Binary options have surged in popularity, drawing traders who are eager to predict whether one asset will rise or fall. Although this market can deliver quick wins, it carries equally swift losses, making direct trading a risky endeavor. And many turn to brokers’ affiliate programs: because you can earn good commissions on the activity of new traders that you invite. Above, you’ll find our ranking of the best binary options affiliate programs to help you monetize your traffic.

-

1

Direct advertiser

GEOs: any

CPA, RevShare (up to 80%) -

2

Direct advertiser

GEOs: any

CPA (up to $250), RevShare (up to 80%) -

3

Direct advertiser

Japan only

CPA (up to $300), RevShare (up to 45%), Hybrid -

4

Direct advertiser

GEOs: any

RevShare, Turnover Share

Binary Options Affiliate Programs: Market Overview

Before you compare offers or commission models, it’s worth understanding what you’re actually promoting. Binary options funnels are built around speed, simplicity, and short decision cycles, which affects payouts, traffic rules, and retention far more than in “classic” finance.

What Binary Options Are (From an Affiliate Perspective)

For affiliates, binary options are a high-velocity trading product: simple “up or down” decisions with fast outcomes. That structure creates short funnels and monetization driven by immediate intent rather than long education.

Most users arrive expecting quick results, low entry deposits, and a clear win/lose mechanic. Brokers design their onboarding around that behavior: minimal steps from registration to first trade, aggressive conversion UX, and strong focus on first-deposit completion.

Operationally, binary options offers often behave closer to iGaming-style products than traditional investing. What matters is first-deposit rate, redeposits, and effective LTV — not account size or long-term portfolio growth. That’s why terms, compliance, and tracking requirements can be stricter than in adjacent trading verticals.

Why Binary Options Still Convert in Affiliate Marketing

Even with tighter regulation in some markets, binary options still convert because they match demand for fast, low-friction speculation. A segment of users prefers short trades and simple interfaces over complex instruments.

Traffic-wise, this vertical can work well with impulse-driven sources: SEO pages targeting “fast result” queries, native/push placements, social and messenger communities, and email lists built around signals or market commentary. The path to deposit is short, so CPA and hybrid deals remain viable when your funnel is aligned and compliant.

Many brokers also continuously optimize landers, onboarding steps, bonus mechanics, and retention flows, which lifts EPC for affiliates. The offer pool may be smaller than years ago, but the remaining programs tend to be more conversion-focused and selective — and that often translates into more stable performance if you run approved GEOs and follow the rules.

How Binary Options Affiliate Programs Work

Before comparing offers or deal terms, it’s important to understand the operational setup behind binary options affiliate programs: who owns the product, how traffic is processed, and what actually happens between a click and a qualified user action.

Role of the Broker vs Affiliate Network

In a broker-run affiliate program, you work directly with the company that owns the trading platform and brand. The broker controls the entire funnel — from landing pages and onboarding to compliance checks and user management. This setup usually means clearer communication and fewer intermediaries, but also stricter traffic requirements and limited offer variety.

An affiliate network acts as an intermediary between affiliates and multiple brokers. In binary options, networks are mainly used to test different brands, switch offers across GEOs, or simplify operations when running multiple campaigns. The trade-off is an additional validation layer and less direct control over decisions made on the broker side. In practice, direct programs are preferred once a brand is proven, while networks are often used at the testing or expansion stage.

User Funnel: From Click to First Deposit

Binary options funnels are designed around speed. The typical path is short and linear: a user lands on a pre-landing page, moves to the broker’s site, registers, completes basic checks (which vary by GEO), and makes a first deposit.

For affiliates, the key point is that value is tied to deposits, not registrations. Small operational details heavily influence performance: local payment methods, supported currencies, form length, mobile usability, and how quickly a user is prompted to fund their account. Traffic intent matters as well — colder audiences often need more context on the pre-lander, while warmer traffic performs better with minimal friction.

Typical Player Lifecycle and Retention Logic

After the first deposit, binary options platforms focus on fast activation rather than long-term education. Users are encouraged to place an initial trade quickly through guided flows, interface prompts, and ongoing engagement inside the platform. In many GEOs, retention is reinforced by direct communication from account managers or automated notifications tied to market activity.

From an affiliate standpoint, this lifecycle directly affects traffic evaluation. Programs closely monitor user behavior after deposit to assess quality. Traffic that leads to rapid churn, repeated failed verifications, or inconsistent GEO signals is often flagged. Aligning your acquisition method with how the broker activates and retains users is critical for maintaining stable approvals and long-term account health.

Top Binary Options Affiliate Programs

With the basics out of the way, the next step is practical: identifying programs that are actually workable in real affiliate setups. The list below focuses on operationally active binary options affiliate programs and networks — not just brand names, but platforms with defined GEOs, clear traffic rules, and functioning payouts.

1. Pocket Partners

Pocket Partners is the official affiliate program of the Pocket Option trading platform, one of the more recognizable brands in the binary options space. Pocket Partners is commonly used for international traffic, especially in emerging and mixed-regulation GEOs, where binary options demand remains stable and onboarding friction is relatively low.

Key features:

- Direct broker affiliate program.

- Global GEO coverage with strong performance in Tier-2 and Tier-3 markets.

- Optimized funnel focused on fast registration and deposits.

- Multiple traffic types supported (subject to approval, though).

- In-house tracking and affiliate dashboard.

- Dedicated affiliate managers for scaling and compliance support.

2. Kingfin

Kingfin is a binary options broker with its own in-house affiliate program, focused on monetizing short-term trading traffic through a classic broker-controlled funnel. Affiliates send traffic directly to the Kingfin platform, where user acquisition is built around fast registration, low entry thresholds, and quick transition from signup to first trade. In practice, Kingfin is mainly used for international and non-EU traffic, where regulatory friction is lower and binary options demand is driven by speculative, fast-result behavior. The program is typically suitable for affiliates running SEO, content funnels, or paid traffic that targets users already familiar with binary options mechanics.

Key features:

- Direct broker affiliate program.

- Single-brand trading funnel controlled by the broker.

- International GEO focus, primarily outside strict EU regulation.

- Registration and trading flow optimized for short decision cycles.

- In-house affiliate panel with basic performance reporting.

- Traffic approval and quality monitoring at broker level.

- Affiliate manager support for traffic review and scaling discussions.

3. Bubinga Partners

Bubinga Partners is the official affiliate program for the Bubinga binary options platform, run as a direct advertiser with traffic routed into one broker ecosystem (one product, one brand, one onboarding logic). The program is positioned around a Japan-focused acquisition setup, where performance is heavily tied to clean localization (language + UX), deposit method fit, and post-click user handling inside the broker funnel. On the affiliate side, Bubinga Partners leans into detailed dashboard stats + ready promo assets and actively pushes partner development through an internal sub-affiliate layer, which is useful if you operate a small team, community, or “media buyer network” model.

Key features:

- Direct broker affiliate program.

- GEO positioning: Japan-only focus (tighter funnel, tighter compliance).

- In-house affiliate dashboard with granular stats and filtering.

- Promo materials / landing support provided inside the partner area.

- Sub-affiliate program with an internal referral layer (base % on invited partners’ earnings).

- Brand-level product hooks that reduce onboarding friction (low min deposit, demo account positioning).

4. Affiliate Top

Affiliate Top is a trading-focused partner platform that lets affiliates promote multiple in-house brands from one interface — currently including Binomo and Stockity. They also announced adding Traditex and QuantaFund to their offer list. The operational value is consolidation: you don’t rebuild your setup for each brand, you manage traffic and reporting in one place, and you can switch or expand across brands while staying inside the same partner ecosystem.

Key features:

- Real-time reporting for core events (deposits, sign-ups, balance changes, etc.).

- Telegram bot for quick stat checks and notifications.

- Promo/demo-style accounts for creating video creatives and educational content.

- Multi-language support via messengers.

- Events/contests/bonuses mechanics aimed at boosting trader activity.

- Partner dashboard positioned around trading-platform workflows.

Comparison Table (with Commission Rates)

| Program | Type | RevShare rate | CPA rate | Notes |

|---|---|---|---|---|

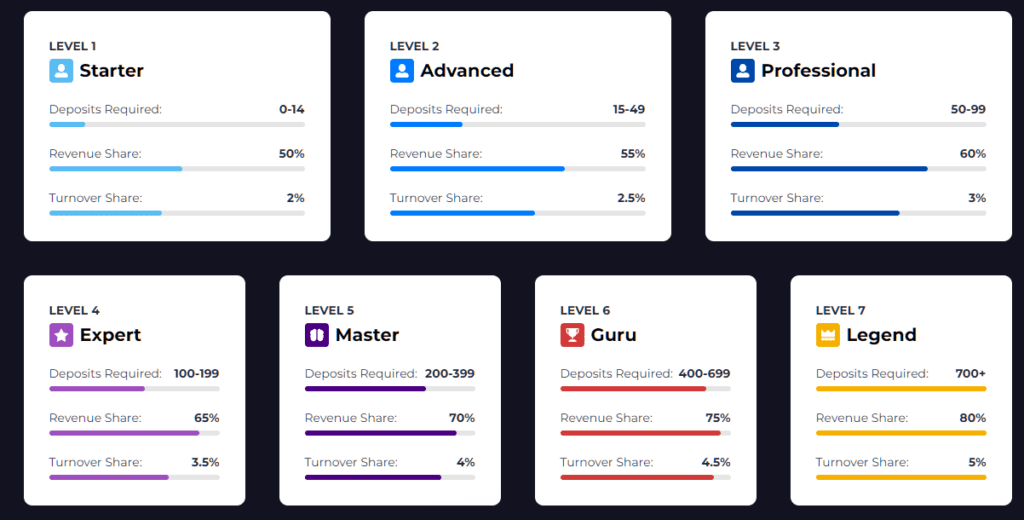

| Pocket Partners | Direct advertiser | Up to 80% | Not publicly stated (often “flexible CPA”) | RevShare is presented as tier-based/level-based; CPA terms usually shown inside the partner cabinet. |

| Kingfin | Direct advertiser | Up to 80% | Up to $250 (example given for first deposit) | Kingfin explicitly describes both models on the official site. |

| Bubinga Partners | Direct advertiser | 25–45% | $50–300 per FTD | Official commissions page gives the ranges (also mentions hybrid eligibility conditions). |

| Affiliate Top | Multi-brand affiliate program | Up to 80% | Custom rates (not fixed publicly) | Also advertises turnover share up to 6%; CPA is stated as custom. |

How We Compiled the List of Best Binary Options Affiliate Programs

This top-list is based on operational viability, not advertised rates or brand popularity. We evaluated programs on how they function in real affiliate setups: consistency of the registration-to-deposit funnel, clarity and enforcement of traffic rules, reliability of tracking, and payout execution over time. Programs that look attractive on paper but break down at scale were excluded. You can find more details in reviews of these programs — all of them are thoroughly reviewed by our team, simply press the ‘Review’ button located in each program’s card.

Selection also accounted for GEO coverage and compliance fit, including how clearly programs define allowed regions, verification requirements, and payment-method availability. Preference was given to broker-run programs and partner platforms with transparent onboarding logic, stable affiliate dashboards, and responsive manager support — factors that directly affect approval rates, EPC stability, and long-term account health.

How to Choose the Right Binary Options Affiliate Program

Choosing a binary options affiliate program comes down to operational fit, not headline numbers. Start with the broker itself: brand reputation, market history, and regulatory posture determine how stable the offer will be over time and how aggressively user quality is enforced. Programs tied to brokers with clear GEO positioning and consistent compliance rules tend to be easier to scale without sudden traffic rejections or retroactive changes.

Next, evaluate payment mechanics. Look at how deposits are validated, how long approvals take, whether holds are applied systematically, and how predictable payouts are once traffic is approved. Reliability matters more than frequency here — delayed or inconsistent payments break cashflow faster than slightly lower rates.

Finally, review traffic rules and enforcement. This includes allowed sources, restrictions on brand bidding or misleading angles, and how strictly violations are handled in practice. Programs with clearly documented rules and active manager communication are easier to work with long-term, because you can adjust funnels early instead of dealing with scrubs or account reviews after volume is sent.

Binary Options Affiliate Commission Models

In binary options, commission choice is mainly about cashflow vs upside and how your users behave after the click. The same headline terms can produce very different results depending on deposit rate, verification pass rate, redeposit behavior, and how strict the program is on “quality” approvals.

CPA in Binary Options (Fixed vs Dynamic CPA)

Most CPA deals are paid per FTD, but the mechanics differ. Fixed CPA is the simplest: one amount per qualified depositor, easy to forecast and optimize for when you’re buying traffic. Dynamic CPA adjusts based on user quality signals (deposit size, verification success, fraud score, early activity, sometimes GEO/device mix). Dynamic CPA can outperform when your cohorts are consistently clean, but it can also drift down if your traffic underperforms on the broker’s retention/quality metrics. CPA generally fits setups where you can control intent and filter junk before the broker funnel.

RevShare (Lifetime vs Capped Models)

RevShare pays a % of the broker’s net revenue from your traders, so it only wins when users keep trading and redepositing. “Lifetime” RevShare means you earn while the user stays active; capped RevShare limits the duration or total earnable amount per user, reducing upside but improving predictability. Your real lever here is cohort quality: communities, repeat audiences, and content-led funnels tend to produce better RevShare than one-off impulse traffic.

Hybrid Deals and When They Make Sense

Hybrid combines a smaller CPA with a RevShare tail. It’s a practical middle ground when you want upfront revenue but don’t want to leave long-term value on the table. Hybrid works best once you’ve proven that your cohorts don’t just deposit once — they trade again, redeposit, and stick past day one. The common mistake is taking hybrid too early on cold paid traffic: you give up CPA without earning enough on the backend to compensate.

Traffic Sources That Work for Binary Options Affiliates

Binary options is a fast-decision product, so traffic performance is driven by intent quality and predictable post-click behavior: verification success, deposit rate, and early trading activity. The sources below are commonly used in this vertical and align well with how brokers evaluate traffic.

SEO & Content-Driven Funnels

SEO traffic works best when pages target high-intent queries such as brand reviews, platform mechanics, deposits and withdrawals, supported countries, or mobile app usage. Effective content prepares the user for the exact flow they will encounter: registration steps, verification expectations, deposit methods, and the first trading session. This alignment reduces bounce, improves deposit rates, and gives affiliates control over user intent before traffic reaches the broker funnel. SEO setups tend to perform best when focused on a limited number of brands and GEOs rather than broad, generic coverage.

Paid Traffic (Ad Networks, Native, Push)

Paid traffic in binary options relies on controlled testing and strict filtering. Native and push formats are commonly used because they scale quickly and support fast iteration. Performance depends on placement quality, pre-landing structure, and compliance-safe messaging. Campaign optimization is tied to downstream events such as verified deposits and early activity, not surface-level metrics. Paid traffic becomes sustainable when GEO targeting, creatives, and funnels are kept consistent and evaluated against deposit quality rather than click volume.

Communities, Messengers, and Email Lists

Community-based traffic performs well in binary options because it matches how users consume trading-related content: signals, short-term setups, and market commentary. Messenger channels and groups work when promotion is embedded into regular updates and trading context. Email lists perform best when built around recurring informational content and structured cadence. These sources tend to produce stable user cohorts when they focus on one language, one GEO cluster, and one core platform, which simplifies both user expectations and broker-side evaluation.

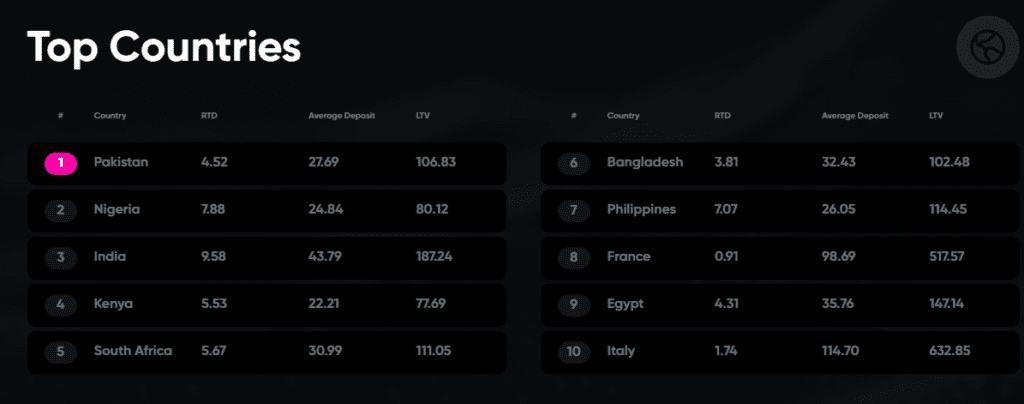

GEOs & Regulation in Binary Options Affiliate Marketing

Geography plays a decisive role in binary options affiliate marketing. Demand, onboarding friction, payment availability, and compliance rules vary sharply by region, so performance depends on aligning traffic sources and funnels with GEO-specific realities rather than treating the market as global.

Regions With Active Binary Options Demand

Binary options demand is strongest in international, non-EU GEOs, especially across Tier-2/Tier-3 markets where onboarding is simpler and local payments are widely supported. These GEOs usually work best with localized SEO, communities, and paid traffic, because language fit, deposit-method fit, and mobile UX directly drive deposit rates. Results improve when you focus on a small GEO cluster instead of scattering traffic across unrelated countries.

Restricted and High-Risk GEOs

EU and other tightly regulated markets are high-risk for binary options: higher KYC friction, lower approval rates, and more sudden compliance changes. These GEOs require strict discipline: accurate geo-targeting, compliant messaging, and clean pre-qualification so you don’t send users a broker can’t accept or monetize. When GEO controls are loose, you typically see scrubs, delayed approvals, and account reviews.

How Much Can Binary Options Affiliates Earn?

Earnings in binary options affiliate marketing are driven by two levers: how efficiently your traffic turns into first deposits and how long those users keep trading. SEO and community traffic usually produces higher-quality cohorts and more stable ROI because intent is pre-qualified before the click. Paid traffic can scale faster, but profitability depends on clean targeting, strong pre-landers, and strict filtering to keep deposit quality consistent.

Commission ranges you’ll actually see in the comparison table after the top-list above:

- CPA (FTD): $50–300 per depositor is a common published range (example: Bubinga Partners).

- Higher CPA tiers can reach ~$450–500 per trader (mentioned as an upper-end benchmark in industry writeups).

- RevShare: up to 80% exists in the vertical (Pocket Option / Pocket Partners positioning “up to 80%”).

- Other programs publish lower ceilings like up to 50% RevShare (example: IQ Option affiliate program).

- Some programs publish a RevShare band like 25–45% (example: Bubinga Partners).

What this means in dollars (simple math examples):

If you generate 20 FTDs/month:

- at $50 CPA → $1,000/month

- at $300 CPA → $6,000/month

If your deal is RevShare and your average active trader generates $100 net revenue/month for the broker:

- at 25% RevShare → $25/month per active trader

- at 45% RevShare → $45/month per active trader

- at 80% RevShare → $80/month per active trader

Common Risks in Binary Options Affiliate Marketing

Binary options is a high-risk vertical from an operational standpoint, and affiliates need to account for that upfront. Regulatory shifts can happen quickly: a GEO that converts today may become restricted or commercially unviable after policy changes, payment-provider exits, or broker-side compliance updates. When this happens, offers can be paused or shut down with little notice, forcing affiliates to reroute traffic or rebuild funnels. Programs with clear GEO policies and advance communication reduce this risk but don’t eliminate it.

Another structural risk is payment freezes and account reviews. Binary options programs closely monitor traffic quality, verification outcomes, and post-deposit behavior. Sudden spikes in volume, mismatched GEO traffic, incentive-style promises, or abnormal churn patterns often trigger manual reviews. During these checks, payouts can be delayed or temporarily frozen. Affiliates who run controlled volumes, keep traffic sources transparent, and align funnels with broker compliance standards usually avoid long-term issues, but the risk remains part of the vertical and should be factored into cashflow planning.

FAQ

Most programs accept new affiliates, but “acceptance” and “scaling” are different stages. New accounts typically start with standard terms and stricter traffic review. Once you show clean GEO targeting, stable deposit quality, and predictable volumes, managers usually become more flexible on approvals, landing requests, and operational support.

In most cases, the main qualification event is FTD (first-time deposit), not registration. Programs also evaluate what happens immediately after deposit: verification success, basic activity, and whether users look consistent with the GEO and traffic type you declared. If your traffic produces many regs with low deposits or suspicious patterns, approvals tend to slow down.

Scrubs usually happen because users fail verification, use unsupported payment methods, come from restricted GEOs, or trigger fraud/duplication checks (VPN/proxy patterns, repeated devices, mismatched geo signals). Programs also flag cohorts that deposit once and instantly churn when the pattern looks like incentivized or misleading acquisition.

SEO and content funnels work well when they target high-intent queries and pre-qualify users for the broker’s onboarding flow. Communities/messengers work well when you can build repeat exposure around market context and signals. Paid traffic can work at scale when you keep tight GEO control, use compliant messaging, and optimize based on downstream deposit quality rather than clicks or registrations.

GEO rules are one of the biggest deal-breakers in this vertical. A GEO that is restricted or heavily regulated often means higher KYC friction, more payment issues, and stricter enforcement. When traffic leaks across GEOs or you mix languages and regions inside one campaign, programs typically respond with scrubs, delayed approvals, or account reviews.

Confirm that your GEO has working deposit rails, your funnel matches the language and UX expectations, and your tracking is clean (subIDs + postback configured). Then scale only after you see stable patterns: verification passes, consistent FTD rate, and no unusual spikes in duplicates or unsupported GEO traffic.

Keep volumes predictable, declare your traffic source honestly, and don’t change creatives/angles drastically without telling the manager. Use strict geo-targeting, avoid misleading promises, and watch for quality signals early (low deposit rate, high verification failures, weird device/geo patterns). Programs are far less likely to freeze payouts when your cohorts look consistent week to week.

Direct programs are usually easier to manage once a brand is proven because the funnel and rules are consistent and communication is clearer. Multi-brand platforms can be useful for testing or expanding across offers, but performance still depends on matching GEO, onboarding friction, and traffic rules to your source. The right choice is the one that lets you keep user quality stable as you scale.