The Gambling vertical still remains the most profitable among affiliates and webmasters all over the world. Rates are high, payouts are steady, and the market is constantly evolving. The choice of affiliate offers here is huge, so is the choice of companies to partner with. Here’s our top-list of best gambling affiliate programs and gambling affiliate networks for you to make money in:

-

1

Direct advertiser

Offers: 20+

CPA, RevShare, Hybrid

GEOs: CIS, Asia, LatAm, Bangladesh, etc -

2

Offers: 15+

GEOs: 10+

CPA only -

3

Direct advertiser

Core offer: crypto casino

RevShare: 30%

WagerShare: 10% of house edge

custom deals (higher %) possible case-by-case -

4

Direct advertiser

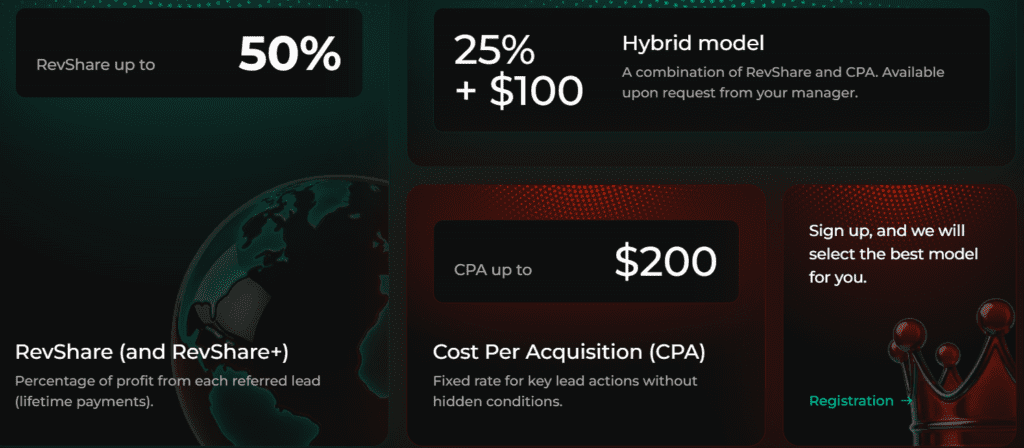

CPA, RevShare (up to 50%), Hybrid, Flat Fee, Guarantee, other individual models

GEOs: SE, AT, CA, AU, NZ, NO, FI, GR, PL, DE, CZ, IT, DK, CH -

5

Offers: 18,000+

GEOs: 180 -

6

Both direct advertiser and a network

GEOs: CA, AU, NZ, DE, AT, CH, IT, PT, IE, DK, NO, SE, FI, HU

Offers: 600+ indirect offers and 3 direct offers

CPA, RevShare, Hybrid -

7

1 in-house offer

GEOs: RU, KZ, AZ, UZ/KG, BD, TR

CPA only -

8

Offers: 1200+

GEOs: any

RevShare, CPA, Hybrid, Listing Fee, Flat Fee -

9

Direct advertiser

GEOs: India only

CPA, RevShare (50%), Hybrid (25% + $30, and some others) -

10

Offers: 6+

GEOs: CA, GE, AT, CH, PL, NO, BE, AU

CPA, RevShare, Hybrid -

11

Direct advertiser

Offers: 34

GEOs: India only

CPA, RevShare, Hybrid -

12

CPA, RevShare, CPL, Hybrid

CPA up to €600

GEOs: FR, BE, UK, ES, IT, CA, AU, NL, CH, DK, NO -

13

Direct advertiser

GEOs: South Africa

CPA, RevShare (from 35%), Hybrid (on request) -

14

Offers: 2000+

GEOs: any

CPA, CPL, CPS, CPI, RevShare, Hybrid -

15

Offers: 4000+

GEOs: 100+

CPA only

In-house SmartLink

For experienced affiliates only -

16

Offers: 800+

GEOs: 80+

CPA, RevShare, Hybrid -

17

Direct offers

GEOs: any

CPA, RevShare, Hybrid -

18

Direct advertiser

CPA, RevShare (up to 40%), Hybrid

GEOs: 200+ -

19

RevShare (25-50%)

GEOs: any -

20

Offers: 700+

GEOs: any

CPA, FTD, RevShare, Hybrid, CPL, CPI, CPS, free trial -

21

Offers: 1000+

GEOs: any

CPA, RevShare -

22

Offers: 1000+

GEOs: 40+

CPA, CPL, RevShare -

23

Offers: 50+

GEOs: 100+

CPM, CPA, RevShare, Hybrid -

24

Offers: 250+

CPA, RevShare, Hybrid

GEOs: any

Min. payout is $250 -

25

Direct advertiser

GEOs: any

Broad selection of tools for affiliates

RevShare, CPA -

26

GEOs: any

CPA, RevShare, Hybrid

Up to $150 per player -

27

GEOs: India, Bangladesh, Brazil

CPA, RevShare, Hybrid

Holds Curacao license -

28

Offers: 7300+

GEOs: any

CPA, CPL, CPS, COD, SS

In-house SmartLink -

29

Offers: 400+

GEOs: 80+

CPA, CPL, CPI, CPS, CPR, RevShare

A great option for beginners -

30

Direct advertiser

CPA, RevShare

GEOs: limited -

31

Offers: 1000+

GEOs: any

CPA -

32

GEOs: any

CPA, CPI, CPS, CPL, Hybrid, RevShare -

33

Direct advertiser

Strict requirements for traffic sources

RevShare (50%), CPA (up to $450), Hybrid -

34

Offers: 1000+

GEOs: any

CPA, RevShare, Hybrid

What Is Gambling Affiliate Marketing

Gambling affiliate marketing is a performance-based model where you send players to an iGaming product (casino, sportsbook, poker, lottery, etc.) and earn when those users complete a target action. Depending on the deal, that action can be a registration, a first deposit, a qualified bettor, or long-term revenue generated by the player. In practice, it’s not “just traffic”: affiliates work within strict platform rules, licensing requirements, KYC flows, payment limitations, and attribution tracking — and profitability depends on matching the right offer type to the right traffic source and GEO.

More about iGaming marketing in our special guide.

What Are Gambling Affiliate Programs

A gambling affiliate program is a direct partnership with a specific brand or operator (for example, one casino or one sportsbook group). You promote that operator’s product and get paid under terms set by the brand. Such direct advertisers usually give you deeper product context (funnel, retention, VIP, payment methods, localized promos), clearer brand rules (what you can say, whether brand bidding is allowed, what creatives are approved), and more predictable player value if the operator is strong in your GEO. The trade-off is that you’re tied to one brand’s licensing footprint, payment rails, and compliance policy — if they tighten traffic rules, cut GEOs, or change funnel/KYC, your EPC can move overnight.

Example of a gambling affiliate program.

What Are Gambling Affiliate Networks

A gambling affiliate network is an intermediary that aggregates multiple iGaming brands and offers under one account, with unified tracking, reporting, and payments. Instead of working with each operator separately, you can access a catalog of casino/sportsbook offers (and often SmartLink options), filter by GEO, payout model, and allowed traffic, and scale faster when you test many angles or run mixed GEO traffic. Networks can be especially practical for media buying: one contract, one wallet, one postback setup, and faster switching between offers when a funnel dies. The downside is you’re one step further from the operator: rules may be stricter, some offers are not exclusive, approvals can be more selective, rates are usually lower, and declines/scrubs/holds depend on both the network’s anti-fraud and the advertiser’s KYC and validation logic.

Main Gambling Subniches

iGaming can be divided into several subniches:

- Casino – online slots, live dealer games, roulette, blackjack.

- Sports betting – pre-match and live betting across football, basketball, tennis, etc.

- Poker – tournaments, cash games, and mobile poker apps.

- Bingo – niche but stable vertical, popular in the UK and EU markets.

- Esports – growing fast with titles like CS:GO, Dota 2, and League of Legends.

Each subniche has different player value and retention rates, which affects payouts and long-term profitability.

Payment Models in Gambling Affiliate Marketing

In gambling, the payment model determines not only how you get paid, but how you build the funnel and what traffic is even worth sending. Most deals fall into a few standard formats, but the “real terms” are in the details: what counts as a qualified player, which events are paid, how long the hold is, and how the operator calculates net revenue.

CPA / FTD

You get a fixed payout when a user makes their first deposit (First-Time Depositor, FTD) and meets qualification rules. In gambling, CPA (Cost Per Acquisition) almost always has conditions: minimum first deposit amount, minimum number of bets/spins, no bonus abuse, and sometimes a requirement to place a real-money wager before the FTD is approved. CPA is popular for paid traffic because you can model ROI faster, but it’s also the model most sensitive to KYC and payment issues — if a GEO has slow verification or weak payment acceptance, your “FTD rate” will drop.

RevShare (Revenue Share)

You earn a percentage of the operator’s net gaming revenue generated by your players over time. This can be a long-term, compounding model for SEO traffic, for instance, where retention matters and you want lifetime value rather than quick cashflow. The key point is net revenue, not gross: operators subtract bonuses, payment fees, chargebacks, sometimes admin fees, and then apply your percentage. RevShare is strongest when the product is sticky (good retention/VIP), payments work well in the GEO, and you can send repeat users.

Hybrid (CPA + RevShare)

Hybrid combines a lower CPA upfront with ongoing RevShare. It’s a common compromise when you want faster cashflow but still want upside from strong players. For affiliates running mixed traffic, hybrid can make sense when you’re confident in quality but don’t want all risk on back-end revenue. Operators like it because you’re incentivized to send players that retain, not only “hit FTD and churn.”

Negative Carryover

Negative carryover is a rule in RevShare (and sometimes Hybrid) deals where a player’s losses for the operator in the current period are carried into the next period and offset future profit before your commission is calculated. In practice, if your players win big in January and the account goes “negative,” you may earn little or nothing until their activity turns the net revenue back positive. This matters most with high-variance casino traffic and smaller player counts, because one outlier can swing the balance for weeks.

Always check whether negative carryover is on/off, whether it’s player-level or account-level, and whether it resets monthly (some programs reset; others roll indefinitely). It is stated as NCO (negative carryover is present) or NNCO (“No Negative Carryover”).

RevShare Variants: Turnover Share, Stake Share, and Sub-Affiliate

Some programs offer alternatives or add-ons:

- Turnover/Stake Share: a cut from betting volume rather than net revenue (more common in sports contexts).

- Sub-affiliate commission: a percentage of earnings from affiliates you refer to the program/network.

- Revenue Share floors/caps: less common, but sometimes used to limit risk on either side.

These can look attractive in a table, but the calculation method matters more than the label.

Flat Fees / Media Deals

For large publishers, streamers, or brands with guaranteed traffic, deals can be negotiated as flat monthly placements, fixed sponsorships, or performance + flat hybrids. This isn’t the default affiliate setup, but it exists when you can deliver predictable volume and the operator wants controlled exposure. Mostly, this is how streamers and bloggers on social media work.

Holds, Validation, and Why “The Model” Isn’t the Whole Story

Two affiliates can run the same CPA offer and get very different real payouts because of operational rules:

- Hold period: typically used to validate KYC, detect fraud/bonus abuse, and confirm deposits aren’t reversed.

- Scrubs/declines: duplicates, self-exclusions, chargebacks, fake data, restricted GEO traffic, incentivized patterns, or policy violations (brand bidding, misleading creatives).

- Attribution window: click-to-register/deposit window, last-click logic, and cross-device limitations affect what gets credited.

Top Gambling Affiliate Programs & Networks

Some of the best and most popular affiliate programs and networks include:

Pin-Up Partners

Pin-Up Partners is a direct iGaming affiliate program behind the PIN-UP brand ecosystem, used by affiliates who want a straightforward RevShare/CPA setup with strong promo support and a product that’s built around high-frequency casino play and local payments. It’s easy to launch with (ready creatives + clear funnels), scales well across multiple GEOs, and gives affiliates the operational basics you actually need day to day: tracking, SubIDs, quick offer swaps, and a manager who can push current angles and landing pages.

Features:

- Direct advertiser.

- Common deal types: RevShare / CPA / Hybrid (terms depend on GEO + traffic source).

- Multi-GEO focus with localized funnels and promo calendars.

- Strong casino product emphasis (bonuses, tournaments, retention mechanics).

- Affiliate manager support for “what’s converting now” + landing/creative recommendations.

- Standard affiliate tracking stack: SubIDs, deep links, S2S postback (where supported), detailed stats.

- Regular promo materials: banners, LPs/pre-landers, seasonal campaigns.

- Practical payout setup: clear payout cadence/minimums and multiple payout methods (varies by region).

Revsharks

RevSharks is a direct iGaming affiliate program built around its own casino brands, positioned for affiliates who want Tier-1/Tier-2 traffic focus with localized payment coverage and a funnel designed for conversion and retention. It’s a solid “top-list” pick when you prefer working closer to the product side (brand rules, promos, player journey) while still having the operational basics you need to scale.

Features:

- Direct program with in-house brands (e.g., SlotsVader, Winshark) — you’re promoting the operator’s properties, not a reseller catalog.

- Tier-1 / Tier-2 market orientation with emphasis on localized user journey and native payments (important for deposit rate).

- Clear affiliate onboarding flow (dedicated partner area + registration), which usually means faster start vs. fragmented setups.

- Standard iGaming deal stack (RevShare/CPA/Hybrid are commonly offered by programs in this class; exact terms depend on GEO and traffic).

- Brand-first promos and creatives (promotional campaigns tied to the brands, not “one-size-fits-all” network banners).

ClickDealer

ClickDealer is a large performance-marketing affiliate network with a dedicated iGaming line, used by affiliates who want a broad catalog, stable tracking, and “adult/high-risk capable” operations rather than a single-brand program. It makes sense in a top-list when you’re testing multiple GEOs/offers, need one contract + one payout flow, and want the option to move faster on payments once your traffic quality is proven.

Features:

- Scale & catalog: 11,500+ offers across 180 countries (multi-vertical network with iGaming included).

- Payment terms built for volume: default Monthly Net-15 with $500 minimum, with expedited options (e.g., Weekly Net-5/Net-7) for trusted/approved partners.

- SmartLink payout setup: SmartLink has its own baseline terms (e.g., $100 minimum) and can be upgraded after quality approval.

- Network-style flexibility: fast testing/rotation across offers and GEOs without re-onboarding to each operator separately (useful when funnels die or rules change).

- Publisher-side tooling: proprietary platform positioning + emphasis on performance/optimization workflows (the network highlights its in-house tech stack).

Godlike Partners

Godlike Partners is a direct advertiser built around a single in-house iGaming offer — Olymp Casino. It’s positioned for affiliates who want a focused setup (one brand, one funnel, clear GEO list) with fast approvals, no hold, and a practical toolset for paid traffic and app-style funnels (APK/PWA).

Features:

- Offer model: CPA only (country-based rates), 1 in-house offer (Olymp Casino).

- GEO focus: RU, KZ, AZ, UZ/KG, BD, TR (good when you need predictable targeting vs “worldwide” blur).

- Payout ops: no hold, $100 minimum, twice a month, with USDT TRC20 (other methods possible for trusted partners).

- Traffic rules: allows a wide mix — SEO, PPC, ASO/ASA, display, push/pop, social, video, messaging (custom sources on request).

- Funnel assets: Olymp Casino APK, PWA-ready landing pages/pre-landers, brandbook + ready creatives.

- Tracking/support: runs on Affilka with hands-on help for API/postback setup and funnel optimization.

- Private onboarding: short pre-interview; approval is positioned as fast (~15 minutes).

RevenueLab

RevenueLab is a long-established gambling affiliate network (since 2011). They have 11,000+ affiliates, extensive experience across 250+ GEOs, and thousands of brands. It offers flexible commission structures plus advanced tools like API access, Smartlinks, global postback, and sophisticated tracking. Known for responsive affiliate management and support tailored to both beginners and experienced webmasters.

Features:

- Large iGaming inventory: 1,200+ brands and broad coverage across 250+ GEOs.

- Experience + scale: 15 years on the market and 11k+ affiliates.

- Offer/terms flexibility: CPA, RevShare, Hybrid, Flat Fee, and special Listing Fees.

- Workflow value for affiliates: “no endless negotiations” angle — network manages the offer side so you can rotate/test faster.

- Analytics emphasis: up-to-date stats for monitoring campaign performance.

1st Partners

1st Partners is a multi-brand iGaming affiliate program (casino + sportsbook/crypto-first offers) where you work directly with their in-house portfolio and pick the deal type per brand/GEO. They position themselves around wide GEO coverage, lifetime RevShare, and a stats/monitoring stack with frequent reporting updates — basically built for affiliates who rotate offers and need clean tracking plus predictable operator-side processes.

Features:

- Multi-brand offer lineup in one account.

- Deal flexibility: each offer is marked with CPA / RevShare / Hybrid.

- RevShare rate: up to 60% RevShare.

- Wide GEO coverage: 45 GEOs available.

- Tracking/analytics emphasis: detailed stats with hourly updates for monitoring campaigns and traffic flow.

Comparison Table

| Partner | Type | Offer scope | GEOs | Payment models | Payout terms | Tracking & tools |

|---|---|---|---|---|---|---|

| Pin-Up Partners | direct advertiser | in-house brand offers | 10+ GEOs | RevShare / CPA / Hybrid (depends on GEO + traffic source) | “Clear payout cadence/minimums”; multiple payout methods (vary by region) | SubIDs, deep links, S2S postback (where supported), detailed stats |

| RevSharks | direct advertiser | in-house casino brands (SlotsVader, Winshark, etc.) | Tier-1 / Tier-2 oriented | RevShare / CPA / Hybrid (terms depend on GEO + traffic source) | Depends on the offer | Brand-first promos/creatives; standard operational stack implied |

| ClickDealer | network | hundreds of offers from different brands | Global (180 countries) | Offer-dependent (network catalog) | Monthly Net-15, $500 minimum; expedited Weekly Net-5/Net-7 for trusted; SmartLink baseline min $100 (upgrade after approval) | SmartLink, fast offer/GEO rotation, proprietary platform/tooling |

| Godlike Partners | direct advertiser | Olymp Casino | RU, KZ, AZ, UZ, KG, BD, TR | CPA only (country-based rates) | No hold; $100 minimum; twice a month; USDT TRC20 | Affilka; API/postback support; funnel assets (APK, PWA-ready LPs/pre-landers) |

| RevenueLab | network | thousands of offers from 1,200+ brands | 250+ GEOs | CPA / RevShare / Hybrid / Flat Fee + Listing Fees | Depends on the offer | API access, Smartlinks, global postback, sophisticated tracking, up-to-date stats |

| 1st Partners | multi-brand direct advertiser | in-house offers | Up to 45 GEOs | CPA / RevShare / Hybrid (per offer) | Depends on the offer | Detailed stats with hourly updates |

How We Ranked These Programs & Networks

A “best” gambling list is only useful if it maps to ROI at scale: traffic acceptance, clean attribution, predictable payouts, and a funnel that stays stable under volume. We score direct programs and networks differently (brand rules vs offer rotation), but the pass/fail logic is the same: can you launch fast, track properly, and get paid without drama?

What We Check Before Adding a Partner

We start with the basics that break campaigns in real life: GEO fit + payments/KYC, clear deal terms (what counts as a qualified FTD, how RevShare is calculated), and transparent payout ops (cadence, minimum, methods). Then we verify tracking is usable for optimization: SubIDs, deep links, and postback where needed. Last, we look at traffic rules that usually cause bans later: brand bidding, incent grey zones, and creative restrictions—plus whether you get a real manager or just “support.”

What Moves a Partner Up or Down

Higher-ranked partners are the ones that stay consistent: strong local payments, smoother verification, and retention mechanics that make RevShare/Hybrid worth it. On RevShare, we also care about the fine print: net revenue definition and NCO vs NNCO, because carryover can erase months of profit. Networks rank higher when they combine fast offer rotation (incl. SmartLink) with tracking clarity; direct programs rank higher when they can adjust funnels and promos quickly per GEO.

Red Flags That Disqualify

We exclude partners with structural risk: vague hold/payout rules, messy attribution, heavy scrubs without actionable reasons, and “allowed traffic” that turns into penalties once you scale. If support can’t solve basic ops issues (postback, disputes, funnel fixes) or payout reliability looks shaky, it doesn’t belong in a best list.

Tracking, Attribution, and Validation

In gambling, the payout model doesn’t matter if attribution is shaky. What you need is simple: clean tracking, clear validation rules, and predictable approval timing. Most “sudden drops” come from three things: broken attribution, KYC friction that kills approved FTDs, or a spike in scrubs after a source/placement change.

A usable program/network gives you SubIDs (so you can isolate campaigns/placements), deep links (so you can route users into the right GEO/device funnel), and ideally S2S postback for event tracking. Postback is what lets you optimize on real milestones like registration → FTD → qualified bettor, not just clicks and signups. If reporting is only aggregated and you can’t tie events back to SubIDs, you’re basically flying blind.

Scrubs usually aren’t mysterious: duplicates, mismatched GEO/device signals, VPN/proxy patterns, incentive-like behavior, bonus abuse flags, failed KYC, or deposits that don’t meet qualification rules. Holds exist to check those risks, and chargebacks/reversals can still hit after a deposit. The practical fix is to treat validation as part of the funnel: align targeting with offer GEO, keep creatives honest (no “free money” bait), and cut placements that generate registrations without deposits.

Compliance and Market Reality

In iGaming, compliance is an operational constraint, not a legal footnote. The same offer can convert well in one GEO and be basically unusable in another because licensing scope, ad platform enforcement, and KYC/payment flows change the funnel. Regulated markets usually mean stricter rules on bonus language, targeting, and what you can show on landers, but you often get more predictable payments and verification logic. Grey markets can feel more flexible on messaging and traffic sources, but they come with a stability cost: offers get restricted fast, payment rails break, and platforms can tighten enforcement overnight.

Where affiliates get burned most often is brand/trademark policy and creatives. Many programs forbid brand bidding (and close variants) or limit how you can use logos and brand terms in ads and landing pages, and even “allowed” brand bidding tends to have strict conditions. On the creative side, rejections and bans usually come from sloppy bonus claims, “win” promises, missing age/regulatory disclaimers, or targeting mismatches for the GEO. If you want campaigns that survive scaling, treat compliance like part of optimization: match offers to GEO reality, keep messaging defensible, and get the traffic rules in writing from your affiliate manager before you push volume.

Traffic Sources for Gambling Affiliates

When driving gambling affiliate traffic, the “best traffic source” is the one you can run consistently and with positive ROI. The same program can look great on paper and still be unscalable if your source attracts low-intent users (lots of registrations, few deposits) or if the platform policy pressure is too high. Below are the main sources affiliates actually use, and what matters operationally.

SEO

SEO is the most stable long-term channel for gambling because it brings intent-driven users who already want to pick a casino or sportsbook. It works best with review pages, “best X” lists, bonus guides, payment-method pages, and GEO-specific landing hubs. The downside is time-to-rank and higher content costs, plus heavier compliance editing (bonus wording, disclaimers, responsible gambling). Operationally, SEO pairs well with RevShare/Hybrid because retention and LTV matter, and you can build internal linking that pushes users into the right GEO funnels.

PPC / Ad Networks

Paid traffic is about speed: you can test offers and angles fast, but you’re buying risk along with clicks. Approval depends on the operator’s rules and the platform’s tolerance for gambling promotions in your target GEO. What kills PPC campaigns is usually not CTR — it’s FTD approval rate (KYC friction, payment declines) and compliance (ad rejections, account bans, brand bidding restrictions). PPC pairs best with CPA/Hybrid when you have a tight funnel, strong local payments, and tracking granular enough to cut losing placements quickly.

Social Media

Social can scale when the content is native and the audience matches the GEO, but it’s fragile: policies change, accounts get limited, and direct linking is often risky. Most affiliates run social through warmed pages/profiles, use compliant messaging, and route traffic through pre-landers or content hubs rather than hard-selling a bonus. Social traffic quality varies a lot; it can produce volume, but deposits depend on how well you pre-qualify users and whether the offer matches their payment habits.

Telegram / Messengers

Telegram works well in many gambling GEOs because it’s direct, repeatable, and retention-friendly: you can drive users back with match-day posts, promo drops, and VIP-style messaging. It’s especially effective for sportsbook and casino promo cycles, but you need to manage trust and avoid “spam” patterns that attract low-quality users. Telegram pairs nicely with RevShare/Hybrid when you can build an audience, and with CPA when you can segment by GEO and push users into the right funnel.

Email is less “sexy” but very profitable when done cleanly: it’s one of the few channels where you can control frequency, segment users, and run reactivation campaigns. The main constraints are compliance (consent, spam rules) and list quality. In gambling, email performs best as a retention layer — sending users back for events, promos, and new markets — not as cold acquisition unless your list is highly targeted.

ASO

ASO and app-style funnels can be strong in specific GEOs where mobile-first gambling is common and distribution is realistic. It’s a more technical channel (apps, approvals, keywords, retention tracking), but it can produce stable volume when other paid sources are restricted. It fits affiliates who can maintain app assets and understand attribution beyond web clicks.

Find more on how to drive traffic to gambling offers here.

Creatives in Gambling Affiliate Marketing

In gambling, creatives are an ROI lever first and a design task second. An effective creative doesn’t just boost CTR — it filters the audience you attract, which changes deposit rate, KYC pass rate, and scrub risk. The best promo materials are built to “sell the click” in the first seconds, but also to pre-qualify users so you get fewer low-intent signups and more real depositors.

Most converting angles are repeatable across GEOs, then adapted locally: social proof (real people winning/withdrawing), FOMO/urgency (limited-time promos), big win/jackpot moments, lifestyle/luxury (status visuals), bonus-first hooks (welcome bonus, free spins), gameplay + reaction (short clips that feel native), and influencer/stream-style edits (fast cuts + captions). “Simple hooks” like attractive models can raise CTR, but they often hurt ROI if they pull the wrong audience, so they need stronger pre-qualification in the message and landing flow.

Additional info on what mechanisms stand behind creatives in this niche is in this article.

The difference between copied creatives and profitable creatives is adaptation and compliance. Before launch, localize language, currency, and cultural references, match platform-native formats (TikTok/Reels/Stories vs banners), and keep claims defensible (bonus terms, no unrealistic “guaranteed win” messaging). Then test systematically: small changes in the first line, visual hook, or CTA can move CTR and conversion quality enough to swing your effective CPA — which is why strong affiliates treat creatives as iterative performance assets, not one-off designs.

By the way, casino providers started to communicate with affiliates, thus providing them with essential information that helps to drive traffic a lot.

FAQ

A gambling affiliate program is a direct deal with an operator (one brand or an in-house brand group). You get brand-specific funnels, promos, and rules, and you’re closer to what drives ROI: local payments, KYC flow, bonus policy, and retention.

A gambling affiliate network is an aggregator that gives you multiple brands/offers under one account with unified tracking and payouts. It’s built for speed and testing, but you’re one layer away from the operator and rules can be more standardized.

When you already know your GEO and traffic type and want stability and control: localized funnels, tighter promo alignment, and better long-term LTV (especially on RevShare/Hybrid) if the brand retains well.

When your edge is testing and rotation: mixed GEOs, multiple sources, or fast scaling where you need to swap offers quickly. One dashboard, one payout flow, less negotiation.

SmartLink auto-routes users to an offer based on GEO/device/behavior. It’s useful for mixed GEO traffic and early testing, but you lose control over the exact brand/funnel. Once you find a winner, direct offers often outperform.

Often yes. Direct programs focus on whether your traffic fits their rules and GEOs. Networks may apply extra filtering to protect multiple advertisers. ROI-wise, track approved FTD rate, not just signups.

Both use CPA/FTD, RevShare, and Hybrid. Direct programs may negotiate more once you prove quality; networks offer more options but usually with fixed terms per offer.

Usually deposit + conditions: minimum amount, wagering, KYC passed, no fraud/bonus abuse signals. That’s why identical CPAs can produce very different real ROI.

Not always, but it’s common because you face two layers of validation: network anti-fraud plus advertiser rules. Scrubs spike from bad placements, VPN/proxy patterns, GEO mismatches, incent behavior, or failed KYC.

At minimum: SubIDs, deep links, segmented reporting. For scale: S2S postback so you can optimize on real events (FTD/qualified actions), not just clicks and registrations.

Start with a network if you need speed and rapid offer rotation. Go direct once you have a proven GEO/angle and want funnel control and potentially better terms. Always optimize around approved FTD + payout timeline.

Trademark/brand bidding violations, misleading bonus claims, restricted GEO traffic, and incent-style patterns. These lead to scrubs, delayed approvals, or bans, even if CTR looks great.