harder attribution), which pushes affiliates toward tighter funnels and better retention ops.

Regulation & Market Fragmentation

Sports betting is increasingly a patchwork of jurisdictions, not a single global market. The U.S. is the clearest example: legal sports betting spans 38 states + D.C., but every market still has its own licensing, advertising constraints, and operator availability. In newly regulated LATAM markets, compliance is becoming part of the funnel itself: Brazil’s framework includes requirements like licensed operators, “.bet.br” domains, CPF + facial recognition verification, and even limits on welcome bonuses—all of which directly affects what you can promise on landing pages and how users convert.

Shift to First-Party Data / Harder Tracking

Attribution is moving away from “cookie-first assumptions” toward first-party signals and server-side plumbing. Chrome is maintaining a user choice approach around third-party cookies and continues pushing developers to design flows that work when third-party cookies are blocked—meaning affiliates should treat 3P cookie reliability as variable by default. Practically, that increases the value of clean SubID discipline, stable redirect chains, and postback/S2S setups (especially when you run multiple landers or app handoffs).

More Focus on Retention and CRM-like funnels

Operators are pushing more of the monetization into multi-step lifecycles: reloads, cashback windows, missions, loyalty, and cross-vertical wallets. For affiliates, this changes how you build assets: instead of one “bonus page,” you need segmented entry points (by sport, payment rail, GEO) and channels that can re-engage users (communities, email/Telegram, push). The underlying logic is simple: LTV is created after FTD, so brands invest in CRM mechanics—and affiliates who can feed repeat sessions get better terms.

GEOs with Developing Betting Industry

Growth is shifting toward newly regulated or fast-digitizing regions, where offer volume and competition ramp quickly. Brazil is the headline market because regulation fully kicked in on Jan 1, 2025 and changed operator requirements and onboarding rules. More broadly, industry outlooks for 2026 point to Latin America, Brazil especially, parts of Africa, and select MENA jurisdictions as the main expansion vector versus saturated mature markets.

What is means for us, affiliates: betting industry development is inextricably linked to betting affiliate marketing. Fresh GEOs mean weaker competition, and this is a great opportunity to make money.

Compliance and Licensing in Betting

Betting is one of the most compliance-sensitive affiliate verticals because ad rules are tied to licensing, GEO availability, and consumer protection. Before scaling, you need your funnel to match what the operator is legally allowed to market in each country—and what your traffic source permits you to say.

GEO Rules, Age Gates & Responsible Gambling Messaging

Treat GEO as a hard constraint: sportsbooks typically accept traffic only from allowed countries/regions, and many require you to exclude restricted GEOs at the campaign level (not “let the lander sort it out”). Your landers should include an 18+/21+ age gate where required and display responsible gambling language consistent with the GEO (common requirements: “Play responsibly”, help resources, and avoiding minors/underage targeting). If the operator runs under a local license, expect stricter rules on targeting, messaging, and verification flows (KYC/ID checks are part of the conversion path in many regulated markets).

Bonus Advertising Disclosures (terms, wagering requirements)

Bonus creatives must reflect the real conditions: eligibility by GEO, minimum deposit, time limits, max bonus/free bet amount, and the key mechanics (e.g., free bet stake not returned, odds requirements, market exclusions). If the offer has wagering/turnover requirements, your copy should not hide them—especially on paid channels and short landers. For compliance and CR, structure promo messaging as: bonus headline → who’s eligible → key conditions → CTA, and keep “too-good-to-be-true” phrasing out of betting ads (many platforms flag that language).

Brand Bidding, Trademarks & Creative Approval

Most betting programs restrict brand bidding and trademark usage in PPC: rules usually cover bidding on the brand name, using trademarks in ad copy, and running look-alike domains. The same applies to creatives: programs often require pre-approval for ad units, landing pages, and bonus wording, especially in regulated GEOs or when you run aggressive formats. Operationally, lock this down early: get written confirmation on (1) what keywords are forbidden, (2) what brand assets you can use, and (3) which claims are prohibited (odds guarantees, “risk-free” without conditions, misleading “official” language).

FAQ

A betting affiliate program is a direct partnership with a sportsbook/operator where you earn commission when referred users complete defined actions (most commonly registration and first-time deposit) under the program’s terms.

A program is run by the sportsbook itself (direct advertiser). A network aggregates multiple betting brands under one platform, so you can access several offers and reporting in one place.

CPA is built around qualified FTDs and predictable cashflow. RevShare pays from player net revenue over time. Hybrid combines both. The right choice depends on your traffic type (paid vs content/community) and how well your GEO converts to repeat deposits.

Most CPA deals are triggered by FTD, but programs may add qualifiers such as minimum deposit, KYC verification, or a first settled bet. Always confirm the exact trigger before running paid campaigns.

It depends on validation/hold rules and the payout schedule (weekly/bi-weekly/monthly). Many programs also have a minimum payout threshold and process withdrawals through specific methods (USDT, bank transfer, e-wallets).

SEO and content are commonly allowed. PPC, social, email, push, and communities may be allowed or restricted depending on the program and GEO. Brand bidding and misleading bonus claims are frequent restrictions.

Sometimes—usually on non-brand keywords and only in GEOs where the operator is allowed to advertise. Many programs forbid trademark bidding, and ad platforms have their own gambling policies, so you must align both sets of rules.

The most common mechanics are deposit-triggered bonuses (deposit match / bet credits), event hooks (odds boosts), loss protection (cashback / stake-back), and multi-step lifecycle promos (signup → deposit → turnover milestones).

In betting, Reg→Dep is heavily influenced by GEO factors (KYC friction, payment rails, bonus eligibility, currency/localization) and by offer mechanics (minimum deposit, qualifying bet rules, time limits).

Confirm that the brand is operational and licensed (where relevant), supports the GEO’s common payment methods, and allows your traffic source. Then make sure your landing page matches the exact bonus terms for that country.

Many do (often USDT), but methods vary by program. Always confirm the available withdrawal rails, minimum payout, and processing time before scaling spend.

Use SubIDs per source/page, keep redirect chains stable, and set up postback where possible. This matters even more when the path includes web→app handoffs or multiple landers.