e.PN is an international virtual debit card service built for advertising payments, affiliate marketing, SaaS, and online purchases, with cards issued instantly online (no plastic cards). It positions itself around competitive fees, a large BIN pool (102 trusted BINs), low decline rate, and 24/7 support.

Main Features of e.PN

e.PN’s key product and ops features:

- Instant virtual debit cards issued inside the account

- 3DS support for merchants/platforms that require additional verification

- Large BIN pool (102 trusted BINs) with BIN options expanding as your account level increases

- Tier-based conditions: your account level is tied to total spend across cards, and conditions improve as you scale

- 24/7 support with multiple channels (site chat, WhatsApp/WeChat, Telegram bot/channel).

Fees & levels:

- Standard (upon registration): top-up fee 6.7%, card issue/renewal $4

- Silver ($1,000 + KYC): 6%, $3.5

- Gold ($10,000 + KYC): 5%, $3

- Platinum ($50,000 + KYC): 4%, $2.5

- Black ($100,000 + KYC): 3%, $2

Pros & Cons

| Pros | Cons |

| Clear, spend-based tiering: as volume grows, top-up fee drops from 6.7% to 3% and card price from $4 to $2 | KYC is tied to higher tiers (Silver+) if you want lower fees |

| Instant virtual card issuance, online-only workflow | No physical cards (not a replacement for day-to-day plastic) |

| 3DS supported | Cash withdrawals not supported (no ATM usage) |

| Broad top-up rails: crypto + multiple payment systems | Withdrawals cost 5% and start at $100 min |

| 24/7 support with multiple channels and fast stated SLA | Tier benefits depend on total spend; low-spend users remain on higher fees |

Overview of the Personal Account

The personal account consists of the dashboard, accounts, cards, transaction history, teams, earn, support, and API documentation. It’s available in a website browser, and both on Android and iOS.

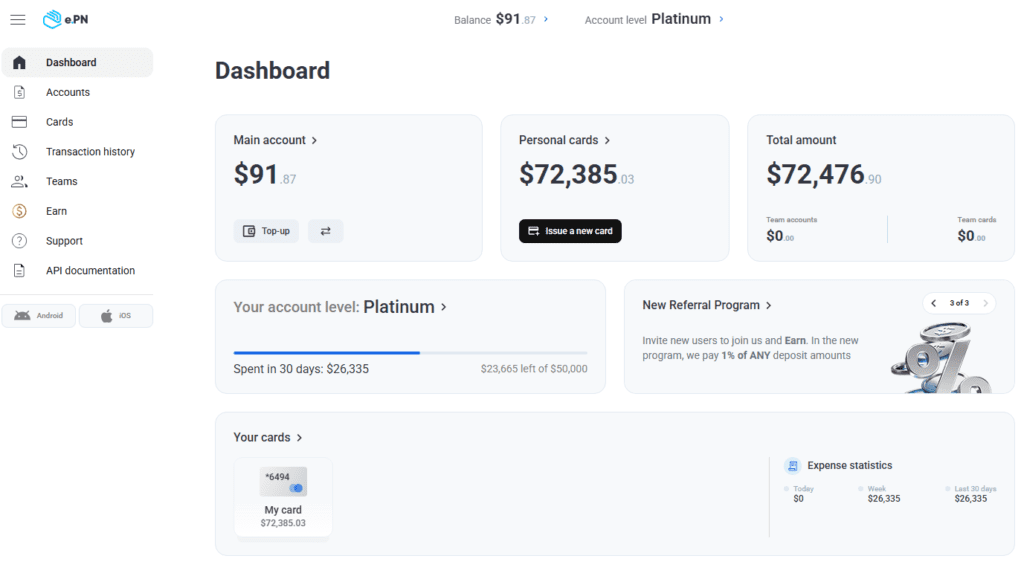

Dashboard

The Dashboard shows your current Balance and Account level, plus quick widgets for Main account, Personal cards, and Total amount across all balances. From here you can top up the main balance in one click and issue a new virtual card.

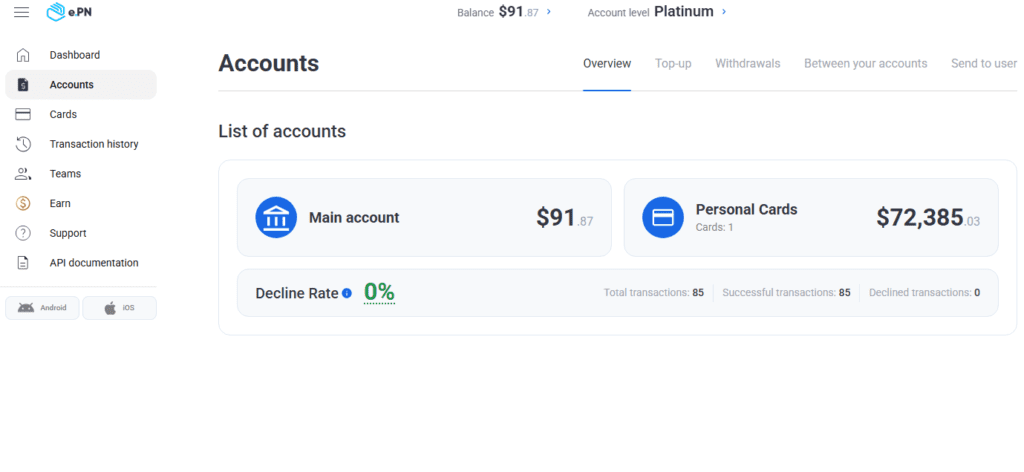

Accounts

This section shows how your funds are split between Main account and Personal Cards (card balance). It also includes a simple Decline Rate widget with counters for total / successful / declined transactions, so you can quickly see whether payments are going through and spot issues.

Here, you can top-up your balance, withdraw, swap funds between accounts, and send funds to another user.

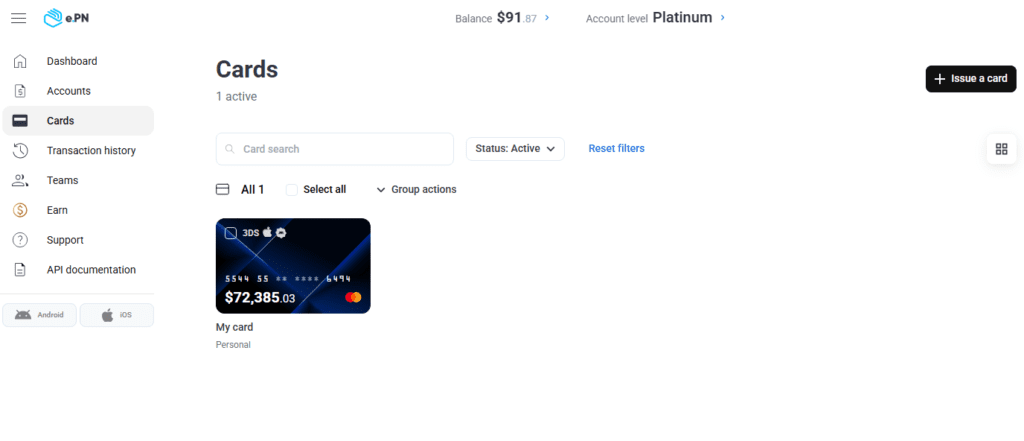

Cards

In the Cards tab, you can see all your cards and issue a new one.

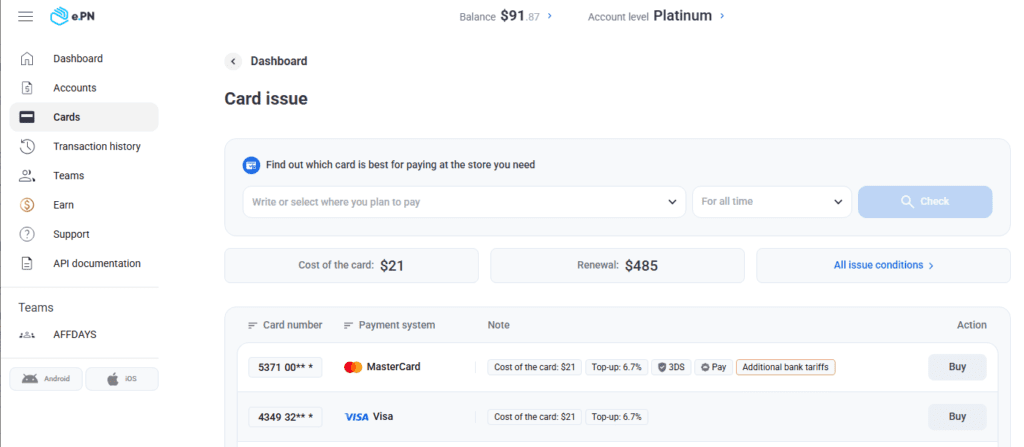

Here’s where you choose new cards to issue.

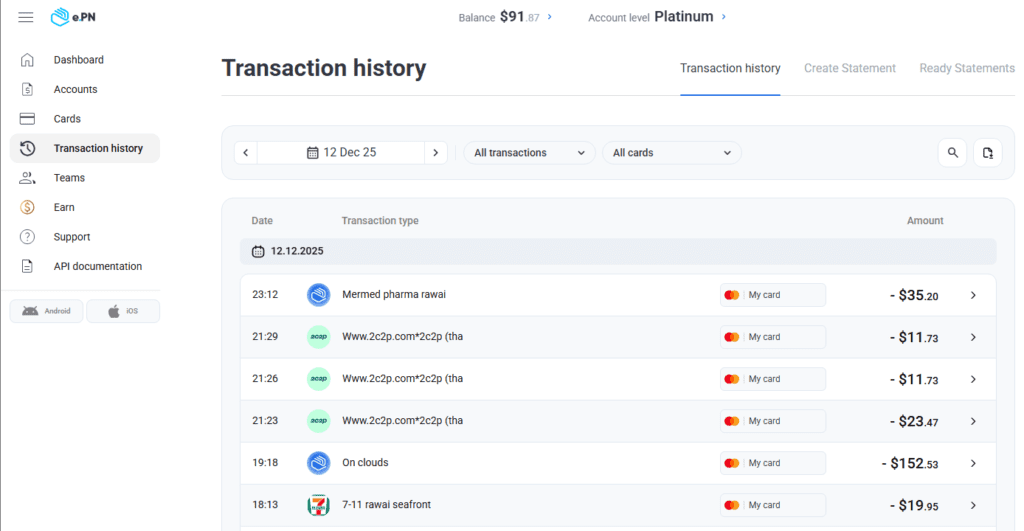

Transaction History

This one is simple — all your transactions are listed here.

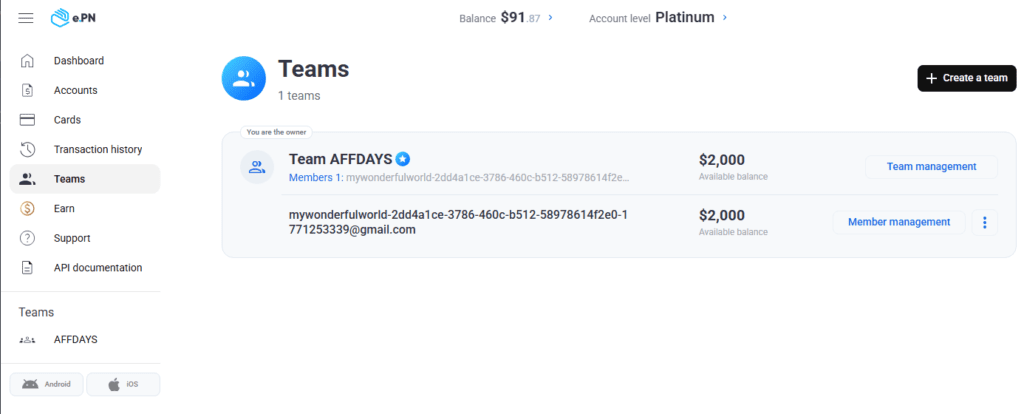

Teams

Affiliate and media-buying teams can use e.PN as well, and this is the section where team actions are available.

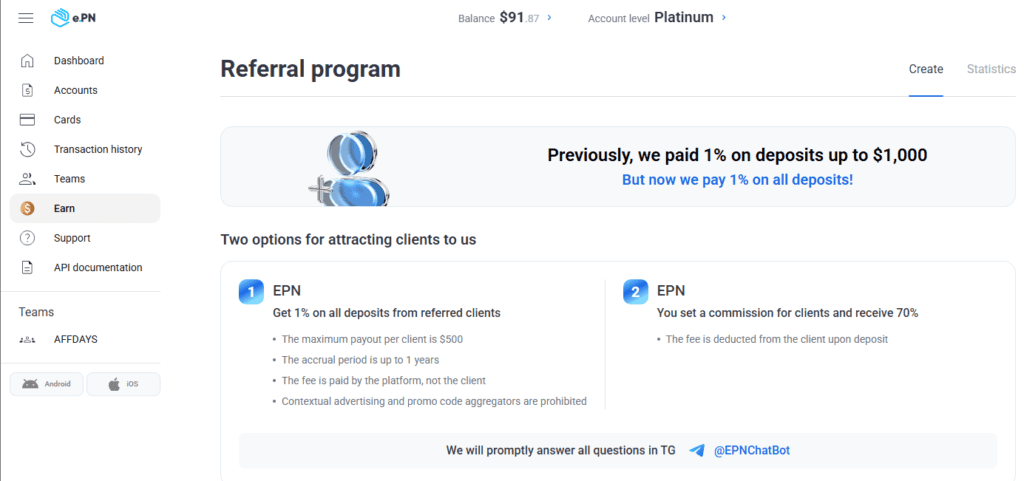

Earn

In the Earn tab, you’ll find everything you need to earn commissions on your referred users.

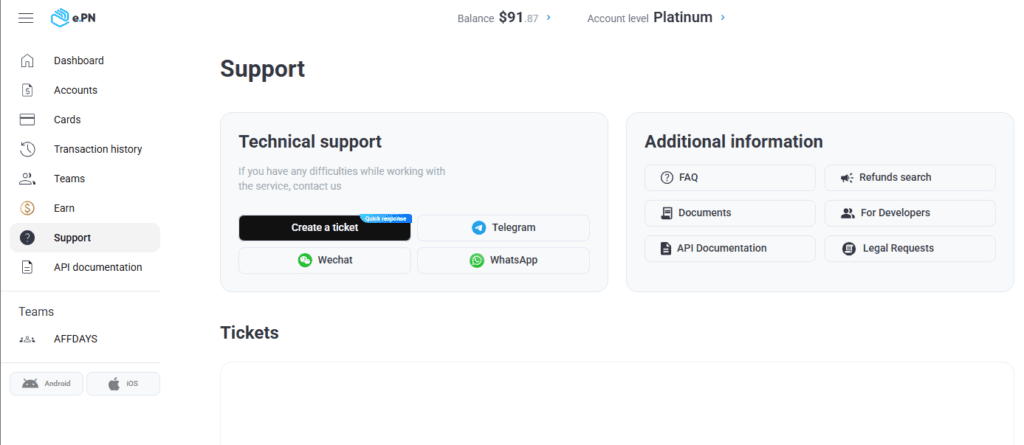

Support

The Support section is where you can create a ticket and track it, contact a support manager via Telegram, WeChat, or WhatsApp, and access additional information.

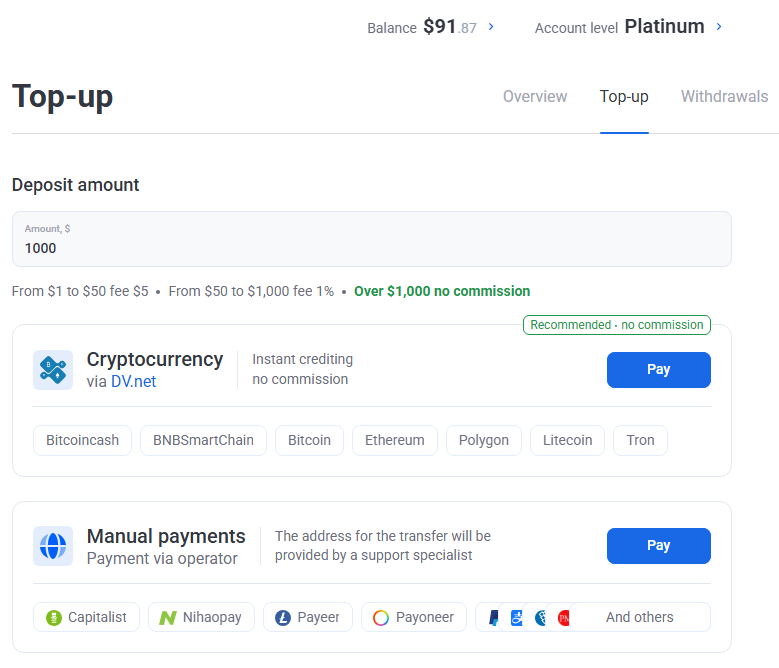

How to Top Up Your Balance

You can top up your balance in the ‘Top-up’ section of the ‘Accounts’ tab.

There’s a $5 fee for deposits from $1 to $50; 1% fee for $50-1.000; and for deposits of over $1,000 there’s no commission at all.

Payment methods include:

- Crypto

- Capitalist

- Nihaopay

- Payeer

- Payoneer

- PayPal

- AliPay

- Webmoney

- Perfect Money

- and some other.

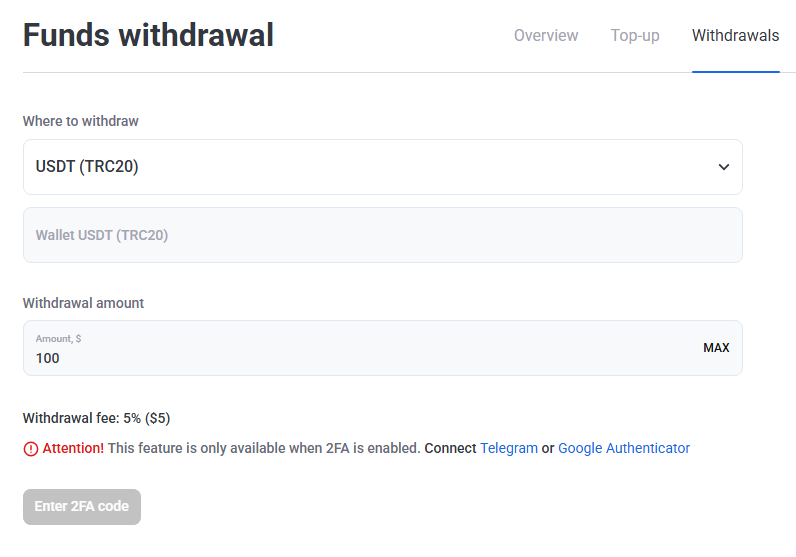

How to Withdraw Funds

Funds are withdrawn in the ‘Withdraw’ tab of the same ‘Accounts’ section. You can withdraw money only in USDT TRC20 and only with the 2FA enabled.

Conclusion

e.PN is a straightforward virtual card service built for media buying and online payments. It lets you fund an account, issue cards instantly, and manage balances, cards, and transactions from one dashboard. The pricing is tier-based, so conditions typically improve as your spend grows. It’s not a substitute for everyday banking, and payout/withdrawal terms matter if you plan to cash out often.

FAQ

It’s positioned for advertising payments (media buying), affiliate/performance marketing, SaaS/tools subscriptions, and general online spending, including travel-related purchases.

They are debit virtual cards funded from your e.PN balance (not credit).

You pay (a) a top-up fee (from 6.7% down to 3% depending on tier) and (b) a card issue/renewal fee (from $4 down to $2). The tier depends on total spend and includes more BIN options at higher levels.

KYC is needed for higher tiers starting from Silver ($1,000) and above. If you want the lower fees, plan for KYC.

Two main routes: crypto via DV.net (multiple networks/coins listed) and manual payments via systems like Capitalist, WebMoney, Payeer, Perfect Money, PayPal, Alipay, Payoneer, and others.

Yes — withdrawals go to external details (e.g., a crypto wallet) with a $100 minimum and a 5% fee. Cash withdrawals from cards aren’t supported.

Ksenia has extensive hands-on experience in affiliate marketing, having worked as a media buyer and affiliate for several years across multiple verticals. Throughout her career, she managed traffic from a wide range of sources, tested funnels, and collaborated directly with advertisers and networks.

For the past six years, she has also been writing in-depth articles, reviews, and analytical guides about affiliate marketing. Her work has appeared on well-known industry blogs and platforms, where she covers topics such as traffic sources, compliance, creatives, tracking, and campaign optimization.

Today, Ksenia combines practical experience with editorial expertise, contributing as a guest expert to various affiliate marketing projects and helping educate both beginners and experienced affiliates.