Today, we’ll discuss the topic of landing pages and online storefronts in the microfinance (MFO) vertical. Each of these options has its own features, advantages, and disadvantages. The choice between them depends on the advertising campaign goals and the characteristics of the target audience.

Analyzing the Landing Page Funnel: Traffic Flow Path

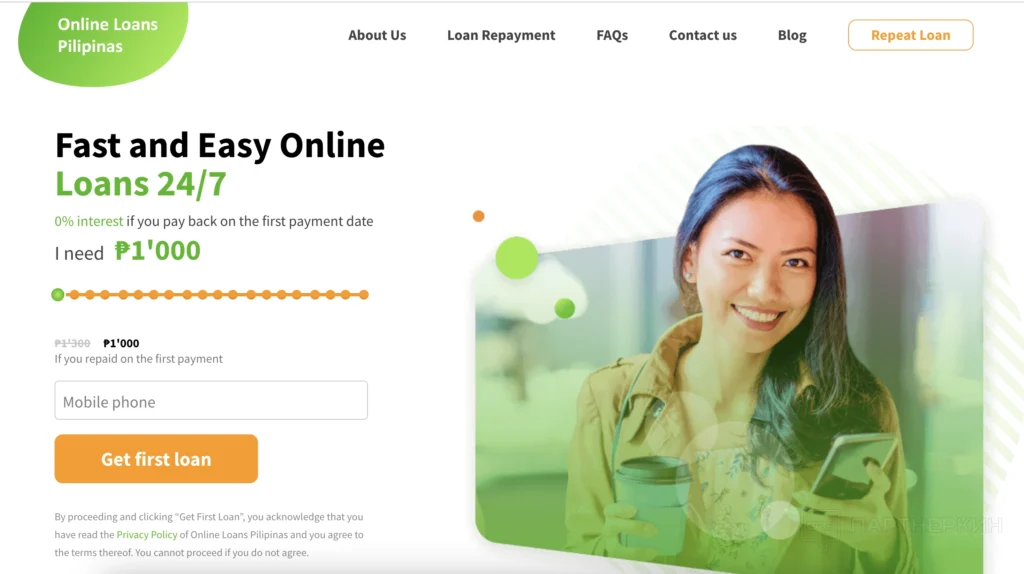

A landing page focuses on a specific loan offer from the MFO vertical. This creates a direct path for the customer: from search to loan acquisition, thereby increasing conversion chances. Let’s see what a funnel with a landing page looks like in the MFO vertical and the stages traffic goes through on the way to a loan.

Breakdown of the Funnel:

- Attracting traffic. It is a crucial aspect. Facebook is a good choice.

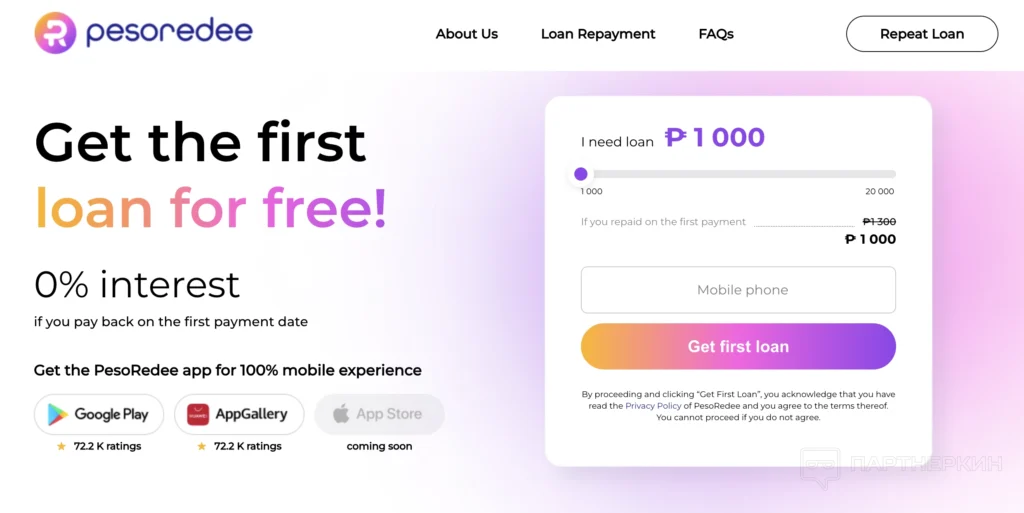

- Landing page and redirect to the MFO site. Once users come to the landing page and select suitable loan terms regarding amount and duration, they encounter a data collection form. After the user submits their contact information on the landing page form, they are redirected to a site where a specific product is presented.

Next, the choice remains with the client: to choose this offer and submit an application or to leave the website if they don’t like the offer. In the future, if the client leaves the site, they can be retargeted using email or SMS campaigns and attempt to monetize them by directing them to a storefront with offers.

When It is Worth Using a Landing Page: Pros and Cons

When attracting new clients for the MFO vertical, you should make good creatives and a quality funnel. Every affiliate has the opportunity to advertise on a landing page.

Possible advantages and disadvantages you should be aware of when driving traffic to a landing page with MFO offers:

| Pros | Cons |

| Higher conversion since the target audience will not have much choice: it will not be able to choose another offer | Landing page is designed to promote advertising to a specific audience and may thereby limit its reach |

| Easier to analyze traffic and make changes | You need a constant flow of traffic |

| You can easily adapt the content and structure of the landing page for a specific audience (microloans for students or retirees with more advantageous and interesting conditions) |

By the way, if you want to know more about landing pages, read our article and find life hacks that will help you get a good landing for nutra offers

Analyzing the Funnel with an Online Storefront: Traffic Flow Path

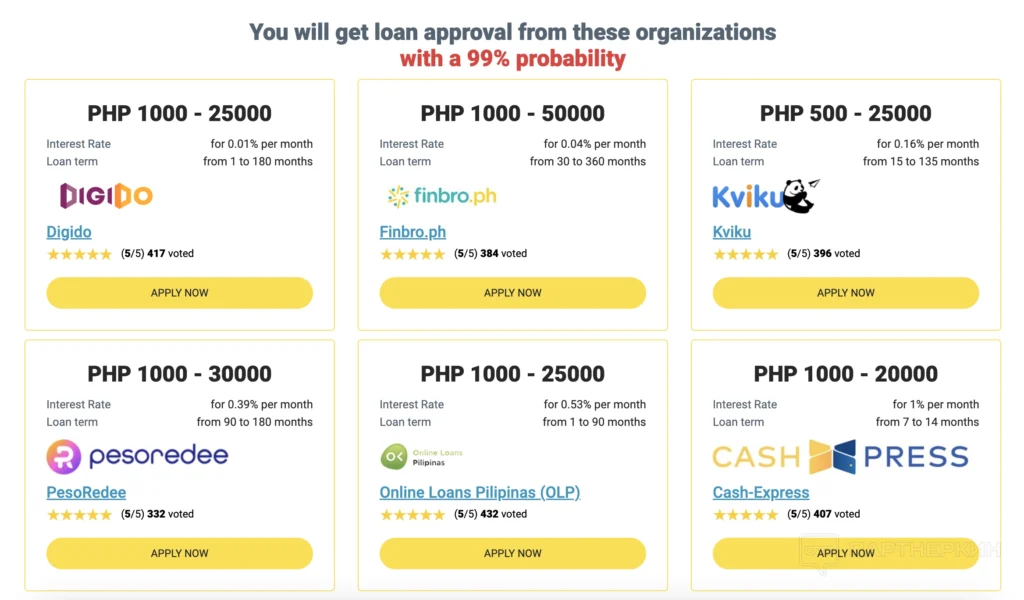

An online storefront allows the target audience to compare terms and choose the most advantageous option for themselves. Let’s discuss when storefronts are used, their pros and cons, and what they look like.

Breakdown of the Funnel:

- Attracting traffic. In the case of an online storefront, besides Facebook, SEO optimization which includes using keywords in URLs or backlinks can also be used. However, it’s important to consider and check search engine rankings for competitors and study the legislation of the country where you intend to promote the site;

- MFO online storefront. Once a user lands on the storefront, they encounter various offers detailing loan terms.

After the user selects the offer they like, they click the “Get Money” button and are redirected to the advertiser’s website, where they fill out a form.

If a user’s loan application is not approved, they have several other options on the online storefront, significantly increasing their chances of acquiring leads.

When It is Worth Using an Online Storefront: Pros and Cons

A storefront, unlike a landing page, serves as a platform where offers from various MFOs are gathered. This allows users to compare loan conditions and select the most suitable option.

Possible advantages and disadvantages you should be aware of when driving traffic to a storefront with MFO offers:

| Pros | Cons |

| There is an opportunity to reach a broad audience with traffic | Reduced conversion rates are possible due to the variety of offers potentially complicating decision-making, leading to a drop in conversion rates |

| For the user, several offers are presented at once: there’s a chance that something will resonate with them, leading them to submit an application | It’s more challenging to analyze the traffic |

| Offering a choice between offers increases user trust in the platform. Once a user obtains a loan on your website, they may return again | The website itself with its storefront should be well-designed and user-friendly |

If your website traffic suddenly dropped after Google’s March core update, here is our article where we explain what can be done in this case.

Conclusion

So what should you ultimately drive traffic to? It all depends on budgets and the availability of offers, but the most common option currently is an online storefront. It can be used both for monetization purposes and generally for driving traffic to it.