Dating is a vertical of affiliate marketing where offers are dating sites or their apps. This niche is considered evergreen — people always want to meet and seek relationships. To help you run such campaigns profitably, we have collected our top-list of best dating affiliate networks:

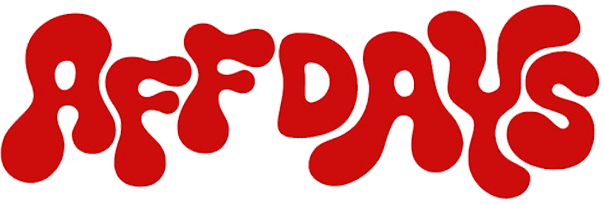

-

1

Offers: 5,500+

GEOs: any

CPA, CPL, COD, SOI, CPS, RevShare, PPI -

2

Offers: 18,000+

GEOs: 180 -

3

Direct advertiser

Offers: 6

GEOs: 63

CPA, CPL, RevShare -

4

Offers: 1500+

GEOs: any

CPA, RevShare

In-house Smartlink -

5

Offers: 4000+

GEOs: 100+

CPA only

In-house SmartLink

For experienced affiliates only -

6

Offers: 1000+

GEOs: any

CPA only -

7

GEOs: any

CPA, CPI, CPS, CPL, Hybrid, RevShare -

8

Offers: 7300+

GEOs: any

CPA, CPL, CPS, COD, SS

In-house Smartlink -

9

Offers: 700

GEOs: any

CPA, FTD, RevShare, Hybrid, CPL, CPI, CPS, free trial

The dating industry remains one of the most profitable verticals in affiliate marketing. According to Statista, the global online market of the industry is projected to surpass $11.7 billion by 2028, driven by mobile apps, niche platforms, and expanding user bases in regions such as North America, Western Europe, and Asia-Pacific. Programs and networks play a central role here by connecting dating platforms with affiliates who can drive traffic and generate sign-ups.

What Are Dating Affiliate Networks

A dating affiliate program is a partnership model offered by sites or apps, allowing affiliates to earn commissions for referring new users. You can promote services through websites, blogs, social media, paid ads, or email campaigns, and be paid when their referred traffic converts into sign-ups or subscriptions.

A dating affiliate network is an intermediary platform that aggregates multiple offers. Instead of working directly with a single brand, you can access dozens or hundreds of campaigns within one system. Networks typically provide:

- Tracking and analytics tools.

- Pre-made ad creatives (banners, landing pages).

- Payment consolidation across multiple advertisers.

- Dedicated account managers.

Who It’s For: Affiliates, Webmasters, Bloggers

Dating affiliate networks are suitable for a wide range of people who want to monetize such traffic:

- Affiliates running paid ads: Those who can promote different offers in Facebook Ads, Google Ads, PPC traffic, and so on.

- Webmasters with niche websites: Site owners covering topics like relationships, romantic tips, or sex.

- Bloggers and content creators: Influencers on platforms such as YouTube, Instagram, or TikTok can promote apps to audiences seeking advice on love and relationships.

This vertical attracts both beginners (due to the high availability of offers) and advanced affiliates (because of the scale and optimization opportunities).

What Is Dating Affiliate Marketing

This is the process of promoting online dating services in exchange for commissions. You can drive traffic through various channels, send users to the advertiser’s landing page, and earn revenue once a defined action occurs — such as filling out a sign-up form or purchasing a subscription.

The mechanics are straightforward:

- Join a program or network.

- Receive a unique tracking link for each campaign.

- Promote the offer using traffic sources (SEO, PPC, social, email).

- When a user converts, you receive payment according to the payout model.

The offers differ here from other verticals in terms of conversion flows. Common flows include:

- SOI (Single Opt-In): User only needs to enter an email to be counted as a lead.

- DOI (Double Opt-In): User must confirm via email, providing higher-quality leads but lower volume.

- Paid subscription: Commission is earned when a user purchases a membership or credits.

- Hybrid flows: Some programs pay for free sign-ups plus a percentage of later purchases.

Advertisers benefit from continuous revenue streams, since dating platforms often use subscription models. Affiliates benefit from recurring commissions if on a revenue-share plan.

Payout Models: CPA, RevShare, CPL

In 2026, there are primarily three payout models:

- CPA (Cost Per Action): A fixed commission is paid when the referred user completes a specific action, such as registration or a paid subscription. Example: $4–8 for SOI/DOI, or $40–100 for paid subscriptions in Tier-1 GEOs.

- RevShare (Revenue Share): You receive a percentage of the user’s lifetime spending. Standard ranges are 25–50%, with top networks offering up to 75% for high-volume partners.

- CPL (Cost Per Lead): Similar to CPA but focused on simple leads, such as email sign-ups or profile completions. Payouts are typically $1–6 per lead, depending on GEO and quality requirements.

Some networks also provide hybrid models, combining a smaller upfront CPA with long-term RevShare. This reduces risk for affiliates while maintaining recurring income potential.

Why Choose This Niche

There are several reasons why promoting this niche is a good option.

Market Size and Trends

The global online dating industry continues to grow. According to Straits, the market is projected to reach $13.25 billion in 2026, with over 650 million users worldwide. Mobile apps dominate usage, with Tinder, Bumble, Badoo, and niche platforms driving most traffic.

Several important trends define this vertical:

- Niche sites: Platforms for specific interests (religion, lifestyle, ethnicity, or hobbies) are gaining popularity because they have higher engagement and lower competition.

- Local and regional services: GEO-specific platforms in markets such as LatAm, Eastern Europe, and Southeast Asia attract affiliates due to lower traffic costs and increasing adoption of online dating.

- AI-driven matchmaking: New platforms use artificial intelligence for compatibility scoring and personalized recommendations, increasing user retention and monetization.

This combination of global reach, niche sections, and regional growth makes this vertical attractive for affiliates targeting both Tier-1 countries (US, UK, Germany) and emerging GEOs (India, Brazil, Philippines).

High Conversion Rates and Customer Lifetime Value

Offers in this vertical generally achieve higher conversion rates compared to other verticals. This is due to:

- Low entry barriers: Many networks use SOI or DOI flows, meaning users only need to submit an email or confirm registration.

- Strong user intent: Visitors usually have a clear motivation — to meet new people or find partners.

- Mobile-first design: Sign-ups happen quickly because of optimization of apps, often within a single click from an ad or landing page.

Customer lifetime value (CLV) is also above average because most services operate on subscription models. A user might pay $20–60 per month, with many retaining memberships for several months. If you work on the RevShare model, this translates into recurring commissions, often far exceeding one-time CPA payouts.

Earning Potential

Affiliate marketing in this niche remains financially rewarding in 2026. Typical payout ranges include:

- SOI/DOI campaigns: $2–8 per confirmed registration (depending on GEO and traffic quality).

- CPL offers: $1–6 per valid lead.

- Paid subscription CPA: $40–100 per purchase in Tier-1 markets such as the US, UK, and Canada.

- RevShare networks: 25–50% lifetime revenue share, with high-volume affiliates sometimes receiving up to 75%.

Example of earnings from Clickadu. An advertising campaign using Clickadu popunder ads and a SOI offer via iMonetizeIt achieved:

- Spend: $486

- Conversions: 281

- Cost per Conversion: $3.07

- Earnings: $863

- Resulting ROI: 77%

This is a very good example, almost too good to be true, because you will not encounter such a ROI rate often nowadays. So be prepared for much lower ROIs.

If you’re having problems with your ad creative being rejected on a platform like Facebook Ads, check out how affiliates from the Nutra vertical got their creatives approved.

How to Choose the Right Dating Affiliate Network

Below are the main selection criteria.

Reputation and Brand

User trust has a direct impact on conversion rates. It’s a sensitive niche where visitors are more likely to sign up with services that look transparent and secure. You should check:

- Feedback on forums and industry listings, like ours, to confirm reliability.

- Whether the platform that is going to be promoted (the offer itself) has a good reputation.

Commissions and Payout Rates

You should focus on the actual commission levels compared to traffic costs:

- Competitive rates in your target GEOs (e.g., $2–6 SOI in Tier-3 markets vs. $50–$100 CPA in Tier-1).

- Availability of RevShare or hybrid for long-term monetization.

- Payment frequency and thresholds (weekly vs. monthly, $50 vs. $250 minimum) depending on your needs.

Compare rates to your ad spend estimates to ensure campaigns remain ROI-positive.

Conversion Rate and EPC

The best way to assess profitability is through Earnings Per Click (EPC) and conversion rate benchmarks:

- EPC reflects how much affiliates earn per click sent to an offer, considering funnel optimization.

- High EPC signals strong pre-landers, optimized user flows, and good brand trust.

- Low EPC may indicate poor funnels or mismatched GEO targeting.

You should always test small traffic volumes first and compare your EPC to the averages reported by the network.

GEOs and Target Audience

Every offer has GEO restrictions and audience targeting specifics. You should check:

- Which regions (Tier-1, Tier-2, Tier-3) the offer accepts and what payouts are available there.

- If the service is localized (languages, payment methods, cultural fit).

- Whether the platform targets a specific niche audience (for seniors, LGBTQ+, religion-based, casual vs. serious relationships).

After you chose your GEO and target audience, make sure you adapted your ad creatives.

Available Promo Materials and Support

Strong affiliate networks provide more than just a link. So you should evaluate:

- Dashboards with transparent reporting, EPC tracking, and GEO breakdowns.

- Access to tracking tools and postback integration.

- Ready-made promo materials (banners, pre-landers, email swipes).

- Smartlinks that automatically route traffic to the best-converting offers.

- Quality of support and account managers, which can make a big difference in scaling.

Best Dating Affiliate Networks in 2026

Our rating is based on opinions of our expert team and features proven networks with best rates. For your convenience, we will also give a comparison table after the rating.

1. MyLead

MyLead is a multi-vertical affiliate network that can work for the dating vertical if you want a broad catalog rather than a pure dating-only lineup. In practice, it’s most useful for affiliates who need multiple dating offer types (lead-gen and sale models), want to test different GEOs quickly, and rely on standard network tooling (tracking links with subIDs, postback/S2S, basic promo assets, and manager support) to iterate creatives and funnels fast.

2. ClickDealer

ClickDealer is a performance-focused CPA network with a long history in dating/social networking, and it’s usually picked by affiliates who want either direct dating offers or a SmartLink-style setup that routes clicks to the best-matching offer by GEO/device. It’s positioned as a multi-vertical network, but dating is one of its core niches, with emphasis on experienced affiliate managers and a built-out platform/tooling for scaling campaigns.

3. AdsEmpire

AdsEmpire is a dating-focused CPA network built around exclusive/direct dating offers plus an in-house SmartLink to monetize mixed or worldwide traffic by routing each click to the best-matching offer by GEO/device. They position dating as a core vertical, typically running CPA/CPL-style flows, with global GEO coverage and payouts commonly described as weekly/monthly with a $250 minimum, supporting methods like wire and crypto (e.g., USDT/Bitcoin) (and other e-wallets depending on setup).

4. Trafee

Trafee provides best offers powered by Smartlink technology, automatically matching your traffic to the highest-converting offers across all GEOs, devices, and traffic types. It can be mobile apps, push notifications, social, or email. You get a dedicated manager and optimization tools for campaign scaling. Reviews on affiliate platforms also highlight its AI-driven funnel efficiency in this vertical.

5. LuxeProfit

Although primarily known for iGaming and nutra verticals, LuxeProfit also provides a lot of offers with attractive rates. Many people note that network’s support team is quick and effective, and that payouts can be made upon request which is really helpful.

6. Advertise

Advertise.net has a proven track record since 2015. One of its main verticals is Dating, so they did not simply connected to a couple of offers just for statistics. They offer in-house tracking software, personal manager, high payouts, and payment flexibility for their partners.

7. iMonetizeIt

iMonetizeIt features thousands of offers, inclusive of niche and mainstream campaigns. This network provides you with the in-house Smartlink, free tracker (AdsBridge), and access to drive traffic from 200+ GEOs.

8. Yellana

Part of the RichAds advertising group, Yellana is a global CPA network that includes 700+ offers across multiple verticals. You can get relevant GEO+niche combinations, effective ready-made ad creatives, and assistance with campaigns adjustment. Multi-postback and traffic back features are available as well.

Comparison Table

| Network | Operating since | Available GEOs | No. of offers | Available sub-niches | Referral rates | Min. payout | Payout frequency | Withdrawal methods | Smartlink available | Personal manager | Promo materials |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Trafee | 2016 | Worldwide | — | Adult, gay | 5% | $100 | Weekly | WebMoney, Paxum, Wire, Qiwi, PayPal, Capitalist, Bitcoin | Yes | Yes | No |

| iMonetizeIt | 2015 | Worldwide | — | Niche | 5% | $80 | — | Webmoney, Capitalist, BTC, Bank transfer, USDT (TRC20, ERC20), Paxum, Kiwi, Skrill, Dana | Yes | Yes | Yes |

| CPA.House | 2019 | Worldwide | 35 | Adult | 3% | $50 | In 7 days upon request | WebMoney, Yandex Money, Qiwi, Capitalist, Card | No | Yes | No |

| Advertise | 2015 | Worldwide | 37 | Adult | 5% | $100 | Weekly | Wire Transfer, PayPal, Capitalist, USDT | Yes | Yes | Yes |

| LuxeProfit | unknown | Worldwide | — | — | — | $100 | Daily | Webmoney, USDT | No | Yes | No |

| Yellana | 2022 | Worldwide | — | Mainstream only | — | $100 | Weekly | Wire Transfer, Capitalist, Payoneer | Yes | Yes | No |

Types of Traffic

Here, traffic sources are almost the same as in other major verticals. But still, there are some differences because there are additional payment models: SOI/DOI. Below is an overview of the main traffic types and their relevance in 2026.

Paid (Facebook Ads, Google Ads, Push, Native, TikTok)

Paid advertising remains the fastest way to drive traffic, but it requires strict and constant optimization to remain ROI-positive.

- Facebook Ads: Still popular for lead gen, especially if you make good ad creatives to bypass strict moderation. Works best with mainstream dating offers in Tier-1 GEOs, where CPA payouts are $40–100. Some non-explicit sub-niches like religion-based is a good option, too.

- Google Ads (Search & Display): Allows precise keyword targeting like “dating apps for seniors,” “local singles near me.” But strict rules make affiliates often run pre-landers to redirect users to offers.

- Push Notifications: One of the most effective traffic formats in Tier-2 and Tier-3 GEOs. Average CPC ranges from $0.01–0.05, with CTRs often above 1%. Best for SOI/DOI flows.

- Native Advertising: Ad networks like Kadam, ReachEffect, and RichAds provide good sources for native ads. CTR depends heavily on ad creatives (teasers, curiosity headlines).

- TikTok Ads: Growing channel for dating apps targeting younger demographics. Offers high reach at relatively low CPMs, but requires creative, authentic short-form video content.

Paid traffic is best suited for testing budgets in order to optimize EPC against ad costs.

Free Traffic (SEO, social media, YouTube)

Free (or almost free) sources remain relevant, especially for those who want to avoid high paid-ad costs. They take longer to build but have highest ROI.

- SEO: Building blogs or review sites about dating apps, relationship advice, or niche communities. Add good on-page SEO, get some backlinks, and try to rank for terms like “best dating apps in India” or “Christian dating sites.”

- Social Media: Instagram, Twitter (X), and niche forums can drive traffic with posts, memes, or community engagement. But your links will need cloaking or pre-landing pages to avoid bans.

- YouTube: Long-form reviews of apps, tutorials (“how to set up a profile”), or comparisons can drive consistent sign-ups. Channels in lifestyle and self-improvement niches often perform well here.

Email Marketing and Adult Networks

- Email Marketing: A traditional but effective channel, especially when combined with CPL offers. Lists can be segmented by age, gender, or interest. The key here is to get a correct email database which is tough.

- Adult Networks: Platforms such as TrafficJunky or ExoClick specialize in adult traffic and remain highly profitable for adult offers. They allow banners, pop-unders, and in-stream ads with GEO-specific targeting. EPC can be high in Tier-2/3 GEOs where CPC is low.

These methods are especially suitable for the adult sub-niche and SOI/DOI campaigns with high volume.

Best Traffic Sources for 2026

The most profitable traffic sources depend on budget, GEO, and niche:

- Tier-1 GEOs (US, UK, Germany): Best results from Facebook Ads, Google Ads, and Native Advertising.

- Tier-2 GEOs (Brazil, Mexico, Eastern Europe): Push traffic and TikTok are dominant due to low CPC and high conversion rates.

- Tier-3 GEOs (India, Philippines, Africa): Popunders, push, and adult networks drive high volumes with CPL/SOI flows.

- SEO & YouTube: Strong long-term sources across all GEOs, especially if you target specific categories of people like seniors or religious people.

- Email marketing: Still powerful for re-marketing and scaling proven funnels.

Push traffic + smartlink and TikTok Ads + niche apps are emerging as the best performing combinations in terms of ROI and scalability.

Promotion Strategies

Content Marketing (Sites, Blogs, App Reviews)

Content-focused promotion generates high-quality, long-lifetime users. Review-style sites and niche blogs typically convert at 5–12% registration rates when the content is tightly aligned with the offer. For ranking on long-tail keywords such as “best dating apps in Canada 2026”, EPC values can range from $0.40 to $0.70 in Tier-1 GEOs. Well-structured app reviews with screenshots and pros/cons increase trust and pre-sell users, raising the likelihood that free sign-ups later convert into paid subscriptions.

PPC and Targeted Advertising

Paid advertising is the fastest way to scale but also the riskiest in terms of ROI. On Facebook Ads, average CTRs for such campaigns range from 0.8-1.5%, while CPCs in Tier-1 GEOs often exceed $1.50–2.00. Google Search campaigns targeting intent-based queries can achieve conversion rates of 10–15% on SOI/DOI flows, though compliance restrictions demand careful use of pre-landers. Push traffic remains one of the cheapest formats, with CPCs between $0.01–0.05 in Tier-2/3 GEOs and EPCs averaging $0.20–0.40 when optimized. If you monitor EPC versus CPC daily and cut underperforming ads, you often achieve ROI margins of 30–70% on successful campaigns.

Social Media and Influencers

Influencer-driven campaigns frequently outperform cold ad traffic in terms of retention. TikTok and YouTube creators showcasing apps often produce EPCs of $0.50–1.00 in Tier-1 GEOs because their audiences are primed for recommendations. Micro-influencers (under 50k followers) usually deliver better cost efficiency, with engagement rates 2–3 times higher than larger accounts. Conversion rates from influencer traffic can reach 12–18% for free sign-ups when content looks authentic and relatable. Providing influencers with tracking links allow you to scale based on verified ROI rather than vanity metrics.

Email + Push Campaigns

Email marketing continues to be effective when lists are properly segmented. Average open rates for email funnels are 15–25%, with CTRs of 2–5%. Well-crafted sequences can generate EPCs of $0.30–0.60 depending on GEO and list quality. Push notification campaigns perform best in Tier-2/3 GEOs, where CTR often exceeds 1%, and EPCs range between $0.15 and $0.30. Usually, you would schedule pushes in the evening, when engagement with the romantic content peaks. For both email and push, revenue share offers tend to yield higher LTV, while CPA works best for immediate cash flow.

Adult Traffic and Its Conversion Specifics

Adult traffic networks like ExoClick and TrafficJunky remain central to adult promotion. Typical CTRs for banner ads are 0.2–0.5%, while popunder campaigns can drive huge volumes with CPCs as low as $0.001–0.005. Conversion rates for SOI offers in Tier-2/3 GEOs average 8–12%, with EPCs of $0.10–0.25. However, retention is usually short, so you can optimize funnels for immediate sign-ups rather than long-term subscription revenue. Case studies show ROI potential between 40–100% when creatives are localized and campaigns are tested across multiple GEOs.

Trends and Future of Affiliate Marketing in This Vertical

This vertical is actively evolving in terms of niche products promotion, AI influence, and some other factors.

Growth of Niche Platforms (by Interest/Religion/Age)

The vertical is moving away from one-size-fits-all platforms and toward niche products. Apps that target seniors, religious people, or lifestyle interests convert better because they attract users with clear intent. According to Statista, about 40% of US online daters already use at least one niche service, and this trend is expected to expand in Europe and Latin America. This means higher EPC and better retention when promoting offers tied to specific demographics.

AI Matching and Tech Influence

AI has become a core feature of modern apps. Platforms using AI-driven compatibility scores, chatbots, or AR verification report retention rates 15–20% higher than traditional sites. This directly benefits those working on RevShare. Tech-forward services are also easier to promote since features like profile filtering and smart recommendations increase user trust and willingness to subscribe.

Competition and Regulation

The niche continues to rank among the most profitable verticals, so competition for quality traffic is increasing, too. In 2026, you face higher CPCs on mainstream platforms and tighter compliance requirements. The result is that white-hat funnels, localized creatives, and compliance-friendly pre-landers are no longer optional but essential.

Do not forget to target women as well. More on female audience is here.

Payout Forecasts and Top GEOs

Payout levels remain stable, but profitability depends on GEO choice. In Tier-1 markets, subscription CPAs typically range from $60–120, though competition and CPCs are high. Tier-2 regions pay $2–5 for SOI leads and are attractive due to lower ad costs. Tier-3 markets offer CPL payouts of $1–3 with very high volume potential. RevShare rates remain at 25–50%, and some networks can offer up to 75% for top partners.

Tips to Maximize Profits

Only those who focus on data-driven optimization can consistently increase ROI. The following methods are proven to improve margins and scalability across different traffic types.

Choosing Offers with High EPC

EPC is the most reliable benchmark when comparing offers. High payouts alone are meaningless if users don’t convert. You should prioritize offers where EPC has been tested and reported as above the average for the GEO. For example, Tier-1 SOI campaigns usually perform at $0.40–0.70 EPC, while Tier-3 CPL traffic often falls in the $0.10–0.20 range. But the latter can simply be a lot bigger in leads, so payouts can be better for you, eventually. This is something that is either said in case-studies, or your affiliate manager can tell you.

Testing Ad Creatives and Landing Pages

Performance depends heavily on the combination of ad creatives and pre-landers. If you run CPC campaigns, this is exactly what you must do: A/B tests for headlines, images, and CTAs to find the highest CTR while ensuring compliance. Even small adjustments, like adapting a text for the chosen GEO or shortening a form field, can shift conversion rates by several percentage points. The goal is to isolate which ad creative elements actually move EPC upward and pause those that drain spend.

Working with Multiple Programs or Networks at Once

No single network has the best-performing offers across every GEO. If you spread campaigns across multiple programs, it eventually reduces risk and gives you advantage in payout negotiations. Running the same campaign on two networks also provides real-world EPC comparisons. Thus, you can easier identify underperforming partners. Managing multiple dashboards requires discipline, but it prevents reliance on a single traffic source or advertiser.

Adaptation of Ad Creatives for Different GEOs and Audiences

Cultural and demographic adaptation is critical. A banner that performs in the US may fail completely in Brazil or India. You need to localize language, visuals, and user promises: for example, highlighting “serious relationships” in Western Europe, while promoting “local chat” or “friendship apps” in Southeast Asia. Testing adapted versions of the same ad usually improves CTR by 20–30% compared to generic creatives.

FAQ

A dating affiliate program is one advertiser/brand (one product, one set of rules, one funnel). A dating affiliate network aggregates multiple dating advertisers/offers under one platform: unified tracking, usually one manager, and consolidated payouts. Networks are better when you need offer variety by GEO/device, fast testing, and easy switching; programs are better when you want a direct relationship with one brand and one funnel.

Many dating-focused networks and some multi-vertical CPA networks offer SmartLink (often called smartlink/auto-optimizer/rotator), but it’s frequently enabled after approval and depends on GEO/traffic type. SmartLink is better when you have mixed GEO traffic, don’t have clean segmentation, or want to monetize long-tail placements fast. Direct offers are better when you can control one GEO/angle and build a stable funnel—usually higher ceiling and more predictable EPC once optimized.

Most dating networks are CPL/CPA-first: paid per registration/lead event (email submit, SOI/DOI confirm) or per purchase/subscription. RevShare and Hybrid exist but are less universal—more common where the advertiser can reliably track downstream revenue (subscriptions, recurring payments) and where the network is confident in traffic quality.

Typical holds range from 7–30 days, sometimes longer on high-fraud GEOs or with stricter advertisers. Holds exist to validate lead quality and reduce chargebacks/fraud: duplicate users, incentivized signups, bot traffic, fake emails/phones, or users who instantly churn/refund.

Often yes, but usually before first payout (or when you hit a payout threshold), not at signup. Some networks do partial checks at signup (basic identity/traffic source review) and full KYC later (ID + proof of address, sometimes company docs) to comply with payment providers and reduce fraud risk.

Common cadences are weekly (often after a first successful cycle), biweekly, or Net-30 depending on the advertiser’s approval window. Minimum payout is frequently $50–$250 depending on payment method (wire tends to be higher; e-wallets/crypto can be lower). New affiliates sometimes start on longer terms until quality is proven.

Most support bank wire and at least one e-wallet option; many also support crypto (often USDT). PayPal is less consistent (risk/chargeback policies), so you’ll see it in some networks but not all. Exact methods depend on your country, payout size, and the network’s compliance rules.

Commonly allowed: SEO/content, push, native, display, and sometimes email (with strict compliance). PPC is often allowed but with rules (no brand bidding, no misleading claims, approved keywords/landers). Most commonly restricted: incent/rewarded traffic, toolbars/extensions, aggressive pop-under on some offers, and brand bidding / direct-to-brand misrepresentation. Social can be allowed, but restrictions vary heavily by GEO and whether the offer is mainstream vs adult.

Main decline reasons: duplicates (same user/email/device), invalid data (disposable emails, fake phones), no confirmation (SOI/DOI not completed), fraud signals (bots, abnormal patterns), and policy violations (prohibited creatives/landing claims). To reduce declines: match the offer’s required action (SOI/DOI) in your funnel, block disposable email domains, add basic anti-fraud filters, segment by GEO/device, avoid incent mechanics, and keep creatives/landers compliant with the advertiser rules.

At minimum: S2S postback, subIDs (placement/creative/GEO/device), and clear conversion status (approved/hold/declined). For scaling: event-based tracking (reg vs confirm vs purchase), flexible pixel/postback per event, API/export for raw data, easy SmartLink reporting (if used), and controls like caps, whitelists/blacklists, and attribution transparency so you can optimize without flying blind.

Conclusion

Dating remains one of the most profitable verticals. Success depends on choosing high-EPC offers, constant testing, adapting ad creatives, and trying different sub-niches. Those who treat the vertical as a data-driven business rather than a one-off campaign will maintain stable ROI even in competitive GEOs. The future of this niche favors affiliates who adapt quickly, manage risk across multiple traffic sources, and continuously refine their funnels.