Ecommerce is an affiliate marketing niche focused on promoting online stores and direct-to-consumer brands, where affiliates earn commissions on completed purchases. Our page lists the best ecommerce affiliate networks and programs, letting affiliates compare commission terms, traffic rules, and payout conditions in one place.

-

1

Offers: 18,000+

GEOs: 180 -

2

Offers: 5,500+

GEOs: any

CPA, CPL, COD, SOI, CPS, RevShare, PPI -

3

Offers: 400+

GEOs: 80+

CPA, CPL, CPI, CPS, CPR, RevShare

A great option for beginners -

4

GEOs: any

CPA, CPI, CPS, CPL, Hybrid, RevShare -

5

Offers: 700+

GEOs: any

CPA, FTD, RevShare, Hybrid, CPL, CPI, CPS, free trial -

6

Direct advertiser

Offers: 500+

CPA

GEOs: Tier-2

What Ecommerce Affiliate Networks Are

Ecommerce affiliate networks are platforms that connect affiliates with multiple online stores and ecommerce brands through a single interface. Unlike direct affiliate programs — where affiliates work with one merchant at a time — networks aggregate advertisers, standardize tracking, and manage payouts centrally.

For affiliates, this means access to a broader range of ecommerce offers, unified reporting, and consolidated payments, while advertisers use the network to handle attribution, fraud control, and affiliate management at scale.

For those who are new to this niche, we have published our ultimate ecommerce affiliate guide.

How Ecommerce Affiliate Networks Work

Ecommerce affiliate networks act as intermediaries between advertisers and affiliates. Merchants upload offers and define commission terms, while affiliates apply to the network and get access to multiple programs through a single account. Once approved, affiliates generate tracking links and drive traffic to merchants’ stores.

Sales are tracked using cookies, pixels, or server-to-server postbacks, with attribution rules defined by the advertiser (most commonly last-click within a fixed cookie window). The network records conversions, validates them for compliance and fraud, and then aggregates earnings so affiliates receive payouts from one platform instead of dealing with each merchant separately.

Ecommerce Affiliate Offer Types: White-Hat, Gray-Hat, and Black-Hat

White-hat offers are affiliate offers built around fully compliant merchants and promotion terms. These typically include established ecommerce brands, official online stores, and marketplaces that allow standard traffic sources such as SEO content, approved PPC, email to opt-in lists, influencer traffic, and cashback or coupon models under clearly defined rules. White-hat offers prioritize transparency, stable tracking, and long-term cooperation, making them suitable for affiliates focused on predictable revenue and account longevity.

Gray-hat offers sit between strict compliance and direct violations. These are often legitimate merchants with flexible or loosely enforced rules, where affiliates may use aggressive discounting, near-brand keywords, pre-landers with heavy monetization, or high-pressure promotional angles that push policy boundaries. Gray-hat offers can convert well and scale faster than white-hat ones, but they carry higher risks of commission cuts, traffic rejections, or sudden changes in terms once volume increases.

Black-hat offers involve offers or setups that rely on deceptive or prohibited practices. This may include fake storefronts, misleading product claims, unauthorized brand usage, cloaked redirects, forced clicks, or artificial traffic generation. While such offers may show short-term performance spikes, they are unstable by design and commonly lead to blocked accounts, reversed payouts, or permanent bans at the network level. As a result, black-hat ecommerce offers are incompatible with long-term affiliate strategies.

| Offer type | What it means | Typical examples | Pros for affiliates | Cons / risks |

|---|---|---|---|---|

| White-hat | Fully compliant ecommerce affiliate offers promoted strictly within merchant and network rules. Clear branding, approved traffic sources, transparent terms. | Official brand stores, large marketplaces, DTC brands with published affiliate policies, approved coupon & cashback offers. | Stable accounts and payouts; predictable tracking; long-term cooperation; low risk of clawbacks or bans. | Slower scaling; stricter traffic restrictions; lower margins in competitive niches; limited flexibility with creatives and angles. |

| Gray-hat | Legitimate offers promoted using aggressive or borderline tactics that push policy limits without outright violations. | Brand-adjacent coupon sites, near-brand PPC, pre-landers with urgency, “exclusive deal” pages without formal exclusivity. | Higher short-term ROI; faster scaling; more creative freedom; works well with paid traffic and arbitrage. | Risk of commission reversals; sudden rule changes; partial traffic rejections; account warnings or caps once volume grows. |

| Black-hat | Offers or setups relying on prohibited or deceptive practices that violate network or merchant rules. | Fake storefronts, counterfeit products, misleading claims, cloaked redirects, bot or incentivized traffic. | Potential for fast short-term gains in isolated cases; minimal setup requirements. | High probability of bans; withheld payouts; no scalability; unsustainable and incompatible with serious affiliate work. |

Best Ecommerce Affiliate Networks & Programs

Our top-list features only those ecommerce affiliate networks and programs that we have thoroughly reviewed. Although each has its own advantages and disadvantages, these are legit platforms to make money with.

ClickDealer

ClickDealer is a global CPA network/performance marketing platform where eCommerce is one of the core verticals, alongside other high-volume niches. For ecom affiliates, it’s most useful when you want direct-style retail campaigns on CPA/CPS terms with strong tracking and hands-on optimization from a manager, rather than a “self-serve marketplace of small shops.” It also offers SmartLink routing (helpful for mixed GEO traffic when you don’t want to hand-pick an offer per country/device).

| Advantages | Disadvantages |

|---|---|

| eCommerce is a stated focus; built for performance campaigns at scale | High threshold on regular affiliate terms can be rough for low-volume starters |

| Offers CPA/CPS style deals that map well to ecom funnels (sale/lead based) | Many “best” ecom deals are effectively manager-driven (approval, caps, rules vary by offer) |

| SmartLink option for broad traffic mixes + automated optimization | SmartLink simplifies setup, but you trade off some granular offer control |

Read our full review here.

By the way, check out their case study that they shared with us.

MyLead

MyLead is a large, multi-vertical affiliate network with a meaningful eCommerce catalog (fashion/retail and other consumer categories), where you’ll typically work with CPS and COD-style campaigns alongside classic CPA/CPL. For ecom affiliates, the main advantage is operational: a big catalog across GEOs, an in-house platform, and tools like SmartLinks that can auto-route traffic to the best-matching offer based on user parameters (useful when you run mixed GEO/traffic).

| Advantages | Disadvantages |

|---|---|

| Wide eCommerce coverage inside a big catalog (good for testing many offers fast) | Not ecom-only: you’ll need filtering + manager help to avoid wasting time on non-ecom campaigns |

| Supports ecom-relevant models like CPS and COD | Hold/validation is real (e.g., listed as ~14 business days in your review), so cashflow planning matters |

| Many withdrawal options, including PayPal/Skrill/Revolut + crypto (USDT/BTC) | Payouts are typically on request, so you’re managing withdrawals actively |

| SmartLink can simplify monetization for broad traffic mixes | SmartLink routing reduces manual work, but also means less “single-offer control” vs hand-picked campaigns |

Read our full review here.

CpaRoll

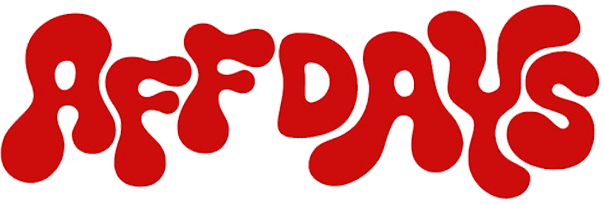

CpaRoll is a multi-vertical CPA network that includes a solid eCommerce segment built mostly around CPS offers and retail-style funnels, often with different rates for new vs returning buyers (common on marketplace/large-brand programs). In practice, it’s a good fit if you run paid traffic, push/pop, or performance-style funnels and want manager-picked eCom campaigns rather than a fully self-serve catalog: your account is moderated on signup, and access/terms typically get set with a manager.

| Advantages | Disadvantages |

|---|---|

| CPS-heavy eCom offers (good for scalable ROI when AOV is strong) | Not eCom-only: the “best” eCom deals can be manager-gated |

| Often supports retail/marketplace-style brands where conversion intent is already warm | Terms vary by offer (cookie rules, validation, new/returning definitions) |

| Flexible payout scheduling is possible (including faster cadence on request, depending on your status/arrangement) | Requires clean compliance: eCom programs often enforce strict coupon/brand-bidding rules |

Read our full review here.

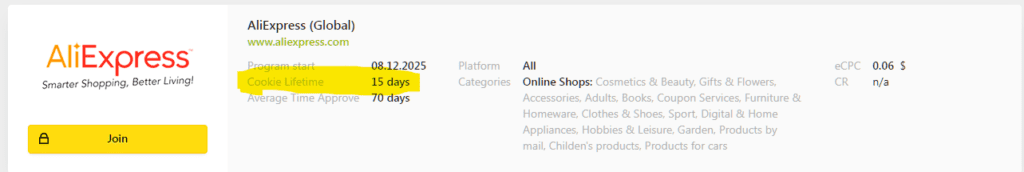

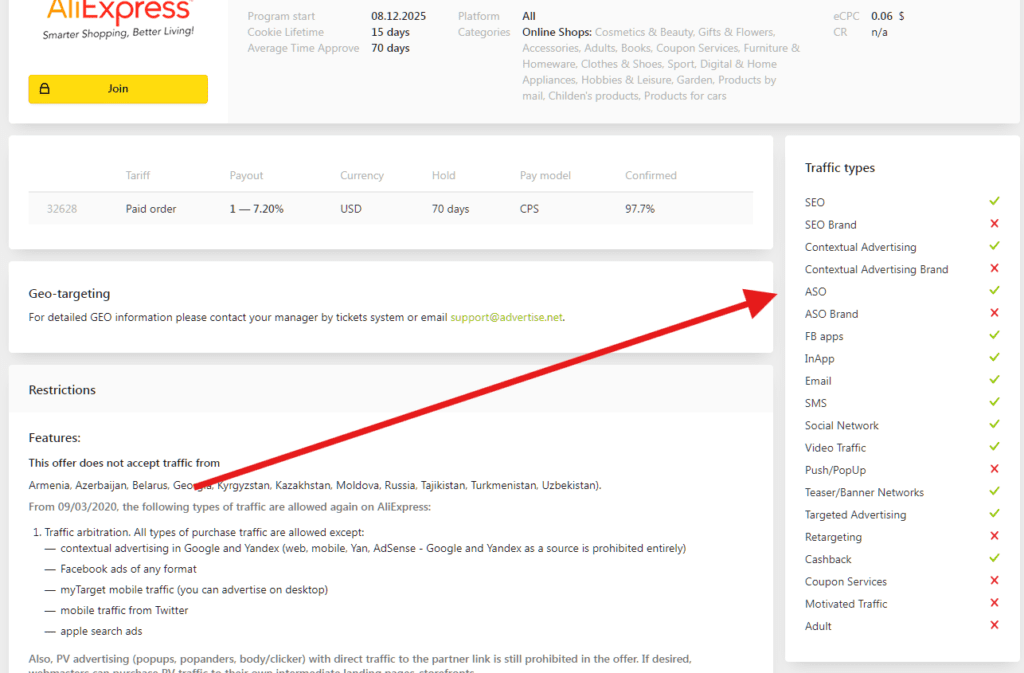

Advertise.Net

Advertise.Net is a multi-vertical CPA network that includes e-commerce alongside betting/gambling, dating, finance, apps, and education. From an ecom angle, it’s mainly useful when you need breadth + flexible payout scheduling: you can run CPS/CPA-style retail flows and keep scaling without being locked into one payout cadence, while using built-in tools like SmartLinks, TrafficBack, link testing, and banner rotation to monetize mixed GEO traffic and reduce leak.

| Advantages | Disadvantages |

|---|---|

| Ecom is a core listed vertical, with worldwide GEO coverage | Not ecom-only: you’ll need strict filtering/manager input to stay in ecom and avoid “random multi-vertical” testing |

| Multiple ecom-relevant models (CPS + CPA/CPL/CPI + RevShare/Hybrid depending on offer) | Hold/validation varies by offer (and depends on your publisher level), so cashflow is not “one fixed rule” |

| Payout scheduling is configurable (threshold / weekly / monthly / bi-monthly / daily) — good if you reinvest into paid traffic | “Any traffic except incentivized” is broad, but ecom offers can still have coupon/brand-bidding/creative rules at offer level |

| Practical tooling for ecom ops: SmartLinks + TrafficBack + link tester + banner rotator | If you rely on a personal manager, it’s on request, not guaranteed as a default for every account |

Read our full review here.

Yellana

Yellana is a RichAds-backed CPA network built around “evergreen” performance offers. It’s positioned first as an iGaming-heavy network, but it also runs non-iGaming campaigns (software/apps and other CPA/CPS-style offers), which is where it can overlap with eCommerce-style funnels. Yellana makes sense mainly when you work with direct-response traffic and want weekly payouts from $100 plus a manager who can match your GEO/traffic to whatever retail/CPS inventory is currently active in the dashboard.

| Advantages | Disadvantages |

|---|---|

| Weekly payouts from $100 (cashflow-friendly for paid traffic) | Not an eCommerce-first network: the core positioning is iGaming; eCom availability is offer-dependent |

| Broad traffic acceptance (excluding fraud/incent) + “mixed traffic” is explicitly mentioned | If you need classic retail details (cookie windows, coupon policy, “new vs returning buyer”), you must verify them per offer with your manager |

| Multi-postback + trafficback (useful for routing/cleanup when testing multiple offers) | Hold/validation varies (listed as 7–14 days depending on offer in your review) |

Read our full review here.

LemonAD

LemonAD is best described as a nutra-first CPA network and direct advertiser that also runs whitehat “e-commerce-style” offers (goods/consumer products), mostly across Tier-2 GEOs. For an ecom affiliate, the practical value is in the operational layer: in-house products + own call centers, daily payouts, and manager-driven offer access/approvals — useful when you’re running performance traffic and need predictable processing/validation rather than a pure retail CPS marketplace.

| Advantages | Disadvantages |

|---|---|

| Direct advertiser + call centers (good for “goods” funnels where approval/processing matters) | Not a classic retail ecom network (it’s nutra/whitehat-led, not “brand CPS shopping”) |

| Large claimed inventory: 500+ own offers; broad GEO coverage (90+ countries claimed) | Offer rules vary and access is typically manager/approval-driven (traffic sources “to be approved”) |

| Daily payouts can help cashflow for paid traffic | “E-commerce” here is mostly whitehat goods under CPA/RevShare/Hybrid, not necessarily CPS storefront attribution logic |

| Tracker-friendly workflows (postback templates exist) | You must validate key ecom specifics per offer (hold, rejection reasons, allowed creatives) |

Read our full review here.

Comparison Table

| Network | “E-commerce” fit | Typical ecom-relevant models | Payout minimum / frequency | Best for | Watch-outs |

|---|---|---|---|---|---|

| CpaRoll | Multi-vertical network with a real ecom slice (often retail/marketplace-style + performance funnels) | CPS/CPA (offer-dependent) | $50 / cadence is manager-set (can be daily→monthly) | Testing many offers fast; performance traffic where you need flexible payout schedules | Ecom rules vary per offer (coupon policy, validation, attribution) — get it in writing from manager |

| MyLead | Large catalog where ecom is typically CPS + COD inside a multi-vertical platform | CPS, COD (+ CPA/CPL, etc.) | €100 / processed within ~14 business days after request (per your AffDays review) | Broad catalog + tooling (good for mixed GEO testing) | Not ecom-only; restricted campaigns may require extra approvals |

| ClickDealer | “Ecom” here is performance retail campaigns (more enterprise-style), often manager-driven | CPA/CPS depending on offer | Default Monthly NET15 and $500 minimum (standard); faster plans for trusted partners | Affiliates with volume (SEO at scale, paid traffic with predictable ROAS) | High minimum for standard terms; approvals/terms vary a lot by offer |

| Advertise.Net | Multi-vertical CPA network that includes e-commerce as one of the verticals | CPA/CPI/CPS/CPL (plus Hybrid/RevShare listed in your review) | $100 / configurable (threshold / weekly / monthly / bi-monthly / daily) | If you care about payout scheduling flexibility + broad traffic acceptance | “Any traffic except incentivized” is broad, but ecom offers still have per-offer restrictions |

| Yellana | RichAds-backed CPA network; ecom overlap exists, but it’s not ecom-first | CPA/CPL/CPI/CPS (+ others like FTD/RevShare/Hybrid) | $100 / weekly | Paid traffic where weekly cashflow matters, and you can work manager-led | If you need classic retail specifics (cookie window, coupon rules), verify per offer |

| LemonAD | Nutra-first network + direct advertiser; “ecom” is usually whitehat goods CPA-type flows | CPA/RevShare/Hybrid (per your review) | Daily payouts (per your review) | “Goods” funnels where processing/ops (call center, validation) matters more than brand CPS | Not a classic retail CPS network; traffic sources often need approval |

How We Compiled This Top-List

We added these networks to this list after checking how each network works in real operations, not by marketing claims. We verified that they run offer catalogs suited to online retail/goods campaigns and compared the things that actually affect earnings and scalability: commission model (CPS/CPA and COD-style where applicable), approval and traffic rules, validation/hold logic, payout minimums and schedules, supported payout methods, and tracking features (postbacks, SmartLinks/trafficback when available). Networks with unclear terms, weak onboarding, or no consistent offer availability in this segment were not included.

This shortlist is designed to cover different affiliate setups rather than push one “best” option. Some networks are better for retail CPS flows, others are stronger in manager-curated CPA campaigns, and some are closer to direct-advertiser “goods” funnels where processing and validation matter more than branding. By selecting networks that fit these distinct scenarios, the page stays useful for affiliates running different traffic types (content/SEO, paid social, native/push, email) and helps readers choose based on concrete operational criteria instead of generic promises.

How to Choose an Ecommerce Affiliate Network

When choosing an ecommerce affiliate network, the first thing to evaluate is GEO and merchant coverage. A strong network should offer merchants that actually match your traffic geography and audience intent. Broad GEO coverage matters less than having relevant, converting merchants in your target markets, especially for content and SEO-driven traffic.

Payout terms margins can be thin here. Look beyond headline commission rates and pay attention to cookie duration, payout frequency, minimum withdrawal thresholds, and refund or chargeback policies. Networks with delayed approvals or frequent reversals can significantly distort real ROI, even if nominal CPS rates look attractive.

Tracking quality directly affects earnings. Reliable networks provide transparent conversion reporting, clear attribution logic (usually last-click), and stable tracking that doesn’t break during high-traffic periods. Poor tracking or unclear attribution rules often lead to missed conversions and disputes that are hard to resolve at scale.

Finally, review traffic restrictions carefully. Ecommerce networks tend to enforce strict rules around brand bidding, coupon usage, cashback, email promotions, and paid traffic. Choosing a network aligned with your traffic sources reduces friction, minimizes compliance issues, and allows you to scale without constant renegotiation or account risk.

Commission Models in Ecommerce Affiliate Marketing

Ecommerce affiliate marketing is built primarily around CPS (cost per sale) models, where affiliates earn a percentage of the order value or a fixed amount per completed purchase. Percentage-based CPS is common with retail and DTC brands, while fixed payouts are more typical for subscriptions, bundles, or products with stable pricing. In practice, margins, refund rates, and average order value matter more than headline percentages when evaluating real profitability.

Cookie duration plays a critical role in attribution. Short windows (24 hours to 3 days) favor high-intent traffic such as brand searches and deal pages, while longer cookies (7–30 days or more) better suit content, reviews, and comparison sites where the purchase decision takes time. Affiliates should factor in cross-device behavior and repeat visits, as many conversions don’t happen on the first click.

Some merchants use hybrid or assisted attribution models, combining CPS with CPA elements or crediting multiple touchpoints in the funnel. This may include bonuses for first-time buyers, partial attribution for assisting traffic, or different rates depending on customer status. While these setups can increase total payouts, they also add complexity, making it essential to understand how conversions are credited and when commissions can be adjusted or reversed.

Traffic Sources for Ecommerce Affiliates

SEO and content remain the most stable traffic source for affiliates. Product reviews, comparisons, category pages, and seasonal content work well with CPS models because they target users already close to purchase. SEO traffic benefits most from longer cookie durations and performs best with established brands or clearly differentiated products.

Coupons and cashback traffic is widely used in ecommerce affiliate marketing, especially with large retailers and marketplaces. This traffic converts well at the bottom of the funnel, but commissions are often lower, and attribution conflicts are common due to last-click models. Affiliates relying on coupons need to account for stricter rules around brand usage, discount claims, and voucher validity.

PPC traffic can be effective but comes with tighter constraints. Many merchants restrict bidding on brand keywords or direct URL use, allowing only generic or category-level terms. Non-brand PPC requires careful funnel design and margin control, as CPS payouts can be quickly eaten up by rising click costs and competition.

Ad network traffic (display, native, push, pop) is often used, but it comes with stricter limitations and higher risk compared to search or content traffic. Most merchants restrict direct linking, brand usage in creatives, and discount claims when traffic comes from ad networks, which makes funnels more complex and margins thinner. As a result, ad network traffic is typically used for testing or short-term scaling of specific offers rather than as a stable long-term source, and it works best with non-brand angles, pre-landers, and carefully controlled acquisition costs.

Influencer and social traffic is typically used for product-driven ecommerce offers, launches, and impulse purchases. While conversion rates are lower than search-based traffic, volume and reach can compensate when paired with strong creatives and time-limited promotions. This traffic source works best with recognizable products, clear value propositions, and mobile-optimized checkout flows.

FAQ

Ecommerce affiliate networks are platforms that connect affiliates with multiple online stores and brands. They provide centralized tracking, reporting, and payouts, allowing affiliates to promote several ecommerce offers without working with each merchant directly.

Ecommerce affiliate networks aggregate many merchants under one system, while direct affiliate programs are run by individual brands. Networks simplify management and payouts, while direct programs may offer higher commissions but require separate integrations and approvals.

Most ecommerce affiliate programs use CPS (cost per sale) payouts, where affiliates earn a percentage of the order value or a fixed amount per completed purchase. Payment terms depend on the network or merchant and may include holding periods to account for refunds and chargebacks.

Commission rates vary by product type and merchant, but typically range from 2% to 20% per sale. Physical retail products usually offer lower percentages, while subscription-based or high-margin products may pay higher CPS rates.

SEO and content-driven traffic are the most common sources for ecommerce affiliate offers, including reviews, comparisons, and category pages. Coupon, cashback, and deal traffic also convert well, while PPC and social traffic are often allowed with restrictions depending on the merchant.

Yes, ecommerce affiliate programs are often beginner-friendly because they rely on clear purchase actions and familiar products. However, competition can be high, so beginners typically perform best with niche content, long-tail keywords, or localized traffic.

Many affiliate networks support multiple GEOs, but offer availability depends on the merchant. Some networks focus on global brands, while others specialize in specific regions or countries, making GEO selection an important factor when choosing a network.

Cookie durations in ecommerce affiliate programs and networks commonly range from 24 hours to 30 days, though some merchants offer longer windows. Longer cookie durations generally benefit content and comparison sites where users take more time to complete purchases.

Yes. Ecommerce commissions can be reversed due to refunds, canceled orders, fraud checks, or policy violations. This is standard in ecommerce and should be factored into real ROI calculations rather than relying only on nominal CPS rates.

The best ecommerce affiliate network depends on your traffic type, GEO focus, and monetization strategy. Key factors include merchant relevance, commission structure, cookie duration, payout terms, tracking reliability, and traffic restrictions.