Predicting cryptocurrency price changes is a task that requires special attention. But what if the methods for identifying effective strategies for making informed decisions and detecting early opportunities in the market aren’t so complex?

In this article, you will find 7 key factors impacting cryptocurrency prices. Thanks to them, you’ll be able to make your own forecasts regarding the best cryptocurrencies to invest in and, most importantly, won’t miss out on the good returns offered by the rapidly developing crypto market. However, before diving into it, you should learn more about crypto scams, such as a rug pull to avoid losing your digital assets.

- What Influences Cryptocurrency Prices? 7 Key Factors to Consider

- Token Economics

- Unique Value Proposition

- Token Transfers and Unlocking Schedules

- Market Sentiment

- Market Listings

- Support and Collaborations

- Impact of Macroeconomic Factors

- Analysts’ Tips for Forecasting Cryptocurrency Prices

- A Cryptocurrency Project Worth Paying Attention to in 2025

- Conclusion

What Influences Cryptocurrency Prices? 7 Key Factors to Consider

Understanding the impact of market dynamics and external factors on cryptocurrency prices is key to making highly accurate forecasts. These factors have specific characteristics. Let’s examine them.

Token Economics

Token economics is determined by the demand and supply of the cryptocurrency, as well as its influence on overall valuation. Each cryptocurrency project develops its token economics to best align with its value proposition. For example, Bitcoin (BTC), with its limited supply and low inflation rate, attracts demand from those seeking a hedging tool against inflation and long-term investments.

On the other hand, Ethereum (ETH) is used to pay gas fees, participate in staking, provide collateral in DeFi, and other decentralized financial operations, which supports the demand for this token.

Strong token economics, as seen in projects like Bitcoin (BTC) and Ethereum (ETH), can be attractive to investors, potentially influencing price. Token economics plays an important role in cryptocurrency fundamental analysis.

We hope you know that the right choice of a crypto affiliate network is a crucial factor for success. Special for our readers, at AffDays, we created a list of the best crypto affiliate networks.

Unique Value Proposition

What factor makes a cryptocurrency project worth your attention and investment? Why does one token seem more attractive for investment than another? The answer may lie in the cryptocurrency’s unique value proposition.

Essentially, the unique value proposition describes the benefits that a company, product, or service provides to its users. For example, Bitcoin’s unique value proposition is based on its ability to hedge against inflation, its high degree of decentralization and security Bitcoin provides to its participants, as well as its ability to facilitate payment network.

On the other hand, Ethereum’s unique value proposition lies in being the world’s most popular smart contract platform and being home to the most popular decentralized applications (dApps).

Meanwhile, Layer 1 blockchains, such as Solana (SOL), offer their unique value proposition by addressing issues faced by their larger competitors, such as high gas fees and low throughput.

At the same time, niche platforms like the decentralized GPU computing market Render (RNDR), decentralized exchange Uniswap (UNI), and data availability layer Celestia (TIA) focus on providing specialized products and services for their users.

Token Transfers and Unlocking Schedules

For cryptocurrency investors, understanding token transfer mechanisms and the timing of their unlocking is crucial. When creating a crypto project, the development team, early investors, and founders usually receive a significant share of newly issued tokens as a reward for their contributions.

Tokens allocated to internal project participants are stored in a smart contract that automatically releases tokens in stages at specified time intervals. This is done to control the circulating supply of tokens, alleviate selling pressure, and support the growth of their value.

When tokens belonging to internal participants are unlocked, a significant number of new tokens enter the market. If team members, early investors, and founders start selling their assets on the open market, it can lead to a decrease in the cryptocurrency’s price.

Market Sentiment

The market sentiment reflects the overall mood of investors. Financial markets are subject to human emotions such as fear of missing out and greed, which can lead to irrational decisions and sudden price fluctuations. High levels of greed indicate an overbought market and potential price declines, while high levels of fear indicate an oversold market and potential price increases.

In a bull market, we see cryptocurrency prices rising without an obvious catalyst. On the other hand, a bear market is characterized by low investor interest and price stagnation.

Experienced investors have the intuition that helps them sense the market’s emotional climate. This gives them confidence and allows them to make decisions that may contradict the crowd’s opinion, ultimately profiting from the market’s irrational behavior.

Market Listings

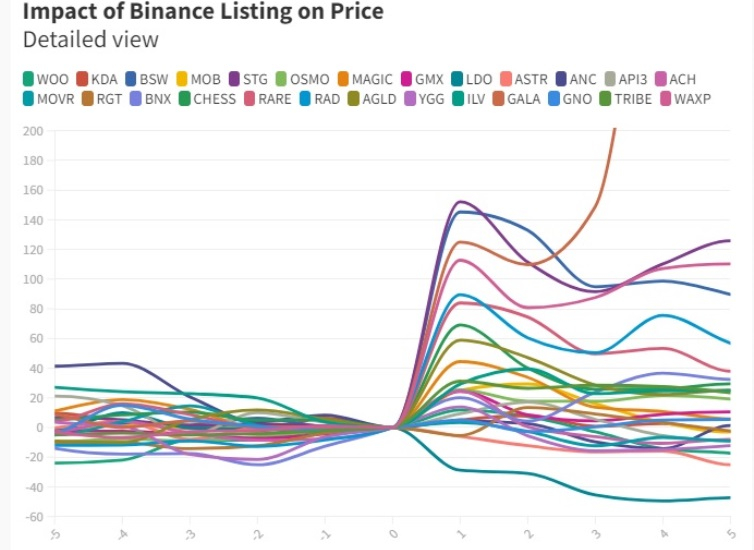

There is a trend of cryptocurrency token prices increasing before they are listed on popular centralized exchanges such as Binance and Coinbase.

Centralized exchanges attract new investors and capital to cryptocurrencies that were previously unavailable for trading. The ease of use of these platforms allows even those without cryptocurrency experience to acquire them using traditional funding methods such as debit/credit cards.

Usually, token delisting has a negative impact on their prices due to regulatory and security issues.

Support and Collaborations

Support from well-known personalities and collaborations with popular brands usually attract attention to cryptocurrency tokens, stimulating investor interest and contributing to price growth.

An example of the powerful influence of support from well-known figures in the cryptocurrency world is Dogecoin (DOGE) and Elon Musk. In 2021, Musk played a key role in drawing attention to DOGE, leading to its significant growth. At the time of writing, DOGE is one of the most valuable cryptocurrencies with a market capitalization of several billion dollars.

Collaborations with well-known brands also help cryptocurrency projects gain trust. For example, in 2022, Polygon (MATIC) became one of the most effective cryptocurrencies after partnering with global brands such as Meta, Disney, and Adobe.

Impact of Macroeconomic Factors

Cryptocurrency markets have become sensitive to macroeconomic factors. Over the past decade, cryptocurrencies have evolved into a multi-trillion-dollar industry. The influence of financial institutions, global corporations, hedge funds, and other institutional investors on digital tokens is increasing.

In 2022, the cryptocurrency market experienced a significant downturn as central banks began raising interest rates in an attempt to curb inflation. The creation of a spot Bitcoin ETF in January 2025 and the subsequent influx of institutional capital make cryptocurrency markets more vulnerable to macroeconomic processes than ever before, so it is essential to consider this factor as well.

Analysts’ Tips for Forecasting Cryptocurrency Prices

Mads Eberhardt, Senior Cryptocurrency Analyst at Steno Research, highlights the significant influence of liquidity — the volume of money in the financial system — in forecasting. He notes, “Liquidity in the economy plays a crucial role for cryptocurrencies as it sustains the speculative environment necessary for their success. Liquidity has been increasing since last October, and there are no signs of it anytime soon.”

Ipek Ozkardeskaya, Senior Analyst at Swissquote Bank and host of MarketTalk, emphasizes the importance of speculation in the young asset class of cryptocurrencies, stating, “Cryptocurrency prices often do not react to fundamental news unless news drastically changes the rules of the game. Speculation remains the main driving force in prices — this is what makes them so unpredictable and volatile.”

Vladimir Rybakov, the Chief Trader at the “Home Trader Club,” offers a more philosophical perspective in his advice, highlighting three pearls of wisdom:

- Big profits require more time; you can’t get $100 without earning less before;

- Trade based on facts, not feelings — otherwise, instead of being a “shark,” you’ll just be a fish;

- Trading can only happen in two ways — slowly and steadily or quickly and aggressively.

This advice can also be relevant in affiliate marketing when driving traffic to online mining platforms. Before making a profit, you need to spend some time testing and optimizing your advertising campaign.

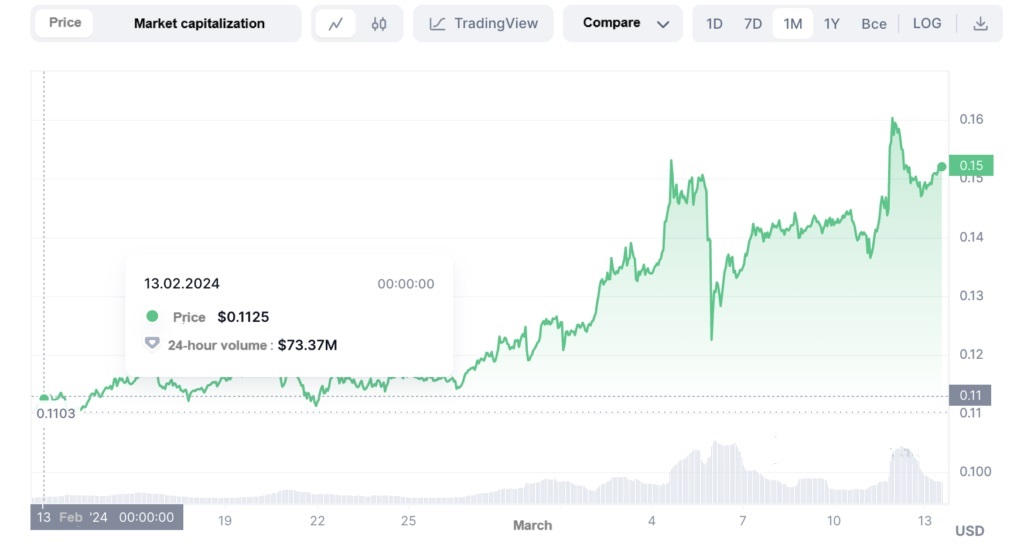

A Cryptocurrency Project Worth Paying Attention to in 2025

Stellar Lumens (XLM) is a digital currency operating within the Stellar blockchain network. Lumens are denoted by the ticker symbol XLM.

Created in 2014 by Jed McCaleb and Joyce Kim, Stellar was conceived as a decentralized platform to facilitate fast and secure cross-border transactions. Additionally, it aims to provide access to financial services for people who cannot use traditional banking systems.

As more organizations and financial institutions join the Stellar network, the demand for XLM will increase which makes it more attractive to investors. Moreover, with the right approach we suppose that it can definitely become one of the most promising crypto offers in affiliate marketing, especially if we use Google Ads for promoting.

Do you know that native advertising is a very cool traffic source for the crypto vertical. Read our article and learn how to earn $11 900 on a crypto offer with no advertising costs.

Conclusion

The 7 factors we have outlined have a significant impact on cryptocurrency prices. Understanding these factors can help you make informed investment decisions about cryptocurrencies. The year 2025 promises a surge in the market, so you should monitor new promising crypto projects, including Stellar Lumens.