Virtual card services allow you to generate payment cards instantly through a web dashboard. Each card includes its own number, CVV and expiration date. You can choose single‑use cards that deactivate after one transaction or reusable cards with adjustable limits. Affiliates assign cards to specific campaigns or traffic sources, keeping their main account separate.

-

1

102+ trusted BINs with 3DS

Tier-based conditions

24/7 support -

2

Available currencies: USD, EUR, GBP

Variety of BINs and cards with 3DS security

Is oriented towards affiliate teams and large IT companies -

3

Mass payments, multi-currency transactions

Supports crypto

Card issuance costs $5

Monthly service fee is $5 -

4

Two types of cards: limited and cards with a shared balance

Card issuance fee: from $0

Balance top-up fee: 3%

Offers 40+ trusted BINs from the US, Estonia, the UK, and Hong Kong

Why Affiliates Use Virtual Cards — and How to Choose a Provider

In practice, affiliates rely on virtual cards for a few very specific reasons.

Paying for Ads Across Multiple Platforms

Facebook, Google, TikTok, and other ad platforms require a card to be linked to each ad account. Reusing the same card across many accounts quickly leads to flags and bans. That makes it impossible to test or scale campaigns using one or two cards — each account needs its own payment method.

Paying for Services and Tools

Many advertising tools, SaaS platforms, and infrastructure services operate only with Visa or Mastercard. Depending on your location, access to these payment systems can be limited, which makes virtual cards a practical workaround for subscriptions and one-off purchases.

Scaling Profitable Campaigns

Once an affiliate finds a working setup, scaling usually means launching it across dozens of ad accounts. Not every card will bind successfully, and some will fail without clear reasons. Having a reserve of cards is not optional — it’s part of normal scaling.

Moving Funds From Crypto to Fiat Spending

Some affiliate programs and CPA networks don’t support direct crypto payments for expenses. In these cases, affiliates use virtual cards to move funds from crypto wallets or exchanges and pay for ads or services directly, without additional intermediaries.

Because of this, using 1–2 personal cards, borrowing cards, or buying random cards online is inefficient and risky. Dedicated virtual card services exist specifically to solve these problems.

What Matters When Choosing a Virtual Card Service

Not all card issuers are equally useful for affiliate work. To avoid wasted time and unnecessary costs, affiliates usually evaluate services using the following criteria.

Fees and Real Costs

Most providers advertise low or “transparent” fees, but the actual cost often includes more than just top-ups. Transfers between cards, currency conversion, hidden service fees, and bank commissions can significantly affect the final spend. Before choosing a service, affiliates typically clarify all fees with support — not just the headline numbers.

BIN Quality and Availability

BINs define the card’s issuing bank, country, and payment system. Ad platforms actively blacklist BINs with a bad history. Cards from these BINs may fail to bind or get rejected immediately. This often happens after abuse by users who spend aggressively and disappear. Reliable services regularly rotate BINs and replace problematic ones.

Card Issuance Model

Some providers issue cards for free but charge higher top-up fees. Others charge a small issuance fee ($2–3) with lower operational costs. Some offer free cards but require monthly maintenance payments. There’s no universal “best” model — affiliates choose based on how often they need new cards and how long they plan to keep them active.

Bonus Programs and Volume Incentives

Certain services offer cashback on spending or reduced fees for long-term or high-volume users. For teams and active affiliates, these programs can noticeably reduce operational costs over time.

Dashboard Usability and Support

A clean interface, fast card replacement, and responsive support matter more than design. When cards fail or get blocked mid-campaign, response speed directly affects results. Reliable services usually replace faulty cards and help diagnose binding issues instead of sending generic replies.

How This List Was Compiled

To build this selection, we reviewed popular virtual card services used in affiliate marketing, spoke with provider support teams, and gathered feedback from active affiliates and media buyers. The focus was not on marketing claims, but on real-world usability in paid traffic workflows.

Best Virtual Card Services for Affiliate Marketing

Our top-list features 4 best virtual cards issuing companies. Affiliates can use them in their work with Google Ads, Facebook Ads, TikTok Ads, and other advertising platforms with strict policies.

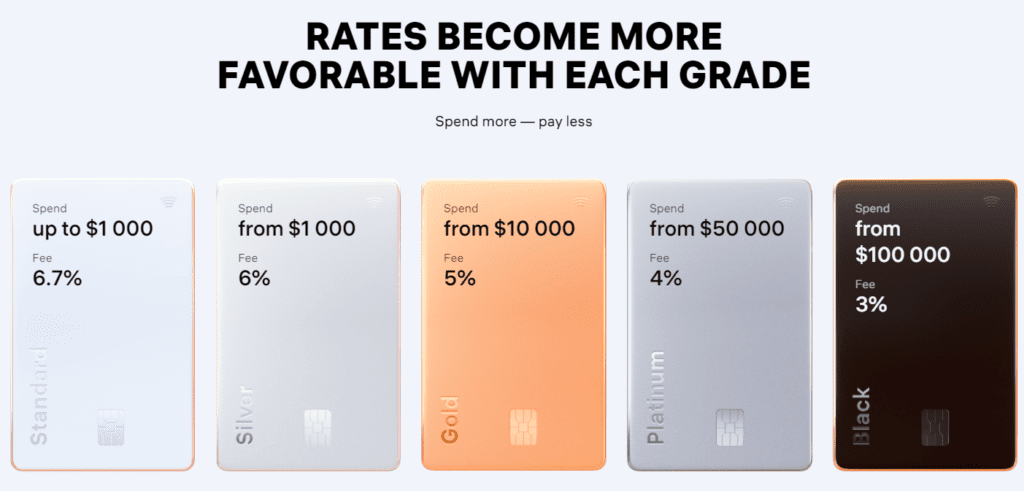

E.PN

E.PN is a volume-oriented payment platform for online advertising and digital services. The brand has been on the market for several years and is well known among affiliates and media buyers working with paid traffic.

The service is built around a tiered pricing model, where fees decrease as spending volume grows. This makes E.PN less attractive for very small test budgets, but more competitive for affiliates who operate at scale and prioritize long-term cost optimization. The platform focuses on card availability, BIN diversity, and predictable pricing.

E.PN is typically used as a core payment layer: affiliates fund the balance, issue multiple cards, and reuse the service across campaigns, ad platforms, and subscriptions. The brand acts as a universal card provider for paid traffic workflows regardless of GEOs and verticals.

Key parameters:

- Top-up fee: ~3%–6.7% (tiered by spend volume)

- Card issuance: $2–4 per card

- BINs: 50+ BINs from ~36 banks (multi-geo)

- Funding methods: Crypto (USDT, BTC) + fiat

- KYC: Required for higher tiers and lower fees

- Best for: Scaling paid traffic with high monthly spend

Read full review here.

AdsCard

AdsCard is a virtual card service built specifically for paid advertising workflows, with a strong focus on media buyers and affiliate teams working across multiple ad platforms. The brand positions itself as an infrastructure provider and emphasizes BIN quality, card stability, and team-oriented features.

The service is commonly used by affiliates running traffic on Facebook, Google, TikTok, and native ad networks, where card reliability and predictable behavior matter more than consumer-style features. AdsCard puts noticeable emphasis on BIN segmentation and platform-specific usage, which makes it easier to align cards with particular ad accounts or traffic sources.

AdsCard is typically chosen by users who work with structured setups: multiple ad accounts, separate cards per campaign, and shared access inside a team. This is a practical, operations-first solution, and is often used alongside anti-detect browsers and proxy stacks.

Key parameters:

- Top-up fee: ~2–4% (depends on BIN and funding method)

- Card issuance: from $2–3 per card

- BINs: Multiple BINs (US, EU), including platform-oriented BINs

- Funding methods: Crypto (USDT) + selected fiat options

- KYC: Required for full access

- Best for: Team-based media buying and structured ad account setups

Read full review here.

Pay2.House

Pay2.House is a payment platform positioned as a fintech-style infrastructure service. The brand focuses on virtual cards, mass payments, and multi-currency operations, which makes it relevant both for affiliates and agencies/teams handling payouts and internal balances.

This service is commonly used in workflows where payments and fund movement are as important as ad spend itself — for example, when managing multiple cards, redistributing balances, or working with different currencies and regions. Compared to ad-platform-centric card services, Pay2.House places more emphasis on payment operations and account-level control.

Key parameters:

- Top-up fee: ~3–5% (depends on funding method)

- Card issuance: ~$5 per card

- Monthly maintenance: ~$5 per active card

- BINs: Multiple international BINs

- Funding methods: Crypto + fiat

- KYC: Required

- Best for: Payment management, multi-currency operations, steady ad spend

Read full review here.

Combo Cards

Combo Cards is a flexible, BIN-focused solution for affiliates and media buyers who need cards that bind reliably across different ad platforms and GEOs. The brand emphasizes BIN diversity and predictable fee mechanics rather than volume-based pricing or complex fintech tooling.

The platform is commonly used for testing and mid-scale traffic, where buyers need multiple cards with different BIN profiles and want to quickly switch between them if a card or BIN stops working. The service offers more than one card type, allowing affiliates to adapt their setup depending on traffic source and platform behavior.

Compared to volume-oriented providers, Combo Cards is usually chosen for operational flexibility: rotating cards, working with multiple ad accounts, and minimizing friction when launching or restarting campaigns.

Key parameters:

- Top-up fee: ~3%

- Card issuance: Free (but depends on card type)

- BINs: 40+ BINs (US, UK, Estonia, Hong Kong, and others)

- Funding methods: Crypto

- KYC: Required

- Best for: Campaign testing and BIN rotation across multiple ad accounts

Read full review here.

Comparison Table

| Service | Positioning | Top-up fee | Card issuance | BINs | Funding methods | KYC | Best use case |

|---|---|---|---|---|---|---|---|

| E.PN | Volume-oriented card provider for scaled buying | ~3%–6.7% (tiered by spend) | $2–4 | 50+ BINs, multi-geo | Crypto (USDT, BTC) + fiat | Yes (for lower fees) | High-volume paid traffic, long-term scaling |

| AdsCard | Team-focused ad payment infrastructure | ~2%–4% | $2–3 | Multiple US & EU BINs, platform-oriented | Crypto (USDT) + limited fiat | Yes | Team-based media buying, structured setups |

| Pay2.House | Fintech-style payment & card management | ~3%–5% | ~$5 | International BINs | Crypto + fiat | Yes | Payment operations, steady ad spend, agencies |

| Combo Cards | Flexible BIN-focused card solution | ~3% | Free (by card type) | 40+ BINs (US, UK, EU, HK) | Crypto | Yes | Testing, BIN rotation, mid-scale traffic |

Which Virtual Card Service Should You Choose?

Different buying setups come with different constraints around card limits, BIN stability, fees, and access control. The scenarios below reflect how virtual cards are typically used in real affiliate workflows.

- Solo affiliate testing new accounts

When testing fresh ad accounts or new traffic sources, cards often need to be replaced quickly due to binding failures or platform rejections. In this case, BIN diversity and fast card rotation matter more than long-term fee optimization.

→ Combo Cards - Team-based media buying

Teams working with multiple buyers and ad accounts usually need clear spending separation, controlled access, and predictable card behavior. Shared workflows benefit from services designed around structured setups rather than single-user convenience.

→ AdsCard - High-volume paid traffic

Once campaigns are scaled and spend grows consistently, marginal costs start to matter. Services with tiered pricing become more attractive at this stage, as lower top-up fees can significantly impact profitability over time.

→ E.PN - Agencies & payment-heavy operations

Some workflows involve frequent balance movements, multiple currencies, and payments beyond ad platforms. In these cases, broader payment functionality and stable account-level management are often more important than rapid card rotation.

→ Pay2.House

Common Mistakes When Using Virtual Cards for Ads

Even experienced affiliates tend to repeat the same mistakes when working with virtual cards. Most issues don’t come from the card service itself, but from how cards are used inside paid traffic setups.

- Reusing one card across multiple ad accounts

Attaching the same card to many accounts quickly creates a shared risk profile. Once one account is flagged, the card often follows. - Ignoring BIN history and platform compatibility

Not all BINs behave the same way. Cards from BINs with a bad advertising history may fail to bind or get declined regardless of balance. - Scaling spend before the account builds trust

Increasing budgets too fast on fresh accounts raises red flags. Card acceptance alone doesn’t mean the account is ready for scale. - Choosing cards based on fees instead of acceptance rate

A cheaper top-up fee doesn’t help if cards decline or stop working mid-campaign. Stability usually matters more than nominal cost. - Relying on a single card provider

BINs burn out, rules change, and services impose limits. Using only one provider increases downtime when issues appear.

This is why most active media buyers treat virtual cards as part of a broader traffic stack — not as a standalone solution.

Are Virtual Cards “Stolen Cards”? Clearing Up a Common Myth

From time to time, you’ll see claims that virtual card services use cards stolen from real people. This perception exists in affiliate circles, but it mixes together very different things.

Legitimate virtual card providers issue cards through licensed banks or EMI partners. These are prepaid or corporate cards generated on demand inside the platform, with balances, limits, and status fully controlled by the user. There is no third-party “owner” behind such cards, and no connection to random individuals. This is standard B2B card issuing, not card reselling.

At the same time, the market has seen short-lived “card shops” that relied on compromised card data or outright fraud. These operations usually had obvious red flags: unrealistically low prices, no KYC at any stage, anonymous teams, and cards that stopped working en masse within days or weeks. When such services disappear, the story spreads that “all virtual cards are stolen,” even though these schemes are not representative of real providers.

Most problems affiliates face in practice — sudden declines, cards no longer binding, or entire batches failing — are almost always caused by BIN reputation and platform risk scoring, not by the origin of the card. Ad platforms block BINs with a history of abuse, regardless of whether the cards themselves are legitimate.

In short: reputable virtual card services do not operate on stolen cards. The risks affiliates deal with come from how aggressively cards are used and how ad platforms react to that behavior, not from illegal card sources.

FAQ

In most cases, yes. Using one card across multiple ad accounts increases the risk of linked bans. A separate card per account helps isolate issues and makes spend control easier.

Most failures are related to BIN reputation changes or platform risk scoring. A card can be valid and funded but still get rejected if the BIN becomes flagged by an ad platform.

Basic access is often available without full verification, but scaling usually requires KYC. Higher limits, lower fees, and long-term stability are typically unlocked only after verification.

Crypto funding doesn’t make cards “safer” for ad platforms, but it simplifies fund management for affiliates paid in crypto. Acceptance depends on BIN quality and account behavior, not the funding source.

Reputable providers issue cards through licensed banks or EMI partners and do not rely on stolen card data. Most card-related issues in advertising come from BIN blacklisting and risk scoring, not from illegal card sources.

Rarely. Many affiliates use two or more services in parallel to rotate BINs, manage downtime, or separate testing from scaling budgets. Relying on a single provider increases operational risk.