Ad networks (also called advertising networks) allow you to acquire quality traffic for any offers — ranging from sweepstakes to nutra offers. Each network has its own features: some focus heavily on adult traffic, while others work only with push notifications on informational websites. To make it easier for you to choose, we’ve created a ranking of the best ad networks for earning money on websites and generating traffic.

Push

-

1

195 GEOs

100+ million impressions daily

API automation

Good for e-Commerce, Nutra, Adult, Gambling, Dating, Sweepstakes, and more -

2

No content or GEO restrictions

Good for Dating, VPN, Utilities, Gambling, Betting

Top regions: the US, CA, UK, DE, ID, IN, BR, AG, JP, RU -

3

195+ GEOs

12 billion impressions daily

Good for Finance, e-Commerce, Mobile Apps and Utilities, Software, and Social niches

In-Page Push

-

1

Available in 195 GEOs

Good for Gambling, Nutra, Betting, Dating, Crypto, Sweeps -

2

GEOs: worldwide

Built-in spy-tool

Good for Betting, Gambling, Dating -

3

No GEO restrictions

Good for Dating, Gambling, Streaming Dates, OnlyFans, Games, Mobile Apps, VPN, Pin-Submit, e-Commerce

Pop-Up

-

1

No GEO restrictions

Good for Dating, Gambling, Streaming Dates, OnlyFans, Games, Mobile Apps, VPN, Pin-Submit, e-Commerce -

2

195 GEOs

100+ million impressions daily

API automation

Good for e-Commerce, Nutra, Adult, Gambling, Dating, Sweepstakes, and more -

3

Prices for 1000 unique Tier-1 visitors start from $4.00

Helps avoid AdBlock and other services alike

Popunder

-

1

13 targeting options

2 billion impressions daily

Min. CPC is $0.001 -

2

195 GEOs

100+ million impressions daily

API automation

Good for e-Commerce, Nutra, Adult, Gambling, Dating, Sweepstakes, and more -

3

Prices for 1000 unique Tier-1 visitors start from $4.00

Helps avoid AdBlock and other services alike

Banner

-

1

Available in 195 GEOs

Good for Gambling, Nutra, Betting, Dating, Crypto, Sweeps -

2

No GEO restrictions

Good for Dating, Gambling, Streaming Dates, OnlyFans, Games, Mobile Apps, VPN, Pin-Submit, e-Commerce -

3

No content or GEO restrictions

Good for Dating, VPN, Utilities, Gambling, Betting

Top regions: the US, CA, UK, DE, ID, IN, BR, AG, JP, RU

Onclick

-

1

GEOs: worldwide

Built-in spy-tool

Good for Betting, Gambling, Dating -

2

195+ GEOs

12 billion impressions daily

Good for Finance, e-Commerce, Mobile Apps and Utilities, Software, and Social niches -

3

13 targeting options

2 billion impressions daily

Min. CPC is $0.001

Native

-

1

Good for Dating, Gambling, Betting, adult-oriented Nutra, Adult

Key GEOs: the US, Germany, India, Bangladesh, Ukraine, Russia, Kazakhstan, Uzbekistan, Belarus, etc. -

2

220+ GEOs available

Best for Gambling, Betting, Nutra, Utilities, Antivirus

Video

-

1

195 GEOs

100+ million impressions daily

API automation

Good for e-Commerce, Nutra, Adult, Gambling, Dating, Sweepstakes, and more -

2

No content or GEO restrictions

Good for Dating, VPN, Utilities, Gambling, Betting

Top regions: the US, CA, UK, DE, ID, IN, BR, AG, JP, RU -

3

No GEO restrictions

Good for Dating, Gambling, Streaming Dates, OnlyFans, Games, Mobile Apps, VPN, Pin-Submit, e-Commerce

Interstitial

-

1

20+ targeting options

248 GEOs

Good for iGaming, eSports, VPN & Utilities, Mobile Apps, Social & Dating, e-Commerce, Subscriptions, Browser Extensions

CPM, CPC, CPA, CPL, CPI -

2

195+ GEOs

12 billion impressions daily

Good for Finance, e-Commerce, Mobile Apps and Utilities, Software, and Social niches -

3

220+ GEOs available

Best for Gambling, Betting, Nutra, Utilities, Antivirus

What Are Ad Networks

Ad networks are platforms that sell advertising traffic from a pool of publishers, sites, and apps. You launch campaigns, upload creatives, choose targeting (GEO, device, OS, browser, carrier, placements, etc.), set bids and budgets, and then buy impressions or clicks in an auction or fixed-rate model — depending on the network.

In practice, an ad network is your traffic source and control panel in one place: it gives you access to inventory, basic anti-fraud filters, reporting, and the operational layer (billing, moderation, support). The quality you get depends on the network’s inventory mix, how transparent it is with placements, and how much control you have over filtering and optimization. Below we break down the main ad formats and what to look at when choosing a network for your traffic source.

Types of Ad Formats

Use this table to quickly choose an ad format for your funnel. Each format behaves differently in terms of volume, click intent, and how much optimization it needs. Start with your goal (fast testing vs scaling vs “warmer” users), then pick the format that matches your landing flow and budget. If you need a full shortlist of platforms and format-specific details, open the dedicated format page from the last column.

| Ad format | Best for | Typical funnel fit | Main risks | Key settings to control |

|---|---|---|---|---|

| Push | Fast testing, broad GEO coverage | Direct + simple prelanders | Placement quality variance, fatigue | Frequency, zones, creative rotation |

| In-Page Push | Mobile reach without subscription | Direct + lightweight prelanders | Zone-driven results, CTR swings | Zones, device split, whitelist/blacklist |

| Pop-Up | Cheap volume, quick validation | Direct funnels, fast LP | Quality inconsistency, bot pockets | Zones, caps, strict targeting |

| Popunder | Scaling once funnel is proven | Direct or prelander → direct | Wasted spend without zone control | Zones, frequency, device/OS split |

| Onclick | High-volume redirect traffic | Direct funnels, minimal steps | Needs tight filtering and tracking | Zones, postback, fast blacklist ops |

| Banner | Broader coverage, less intrusive delivery | Direct + content-style LP | Banner blindness, creative dependency | Sizes, placements, frequency |

| Native | “Warmer” clicks, editorial angles | Prelander → direct / content funnels | Stricter review, higher CPC/CPM | Creatives, compliance, placements |

| Video | High-impact hooks and demos | Direct + strong above-the-fold | Creative cost, inventory variability | Placement type, device, load speed |

| Interstitial | High visibility on mobile | Direct funnels, single CTA | User fatigue, policy sensitivity | Frequency, placements, creative quality |

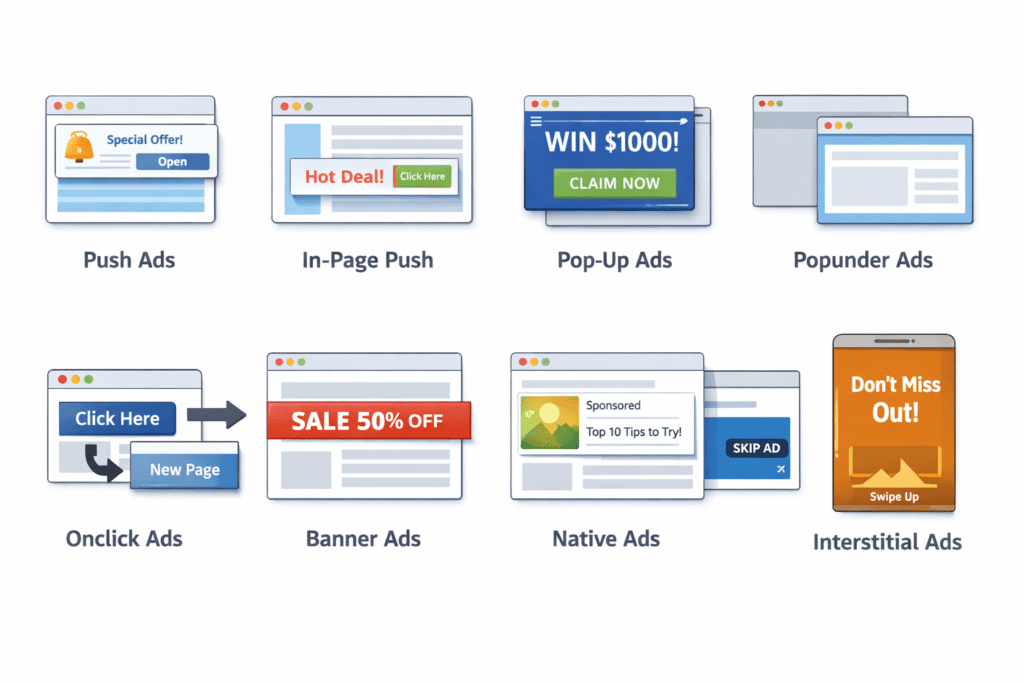

You can get a rough understanding of what these ads look like from this picture:

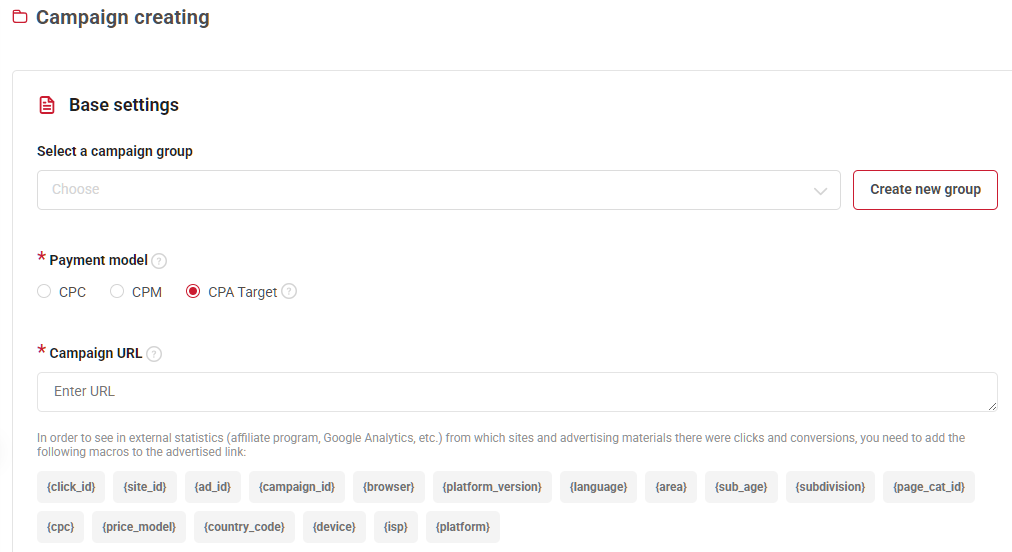

Payment Models in Ad Networks

Most ad networks sell traffic on CPM or CPC.

- CPM (cost per 1,000 impressions): you pay for views. Common for banners, native, video, and interstitials, and also used by some push/in-page push platforms.

- CPC (cost per click): you pay for clicks. Often used for push and in-page push, and sometimes native.

You’ll also see “optimized” bidding modes such as Smart CPC or oCPM. That’s not a new billing model—it’s the platform adjusting bids automatically based on performance signals.

CPA / Target CPA: pure CPA buying (pay only for an action) is uncommon on typical ad networks. What you’ll see more often is Target CPA, where you set a desired CPA and the platform tries to bid toward it. In most cases you still pay CPM/CPC in the background, and it only makes sense when conversion tracking is set up and there’s enough conversion volume for the algorithm to learn.

How to Choose the Best Ad Network

The differences between ad networks show up in inventory, control, and how usable the platform is day to day.

Inventory and Format Fit

“Global reach” doesn’t mean the network is strong in your GEO or on your device mix. Check whether it has real volume in the format you want to run (push, popunder, native, etc.), not just “supports it.” On AffDays, use the main Ad Networks listing as a directory, then open the dedicated format page to compare platforms within that specific inventory type.

Targeting and Transparency

Prioritize networks that expose placement/zone reporting and give practical targeting controls (device/OS/browser, and carrier when relevant). If placements are hidden or reporting is vague, you’re buying mixed quality with fewer ways to separate good sources from junk.

Quality Controls

“Anti-fraud” only matters if the platform provides real tools: filtering options, suspicious placement handling, and reliable postback support. Treat this as a selection criterion, not a bonus.

Pricing and Operations

CPM vs CPC changes how traffic behaves and how you evaluate it. Also check minimum deposit, payment methods, moderation speed, and support responsiveness—these decide how smoothly you can run campaigns.

Also, you can use this checklist to evaluate an advertising network:

| For affiliates: evaluation area | What to check | Pass? |

|---|---|---|

| Format fit | Does it support the exact format you need (push / in-page push / pop / popunder / onclick / banner / native / video / interstitial)? | ☐ |

| GEO reality | Real volume in your target GEOs (not just “worldwide coverage”). | ☐ |

| Device reality | Works on the device split you need (mobile/desktop; Android/iOS where relevant). | ☐ |

| Placement transparency | Can you see placement/zone IDs and get placement-level reports? | ☐ |

| Optimization levers | Whitelist/blacklist by zone/placement (and sites/apps where applicable). | ☐ |

| Targeting depth | OS, browser, language, carrier/ISP (if needed), dayparting/timezone. | ☐ |

| Frequency control | Frequency caps (campaign + user-level if available). | ☐ |

| Tracking support | Postback/S2S supported and stable; pixel support if needed. | ☐ |

| Sub-ID handling | Can you pass sub-IDs and read them clearly in reports? | ☐ |

| Reporting quality | Breakdowns by GEO/device/OS/browser/placement; exports available. | ☐ |

| Stats freshness | Near real-time stats (or acceptable delay that’s clearly stated). | ☐ |

| Anti-fraud controls | IVT/bot filtering options you can actually toggle/use. | ☐ |

| Brand safety | Category controls, site lists, app bundle lists (if relevant). | ☐ |

| Moderation predictability | Clear policy rules + consistent approvals + normal approval times. | ☐ |

| Account management | Dedicated AM available (and not “only after huge spend”). | ☐ |

| Onboarding help | Launch assistance for new advertisers (setup, recommended defaults, basic audit). | ☐ |

| Managed service | Optional: network can run setup/optimization for you (if you want that). | ☐ |

| Pricing model | CPM/CPC fits your funnel; min bids are realistic. | ☐ |

| Minimums | Min deposit and billing thresholds match your workflow. | ☐ |

| Payment methods | Methods you can actually use (card/wire/crypto etc.). | ☐ |

| Refund/credits | Any clear process for invalid traffic credits (if offered). | ☐ |

| Platform usability | UI isn’t a pain: bulk tools, decent campaign builder, stable dashboards. | ☐ |

| API access | API available if you need automation/bulk ops. | ☐ |

| Reliability | Uptime is stable; no frequent reporting/tracking outages. | ☐ |

Affiliate Marketing Verticals: Best vs Worst Fit for Ad Network Traffic

Ad networks are strongest when the user can understand the offer fast and complete the action with minimal friction (signup, install, first deposit). They’re weak when conversion depends on trust, a long decision cycle, or “education” before the user is ready.

Best Fit

These verticals usually handle cold traffic well and can scale across multiple formats:

- iGaming / Betting: casino/sportsbook signups, bonus funnels, free spins flows

- Dating: mainstream dating signups, match/quiz funnels, casual dating offers

- Adult (where allowed): cams, adult dating, memberships

- Mobile apps / utilities (where allowed): VPN trials, cleaners, keyboard/utility apps

- Games & subscriptions (where allowed): casual game installs, carrier/mobile subscription flows

Mixed fit (depends on GEO + compliance + funnel)

These can work, but depend much on GEO, compliance, and the overall funnel:

- Nutra / Health & beauty: supplement/beauty offers (often needs pre-sell; stricter review)

- Finance: insurance/credit/loan leadgen (lead quality + approvals become the bottleneck)

- Crypto / trading: exchanges/trading funnels (policy volatility; rejections in some networks)

Worst Fit

These offers can generate clicks, but turning that traffic into revenue is hard without strong brand demand, retargeting, or a content-heavy funnel:

- B2B SaaS / enterprise: CRM/ERP, cybersecurity tools, “book a demo” offers

- High-ticket / long consideration: premium courses/coaching, luxury goods, travel packages

- Education-heavy subscriptions: investment newsletters, complex memberships that need explanation

- Highly policy-sensitive offers: aggressive medical claims, restricted finance angles, some crypto/trading creatives depending on platform and GEO

How We Built This List of Ad Networks

This page is a curated shortlist of best ad networks that affiliates use to buy traffic at scale. There isn’t one “best” platform for every case, so we treat this listing as a navigation layer: it helps you pick the right ad format first, and then move to the dedicated AffDays format pages where the comparison is tighter (Push, In-Page Push, Pop-Up, Popunder, Onclick, Banner, Native, Video, Interstitial).

What We Evaluate

We only include networks that are practical for performance buying. Our shortlist is based on:

- Inventory reality: consistent volume in the GEO/device mix that matters for the format.

- Placement transparency: zone/placement reporting you can actually use.

- Controls: targeting depth, frequency caps, and fast whitelist/blacklist tools.

- Traffic quality: anti-fraud options and stable delivery (not random spikes).

- Moderation: clear rules and predictable approvals.

- Billing: realistic minimums and payment methods affiliates can use.

- Usability: clean reporting, exports/API, and a dashboard that isn’t a time sink.

How Rankings Are Decided

We rank best ad networks inside their format category, not across unrelated formats. Push and popunder are different products with different “good” metrics, so a network can be strong in one format and average in another. On the hub page, you’ll see representative picks per format; the full shortlists live on the format pages.

Updates and Changes

We update the list when platforms add/remove formats, change targeting/reporting, or when moderation, billing, or traffic quality shifts in a noticeable way. If a network becomes a black box (poor reporting, weak controls, inconsistent approvals), it drops—no matter how popular it is.

Disclosure

Some links on AffDays may be affiliate links. This doesn’t change our inclusion criteria or rankings: networks are listed based on platform usability for advertisers and affiliates, not on partnership status.

Common Mistakes When Buying Traffic From Ad Networks

Most problems with ad network traffic aren’t “bad traffic” — they’re predictable setup and workflow mistakes.

Testing Without Postback

If you’re not sending conversions back to the network (or at least tracking them cleanly), you’re optimizing on clicks and vibes. You can’t compare placements, you can’t spot garbage pockets, and any “winner” you find is usually luck.

Starting Too Broad

Launching with multiple GEOs, all devices, all OS versions, and wide targeting doesn’t give you more data — it gives you noise. Broad setups also push spend into whatever inventory is easiest to deliver, not necessarily what converts.

Judging a Network After 1–2k Impressions

That’s not a test. Many formats and placements need time to normalize delivery, and early results can be driven by a tiny batch of zones. If you decide too early, you’ll either kill something workable or scale something that collapses the moment delivery shifts.

Mixing Too Many Variables at Once

Changing GEO, format, landing flow, offer, and creatives in the same week makes the outcome meaningless. When everything moves, you don’t know what caused the change — and you can’t repeat the result.

Ignoring Placements/Zones

This is the fastest way to burn budget. On most ad networks, performance is not “the network” — it’s a small group of placements carrying the whole campaign. If you’re not reviewing placement reports and filtering aggressively, you’re paying for the worst inventory by default.

No Creative Refresh Schedule

Even good traffic dies when users see the same thing too often. CTR drops, CPM/CPC shifts, and the platform starts pushing you into lower-quality placements to keep spending. Refresh creatives on a schedule, not only after performance is already dead.

Wrong Expectations by Format

Popunder/onclick are not “warm” traffic, and native isn’t a shortcut to cheap clicks. Each format has its own baseline: some bring volume with heavy filtering, some require better creatives and stricter compliance, some need more pre-sell. If your expectations don’t match the format, you’ll call it “bad traffic” when it’s really a mismatch.

Treating Every Network Like It’s Identical

Same format name doesn’t mean same inventory quality, targeting depth, or reporting transparency. Some platforms are controllable environments; others are black boxes. If you don’t account for that, you’ll waste time trying to force the same playbook everywhere.

Skipping Caps and Frequency Control

Unlimited delivery with no caps is how you buy the same users repeatedly and call it “traffic quality issues.” Set frequency caps and pacing so you can evaluate performance instead of burning through the same audience.

Not Checking Landing-Page Speed and Compatibility

A slow page or broken mobile experience makes any network look worse. If your landing page loads heavy scripts, mismatches devices, or fails on common browsers, you’ll bleed spend and blame the traffic source.

FAQ

An ad network sells traffic (impressions/clicks) across specific ad formats. An affiliate network aggregates offers and handles advertiser/affiliate relationships. On this page, we focus on ad networks as traffic sources.

For most affiliates, Push or In-Page Push is the easiest starting point because setup is simple, you can test angles fast, and budgets are easier to control compared to high-volume formats like popunder/onclick.

It depends on GEO, bids, and your funnel, but as a rule you need enough spend to see stable patterns—not a few hundred impressions. Push/in-page push usually reaches “signal” faster; native can require more iterations due to creative review and higher costs in some GEOs.

CPM is paying for impressions; CPC is paying for clicks. Neither is “better” by default. What matters is whether the network delivers consistently and gives you placement transparency and controls—those factors usually impact performance more than the pricing label.

Use networks with practical fraud controls and placement-level reporting. Keep placements visible, review zone stats, and exclude obvious junk sources quickly. If a platform hides placements, it’s harder to clean traffic.

“Push” or “popunder” isn’t a standard product. Inventory sources, auction mechanics, filtering, and placement transparency vary a lot. That’s why AffDays also has format-specific lists—networks can be strong in one format and average in another.

If you’re buying paid traffic seriously, yes. At minimum you want clean attribution, postback support, and sub-IDs so you can see what’s working and what’s wasting spend.

Sometimes, but it depends on the network, GEO, creatives, and policy rules. Expect stricter moderation and higher rejection risk in sensitive niches. Check the format-specific AffDays listings and the network’s current ad policy before launching.

Start by choosing the ad format you plan to run (push, popunder, native, etc.), then open the matching AffDays format listing and shortlist 3–5 networks from there. The format pages are tighter and more comparable, so you’re not mixing networks that behave differently across inventory types.