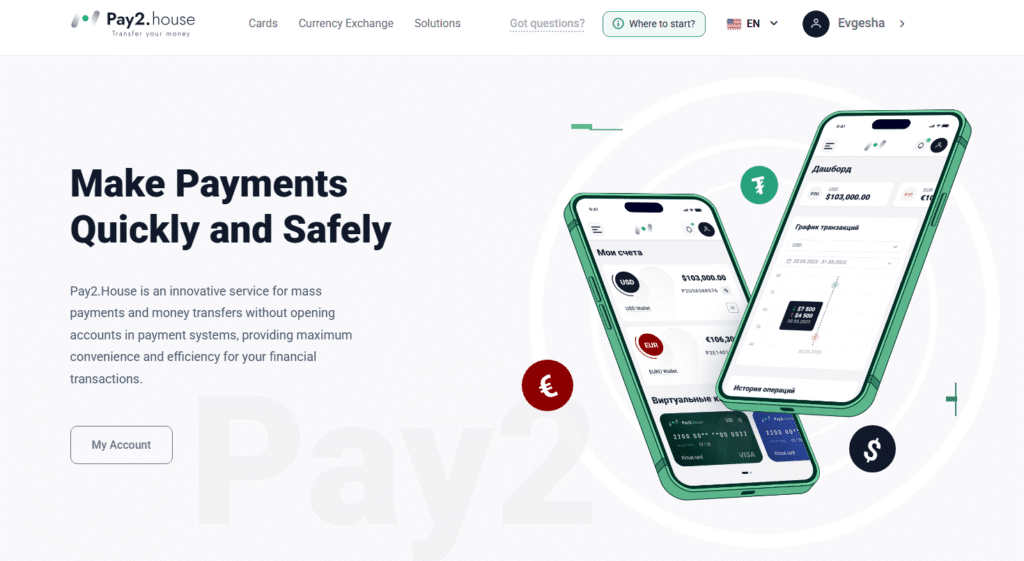

Pay2.House is a full-fledged multifinancial instrument for business and private clients. It combines fast transfers, mass payments, multi-currency transactions and work with crypto. All this in one solution, which has already been appreciated by affiliate teams, media buyers, affiliates and digital agencies, accustomed to flexibility, speed and transparent conditions.

Advantages of Pay2.House

Behind this service is the House Holding — the team that created Push.House, CPA.House, Cloaking.House and some other products familiar to everyone in affiliate marketing. They have 10+ years of experience and a clear understanding of what webmasters need. That’s why it’s not just another payment system, but a tool created by affiliates for affiliates.

Its advantages include:

- Secure virtual cards without restrictions — for services, billing and advertising.

- Clean BINs, stable binding, minimum failures — what you need for large-scale billing.

- Support for mass payments and card issuance — convenient when working with a team or large turnovers.

- API, invoicing and process automation — everything for comfortable and fast work.

- Multi-currency account and withdrawal to bank cards, accounts, crypto wallets.

- Internal transfers between users without commission and delays.

- Referral program with the opportunity to get 33% of the income of each referred client.

- Individual conditions for teamwork.

- Support 24/7 — in Telegram, by mail and via tickets. They answer quickly and really help.

- User-friendly interface that works equally well on desktop and mobile browsers.

The service is constantly evolving, adding new features and addressing real user pain points — blocks, commissions, card declines. Everything here works stably, transparently, and without surprises.

How Much Does It Cost?

Card issuance costs the user $5/€5, and the monthly service fee is $5/€5. The minimum card top-up limit is $50/€50. A fixed commission of 4% applies to deposits and withdrawals. A 20% discount is available when ordering 100+ cards.

There are two options available for withdrawing funds from your account:

- Tether USDT (TRC20) — a fixed commission of 8 USDT + 0.5% of the amount;

- Capitalist — 1%, but not less than $1/€1.

All rates are transparent, with no hidden conditions or pitfalls.

Overview of Personal Account

To create an account, you need to complete two steps:

- Fill out the registration form on the official website.

- Confirm your email address.

Immediately after activation, you will have access to your personal account and will be able to issue cards.

The main screen of the personal account is the dashboard. It displays the current balance, transaction history, and account activity. The interface is intuitive. On the right is the quick actions menu — deposits, transfers, currency conversion, and support. On the left is the main menu. Let’s take a closer look at its sections.

Where to Start

A useful and important section for beginners and experienced users. Here you will find step-by-step instructions on how to register with the service, top up your balance, order cards, connect the API, etc. Quick and detailed answers to all questions about the interface and functionality of the platform.

Bonuses

In this section, you will find a field for entering a promo code that will give you nice bonuses. For example, right now, all you need to do is enter a valid promo code to get $5 credited to your account. That’s enough to issue a virtual card or pay for a month’s service. This bonus is a great way to start using the service with additional benefits and save money at the outset.

Tickets

This section is designed for quick communication with technical support. Managers are available daily:

- on weekdays — from 10AM to 10PM

- on weekends — from 12PM to 6PM (GMT+3)

If you have any questions or problems with the service, you can leave a request here and get help quickly.

My Cards

Here you can see all your virtual cards. You can quickly check the balance, currency, expiration date, and current status of each card. The section also displays transaction history and analytics on declined payments — how many declines there were and what amounts were declined in dollars and euros.

For convenience, there are filters and search options for various parameters: date, currency, card type, status, as well as number, BIN, or name. This makes it easy to find the card you need, even among a large list. In addition, you can apply for a new virtual card right in this section.

My Accounts

The section where you manage your accounts. Here you can:

- open new accounts in USD, EUR, or USDT;

- top them up;

- transfer funds within the service;

- move inactive accounts to the archive or restore them from there.

Important! For unverified users, there is a limit of up to 10 accounts. After verification, the restriction is removed.

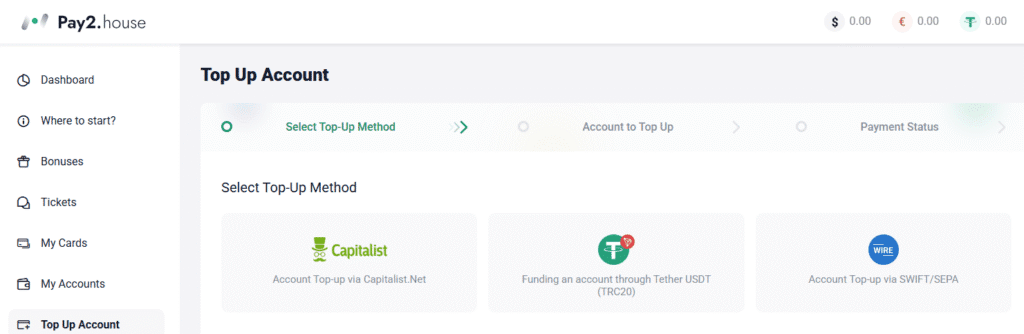

Top Up Account

In this section, you can top up your account in one of three ways:

- Capitalist for USD and EUR;

- USDT TRC20;

- The Wira bank transfer (only possible from a legal entity’s current account after signing a contract).

The top-up process is simple: select the method, account, enter the amount, and proceed to payment. Everything is clear, fast, and transparent.

Transfers

In this section, users can quickly send money within the system or to external accounts. The following transfers are available:

- between your accounts and other users within the service;

- USDT via the TRC20 network;

- USD and EUR via the Capitalist payment system;

- to Ukrainian bank cards with automatic conversion;

All transfers are protected by 2FA and are usually processed within a couple of hours.

Issued Invoices

Section for receiving payments from customers directly through the system. Here you can generate an invoice and send it to the counterparty for subsequent payment.

Transaction History

This is an analytical section where users can view transactions for all their cards. Data can be filtered by transaction status, date, account, and correspondents.

Currency Exchange

A section for instant currency exchange within the system. Transactions are carried out in real time, at the current exchange rate and without delays. Convenient for managing balances between currencies without withdrawing funds to external platforms.

Mass Payments

This section is designed for quickly sending a large number of transfers. The user uploads a file with the details, and the system automatically processes the payments. Convenient for regular payments to employees, partners, or customers.

Accept Payments

This section presents a tool for accepting online payments via Merchant API. It allows you to connect secure and instant transfers directly to your accounts on your website.

Marketplace

This section contains a list of verified partner services and programs that are ready to offer the most favorable terms to the customers. Users receive bonuses, discounts, or other benefits. This is useful for those who are looking for verified tools for work and want to receive additional advantages.

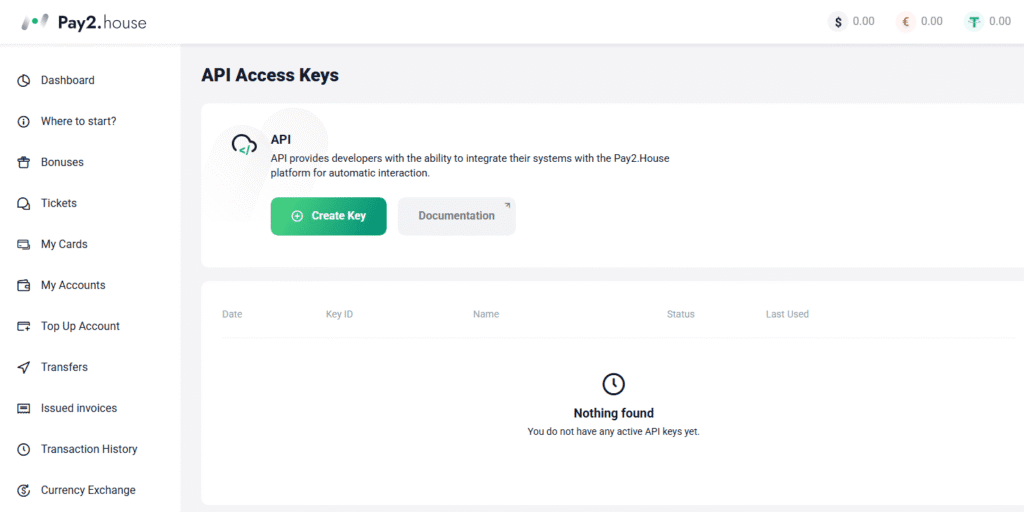

API

This section presents tools for developers that allow you to connect your systems or services to this platform. With the API, you can:

- automate transfers;

- accept payments;

- issue invoices and perform other operations.

How to Top Up Your Account

You can top up your balance directly from your personal account in the “My Accounts” section. There are three convenient methods available:

- Capitalist for USD and EUR;

- USDT TRC20;

- Wira bank transfer.

The minimum top-up amount for crypto is $5. There are no restrictions for Capitalist and Wira.

User Reviews

Pay2.House is deservedly popular and receives many positive reviews. Customers note the convenience and speed of the service, the security of transactions, and the transparent terms of cooperation. Users appreciate the stable operation of the platform, prompt support, and the variety of available features.

Conclusion

Pay2.House is a modern and reliable financial tool that combines the convenience of multi-currency transactions, payment automation, and virtual card processing at the highest level. If you are looking for a tool that can simplify mass payments, provide instant currency exchange, and ensure reliable payment acceptance, it will be your faithful business assistant.

Don’t waste time on complicated solutions — start working with this payment service today and experience all the benefits of the service for yourself.

Ksenia has extensive hands-on experience in affiliate marketing, having worked as a media buyer and affiliate for several years across multiple verticals. Throughout her career, she managed traffic from a wide range of sources, tested funnels, and collaborated directly with advertisers and networks.

For the past six years, she has also been writing in-depth articles, reviews, and analytical guides about affiliate marketing. Her work has appeared on well-known industry blogs and platforms, where she covers topics such as traffic sources, compliance, creatives, tracking, and campaign optimization.

Today, Ksenia combines practical experience with editorial expertise, contributing as a guest expert to various affiliate marketing projects and helping educate both beginners and experienced affiliates.